SLfT2006 - Qualifying materials containing a small amount of non-qualifying material

Note: The following ‘General Guidance’ applies for SLfT purposes to all waste loads which wholly consist of qualifying material apart from a small amount of non-qualifying material.

In this context:

- ‘qualifying material’ means material which is listed in and meets the conditions set out in The Scottish Landfill Tax (Qualifying Material) Order 2015; and

- ‘non-qualifying material’ means material which is not listed (and does not meet the conditions set out) in that Order and which is, therefore, chargeable at the standard rate.

If waste load contains fine material then the guidance under the ‘Qualifying fines’ heading also applies.

General Guidance

We may direct that material disposed of can be treated as qualifying material if it would so qualify but for the presence of a small amount of non-qualifying material.

We are aware that some waste streams, which may otherwise be liable for tax at the lower rate, may arise with small amount of non-qualifying (or standard-rated) materials contained within them as contaminants. This includes fines and contaminated soils, which generally contain a mixture of qualifying and non-qualifying materials, and which make the whole load liable for tax at standard rate.

Where:

- It is unreasonable to have prevented this contamination at source; and

- It is subsequently unreasonable, or there is no practical way, for these contaminants to be removed.

Then the whole load may be taxable at lower rate. Any load which is hazardous waste as defined by Directive 2008/98/EC (see SLfT2004) must, however, be taxed at the standard rate.

Material of a standard taxable rate must not be added to material of a lower rate. For example, it must not have been deliberately or artificially blended or added to the qualifying material(s) after or in connection with removal from its original site. Such an addition would make the entire load taxable at the standard rate. The only exceptions to this are when;

- Standard-rated material needs to be used to contain the lower-rated waste; or

- Standard and lower-rated material at a Materials Recycling Facility are mixed prior to treatment to enable their treatment and segregation.

In cases of doubt the waste will be taxed at the standard rate unless you can demonstrate that the waste qualifies for the lower rate of tax and that all reasonable and practical measures have been taken to remove contaminants contained within the waste.

The lower rate of tax may only be applied to a load containing a small amount of standard-rated material if the standard rate material was formed with the lower-rated waste at the same time, or it is used as necessary packaging and all reasonable and practical measures have been taken to prevent, reduce and remove the standard-rated material from the lower-rated material.

For example, we would accept the following as qualifying for the lower rate:

- a load of bricks, stone and concrete from the demolition of a building that has small pieces of wood in it and small quantities of plaster attached to bricks as it would have not been feasible for a contractor to separate them. (Note: large pieces of wood or plaster which could be removed by hand or other means would make the entire load taxable at the standard rate);

- a load of sub-soil that contains small quantities of grass. (Note: turfs of grass which could have been removed prior to the load of sub-soil being created would make the entire load taxable at the standard rate);

- waste such as mineral dust packaged in polythene bags for disposal; and

- a load of sub-soil and stone from street works containing small amounts of tarmac (Note: large pieces of tarmac which could be removed by hand or other means would make the entire load taxable at the standard rate).

It is not possible for us to advise you on every disposal. It is your responsibility to decide whether a particular load disposed of at your site contains any standard-rated material.

If it does contain such waste you need to satisfy yourself that the load:

- is not hazardous waste; and

- contains only a small quantity of non-hazardous non-qualifying (or standard-rated) waste, which was formed with the lower-rated material and either could not be removed or is necessary for packaging reasons.

The difficulty in separating the standard-rated components from the lower-rated waste is a factor that you can take into account, but this cannot be used to justify applying the lower rate of tax if the standard-rated waste is hazardous or it is more than a small amount of the total load. You will need to Justify your decisions to us.

Qualifying fines

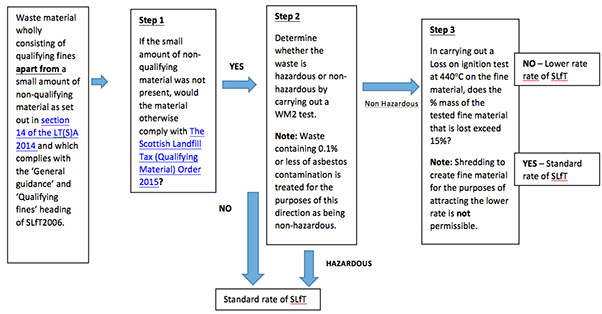

Note: From 1 April 2015, and under a direction made under section 14 of the LT(S)A 2014, we will require you to use the following flowchart in order to determine whether a waste load containing fine material is chargeable at the standard or lower rate.

For SLfT purposes, fines are particles produced by a waste treatment process that involves an element of mechanical treatment.

Qualifying fines are:

- a mixture that consists of:

- fines that consist of materials listed in the Schedule to The Scottish Landfill Tax (Qualifying Material) Order 2015; and

- no more than a small amount of fines that consist of any other (i.e. non-qualifying) material,

- and where:

- the qualifying fines must not result from any deliberate or artificial blending or mixing of any material prior to disposal at a landfill site; and

- the qualifying fines must not be hazardous waste.

Flowchart to determine the Scottish Landfill Tax rate for waste loads containing fine material

Ref ID

SLfT2006

Archive Date

Last updated