Key points

- Residential LBTT, excluding Additional Dwelling Supplement (ADS), was £38.6m in April 2025. This was 14% higher than in March 2025 (£33.8m) and 8% higher than in April 2024 (£35.9m).

- Non-residential LBTT, excluding ADS, was £16.2m in April 2025. This was 39% lower than March 2025 (£26.7m) and 28% lower than April 2024 (£22.5m). Non-residential revenues are highly variable between months, due to the effect of small numbers of high value transactions.

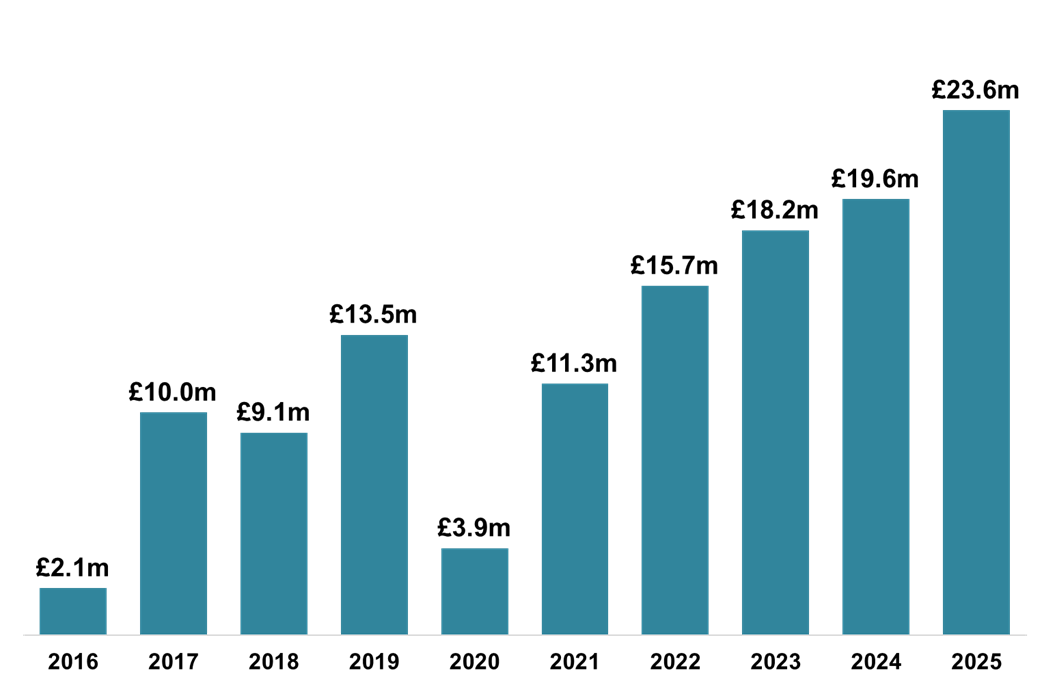

- Gross Additional Dwelling Supplement for April was £23.6m, 13% higher than March 2025 (£20.9m) and 20% higher than in April 2024 (£19.6). Note that the rate of ADS changed from 6% to 8% where the contract for the transaction was entered into after 4th December 2024.

Introduction

This publication is part of a monthly series of Land and Building Transaction Tax (LBTT) statistics, started in April 2015, which provides data on the number and value of notifiable transactions reported to Revenue Scotland.

An Official Statistics Publication for Scotland

These statistics are official statistics. Official statistics are statistics that are produced by crown bodies, those acting on behalf of crown bodies, or those specified in statutory orders, as defined in the Statistics and Registration Service Act 2007.

Revenue Scotland statistics are regulated by the Office for Statistics Regulation (OSR). OSR sets the standards of trustworthiness, quality and value in the Code of Practice for Statistics that all producers of official statistics should adhere to.

Residential LBTT

Residential LBTT, excluding Additional Dwelling Supplement (ADS), was £38.6 million in April 2025. This is a 14% increase compared to March 2025.

Figure 1: Line chart displaying residential LBTT, excluding ADS, by month, April 2015 – April 2025.

Residential LBTT, excluding ADS, was 14% higher in April 2025 (£38.6m) than in the previous month (£33.8m).

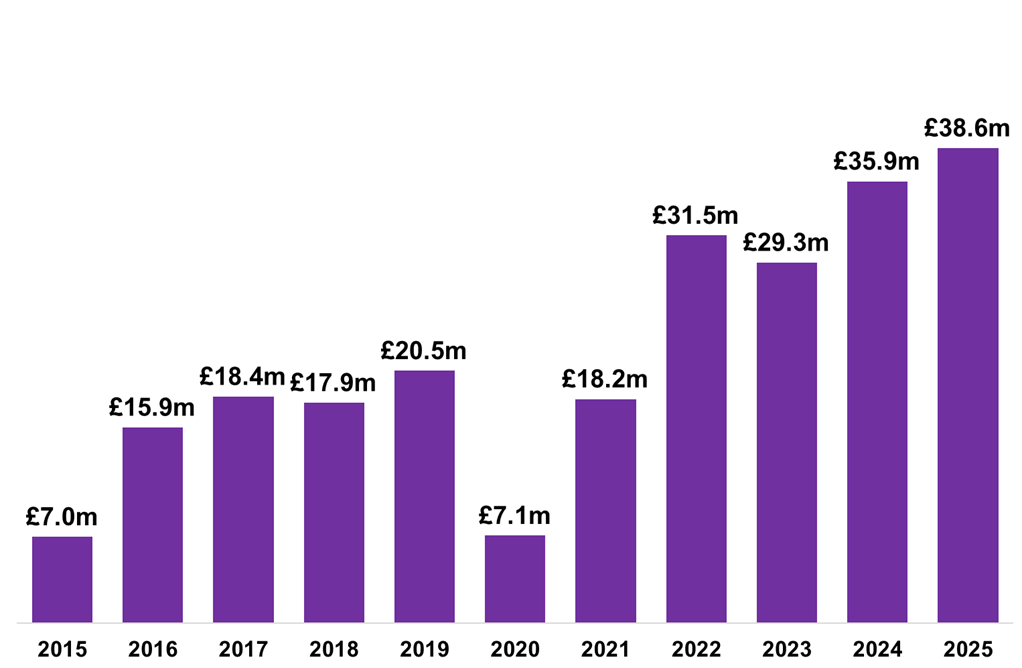

Residential LBTT, excluding Additional Dwelling Supplement (ADS), was the highest for the month of April (£38.6 million).

Figure 2: Residential LBTT, excluding ADS, declared in April of each year, 2015-2025.

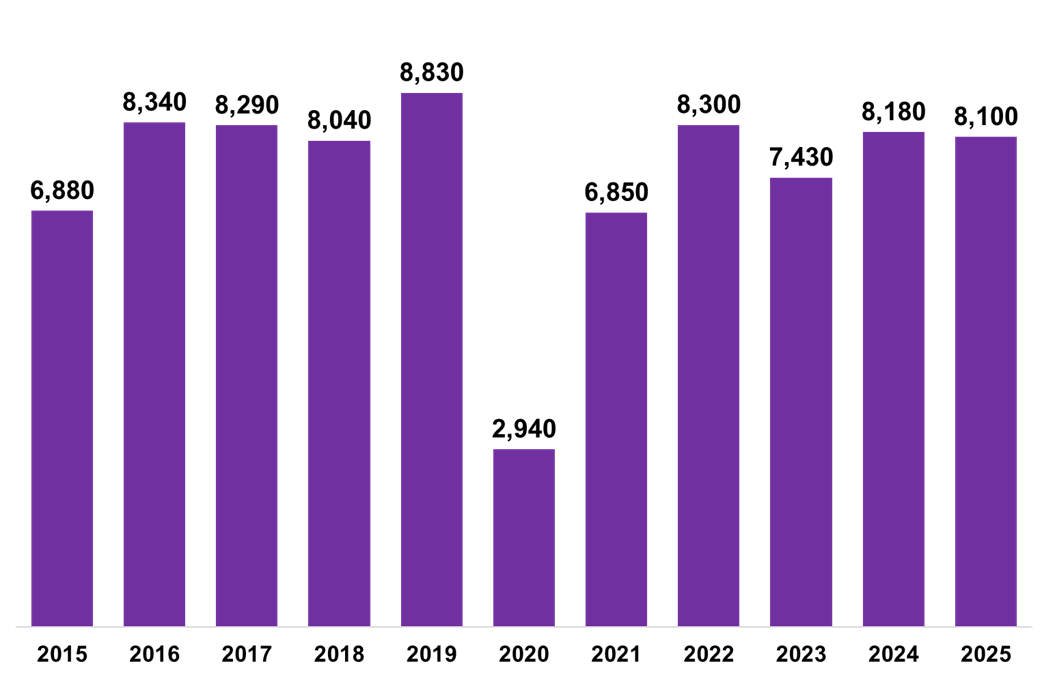

Residential LBTT, excluding ADS, was 8% higher in April 2025 (£38.6m) than in April 2024 (£35.9m). The number of residential LBTT returns submitted was 1% lower in April 2025 (8,100) versus April 2024 (8,180). The increase in LBTT despite a decrease in returns is due to increasing property prices, with a higher proportion of returns being for higher total consideration bands.

8,100 Residential LBTT returns were submitted in April 2025.

Figure 3: Residential LBTT returns submitted in April each year, 2015-2025.

Non-Residential LBTT, excluding ADS

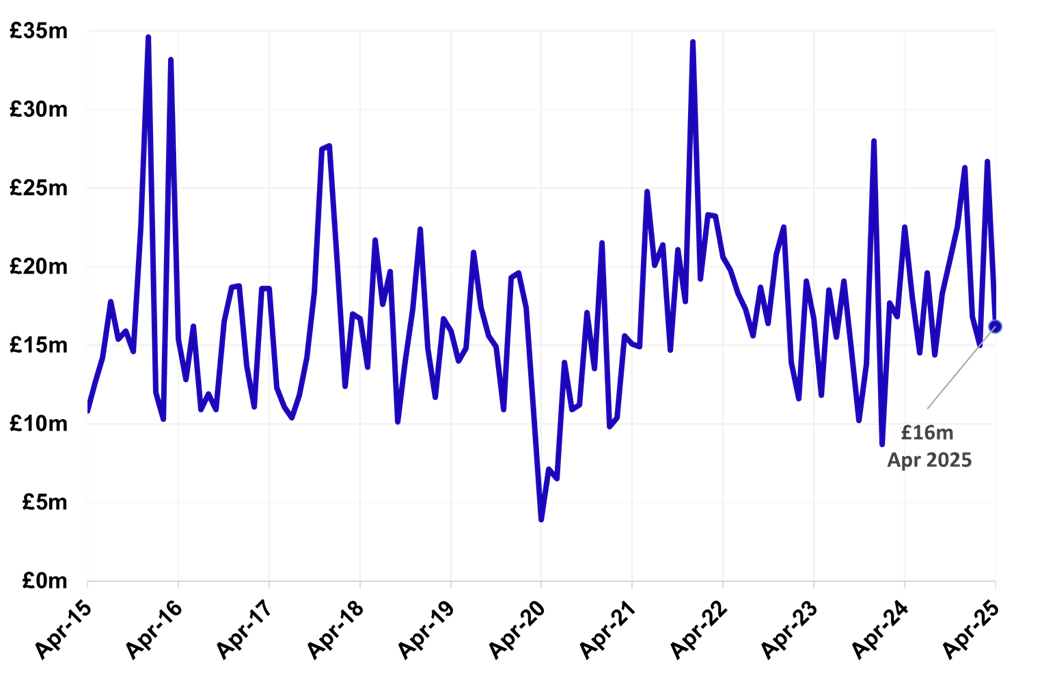

Non-residential LBTT, excluding ADS, was £16.2 million in April 2025. This is a 39% decrease compared to March 2025.

Figure 4: Line chart displaying non-residential LBTT, excluding ADS, by month, April 2015 –April 2025.

Non-residential LBTT, excluding ADS, was 39% lower in April 2025 (£16.2m) compared to the previous month (£26.7m). This is consistent with the general trend of non-residential LBTT decreasing at the beginning of the new financial year.

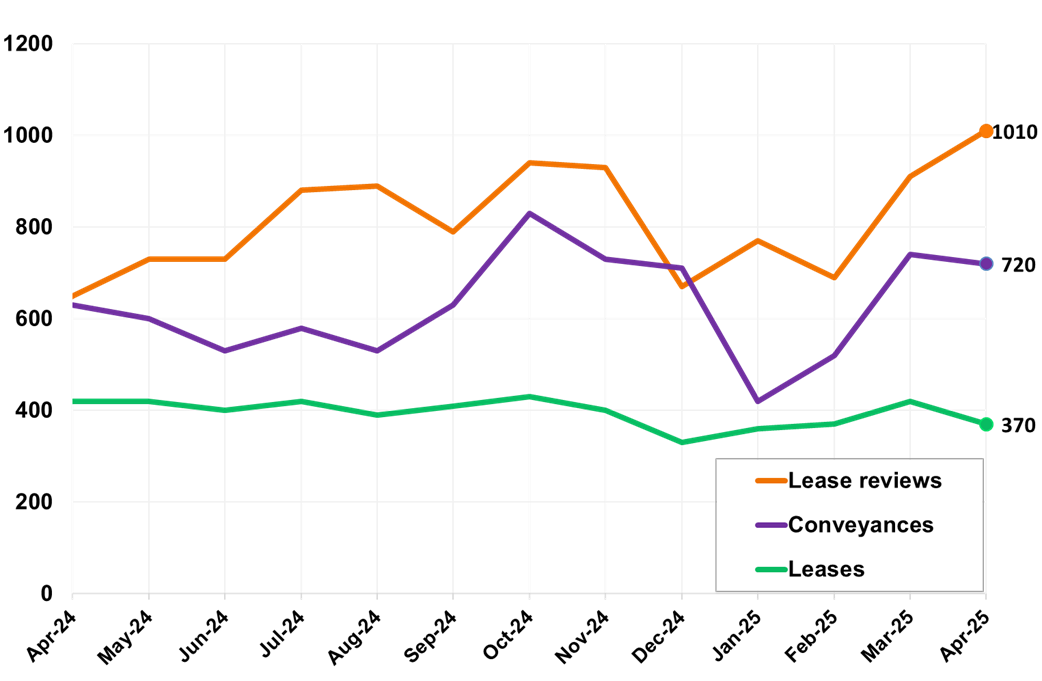

The number of non-residential conveyance returns submitted in April 2025 (720) decreased by 4% compared to March 2025 (750). Leases decreased by 12% and lease reviews increased by 11% compared to the previous month.

Figure 5: Line chart displaying the number of non-residential LBTT returns submitted, by type of return, by month, April 2024 – April 2025.

Additional Dwelling Supplement (ADS)

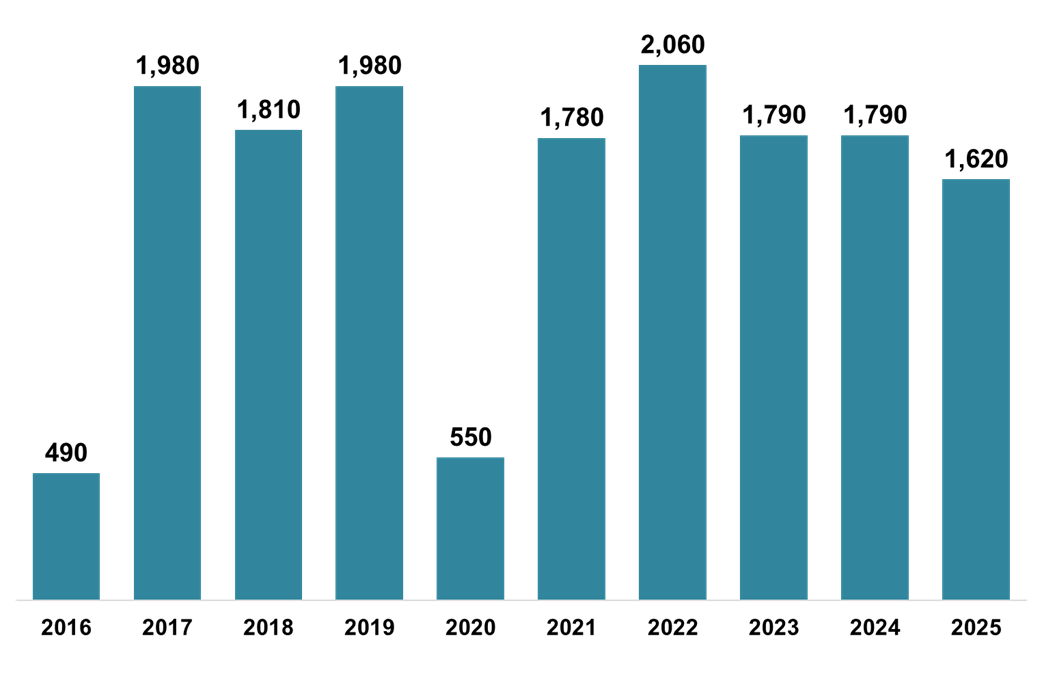

The number of LBTT returns received which declared ADS due was 1,620 in April 2025. This is 9% lower than April 2024 and is the third lowest for any month of April on record.

Figure 6: Bar chart displaying the number of LBTT returns received which declared ADS due, for each month of April, 2016-2025.

The number of returns with ADS due was the third lowest for the month of April (1,620), as was the percentage of residential returns with ADS due (19% in April 2025; in April 2024 the figure was 22% and in April 2023 it was 24%). The fact that gross ADS is higher in April 2025 (£23.6m) than in most previous years is due to the increase in the rate of ADS from 6% to 8% in December 2024.

Gross ADS declared in April 2025 was £23.6 million. This is the highest for any month of April.

Figure 7: Bar chart displaying gross ADS declared due in each month of April, 2016-2025.

Tell us what you think

We are always interested to hear from our users about how our statistics are used, and how they can be improved.

Enquiries

For enquiries about this publication please contact:

Revenue Scotland Statistics & Management Information Team: statistics@revenue.scot