In this guidance you can find information on how to complete the reliefs section in the LBTT online return application.

For more information about reliefs see LBTT3010 - Tax Reliefs.

Step 1 – Edit the relief section

You can start adding information about the reliefs by selecting the ‘Edit reliefs’ button in the LBTT return.

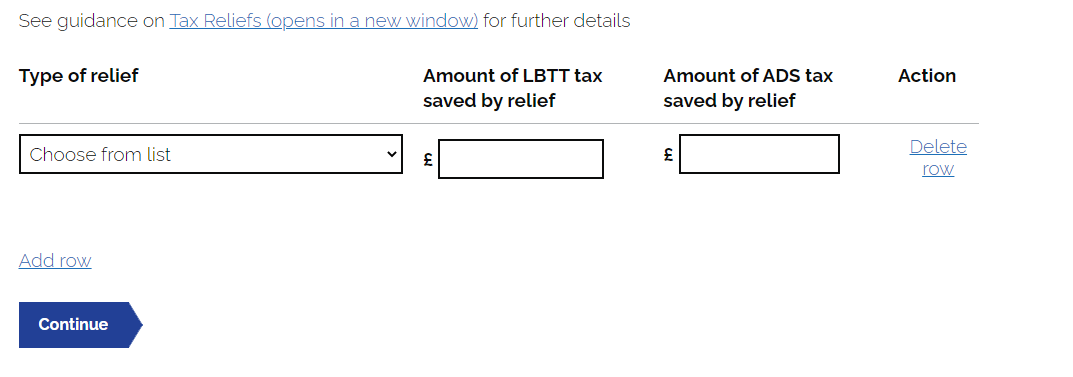

Select the 'Add row' button to add relief.

Step 2 – Select what type of relief you are claiming

You can choose what type of relief you want to claim by clicking one of the options in the drop-down list.

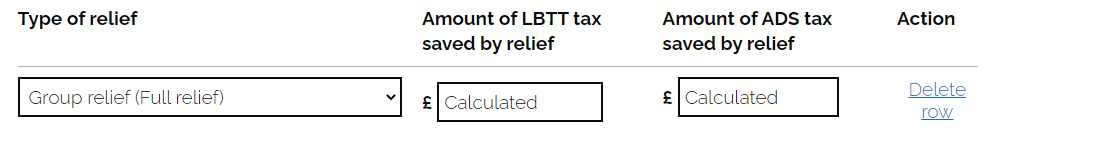

If you select full relief this will be automatically calculated.

If partial relief is selected, you will have to input the amount of partial relief you are claiming.

If you are claiming multiple dwelling relief (MDR) you will be asked additional information about the number of dwellings, the number of dwellings that attract ADS and the total consideration.

Once you select the type of relief you can review the amount of relief claimed. If the information is correct, you can press continue and return to the summary screen.