Key points

- Residential LBTT, excluding Additional Dwelling Supplement (ADS), was £29.3m in February 2025. This was 1% higher than in January 2025 (£29.0m) and 27% higher than in February 2024 (£23.1m).

- Non-residential LBTT, excluding ADS, was £15.0m in February 2025. This was 11% lower than January 2025 (£16.8m) and 15% lower than February 2024 (£17.7m). Non-residential revenues are highly variable between months, due to the effect of small numbers of high value transactions.

- Gross Additional Dwelling Supplement for February was £18.7m, 9% higher than January 2025 (£17.1m) and 73% higher than in February 2024 (£10.8). Note that the rate of ADS changed from 6% to 8% where the contract for the transaction was entered into after 4th December 2024.

Introduction

This publication is part of a monthly series of Land and Building Transaction Tax (LBTT) statistics, started in April 2015, which provides data on the number and value of notifiable transactions reported to Revenue Scotland.

An Official Statistics Publication for Scotland

These statistics are official statistics. Official statistics are statistics that are produced by crown bodies, those acting on behalf of crown bodies, or those specified in statutory orders, as defined in the Statistics and Registration Service Act 2007.

Revenue Scotland statistics are regulated by the Office for Statistics Regulation (OSR). OSR sets the standards of trustworthiness, quality and value in the Code of Practice for Statistics that all producers of official statistics should adhere to.

Residential LBTT

Residential LBTT, excluding Additional Dwelling Supplement (ADS), was £29.3 million in February 2025. This is a 1% increase compared to January 2025.

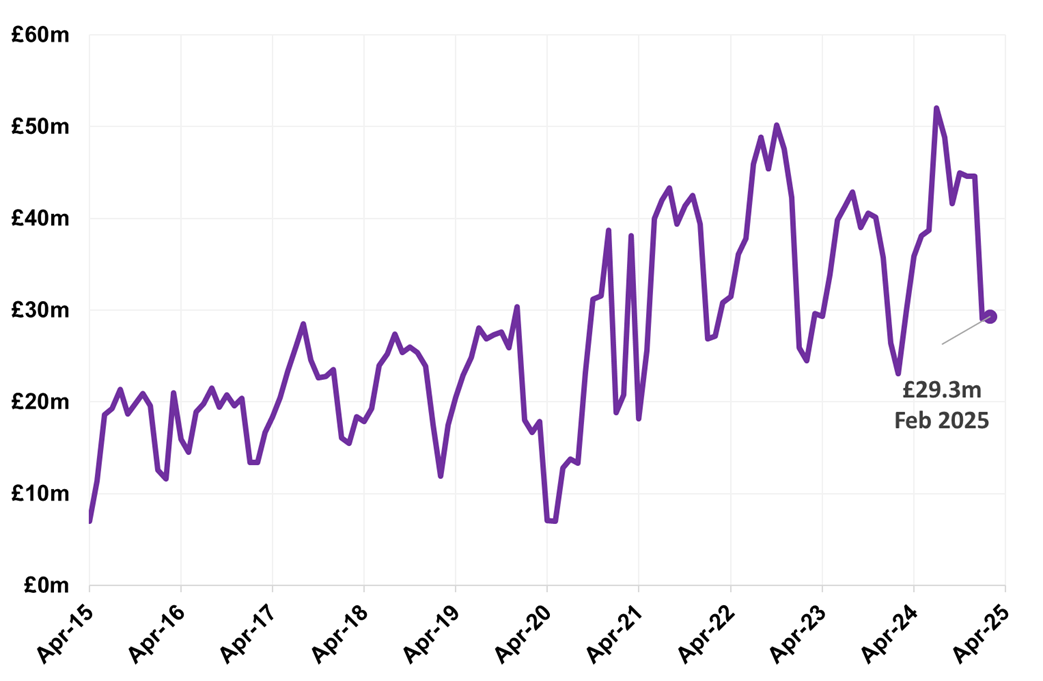

Figure 1: Line chart displaying residential LBTT, excluding ADS, by month, April 2015 – February 2025.

Residential LBTT, excluding ADS, was 1% higher in February 2025 (£29.3m) than in the previous month (£29.0m). January and February are typically a low point in the year for both residential LBTT revenue and residential LBTT returns submitted.

Residential LBTT, excluding Additional Dwelling Supplement (ADS), was the highest yet for the month of February (£29.3 million).

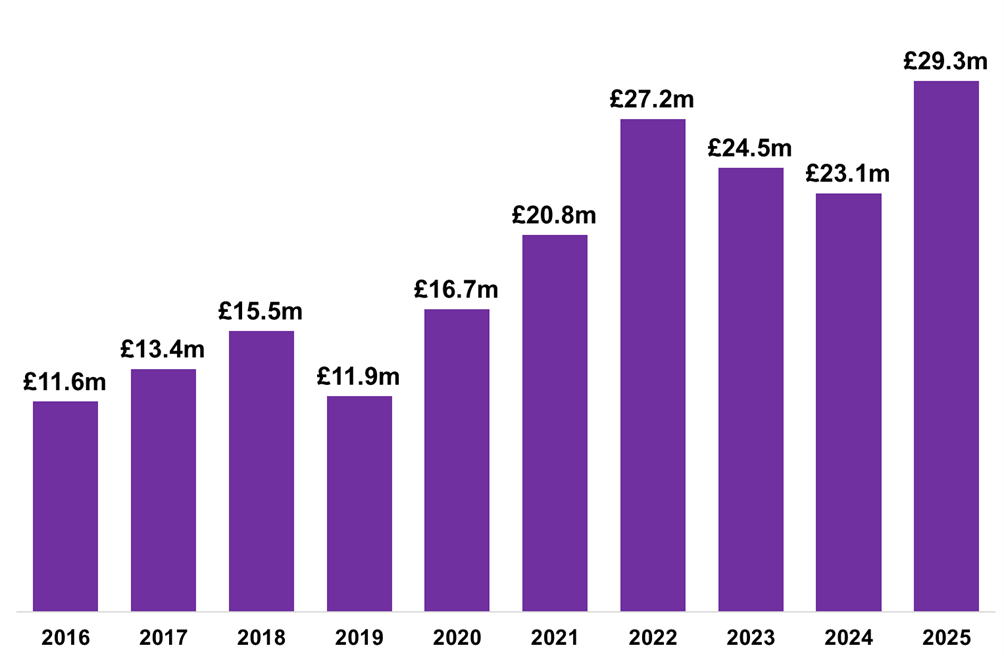

Figure 2: Residential LBTT, excluding ADS, declared in February of each year, 2016-2025.

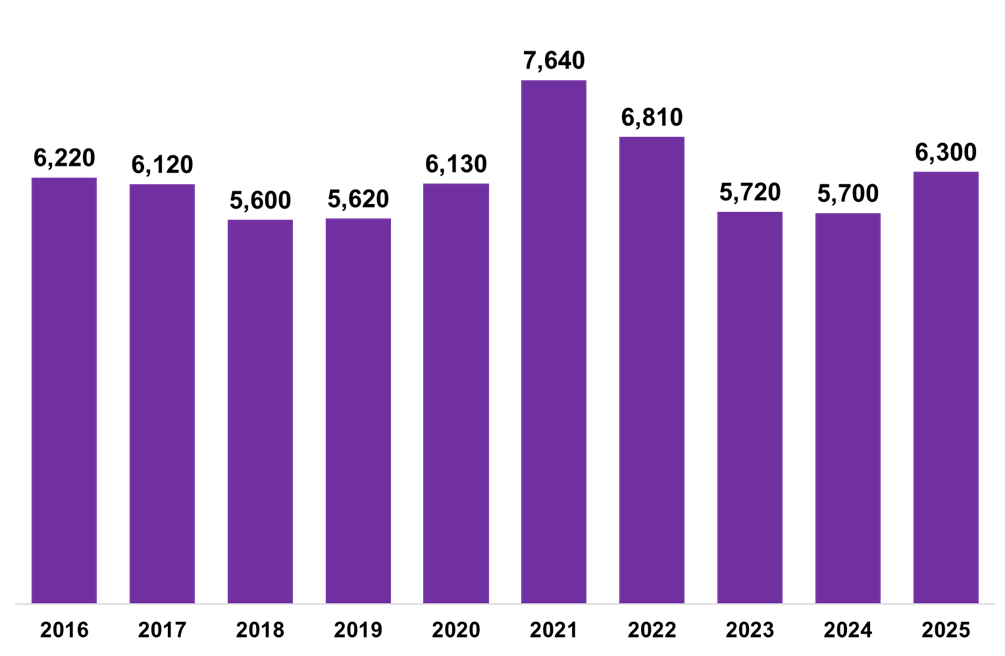

Residential LBTT, excluding ADS, was 27% higher in February 2025 (£29.3m) than in February 2024 (£23.1m). The number of residential LBTT returns submitted in the month of February has been relatively consistent over the years (high of 7,640 in 2021; low of 5,600 in 2018), so the general trend of increasing LBTT revenue is due to rising average property prices.

6,300 Residential LBTT returns were submitted in February 2025.

Figure 3: Residential LBTT returns submitted in February each year, 2016-2025.

Non-Residential LBTT, excluding ADS

Non-residential LBTT, excluding ADS, was £15.0 million in February 2025. This is an 11% decrease compared to January 2025.

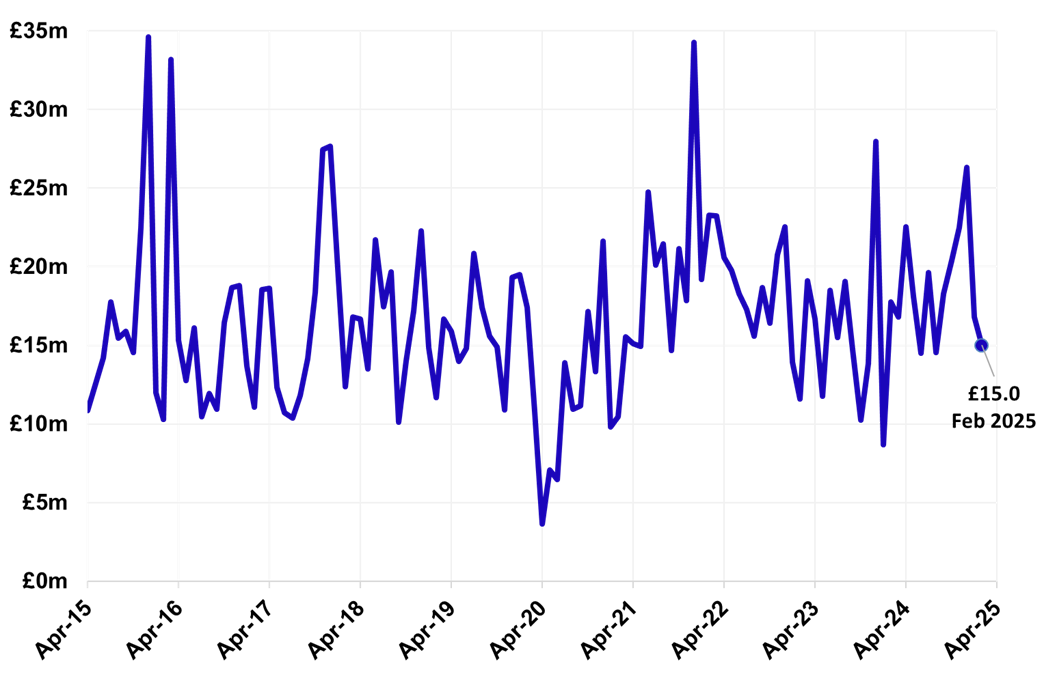

Figure 4: Line chart displaying non-residential LBTT, excluding ADS, by month, April 2015 – February 2025.

Non-residential LBTT, excluding ADS, was 11% lower in February 2025 (£15.0m) compared to the previous month (£16.8m). This is consistent with the general trend of non-residential LBTT being high in December and dropping from January onwards.

The number of non-residential conveyance returns submitted in February 2025 (520) increased 24% compared to January 2025 (420). Leases increased slightly and lease reviews decreased compared to the previous month.

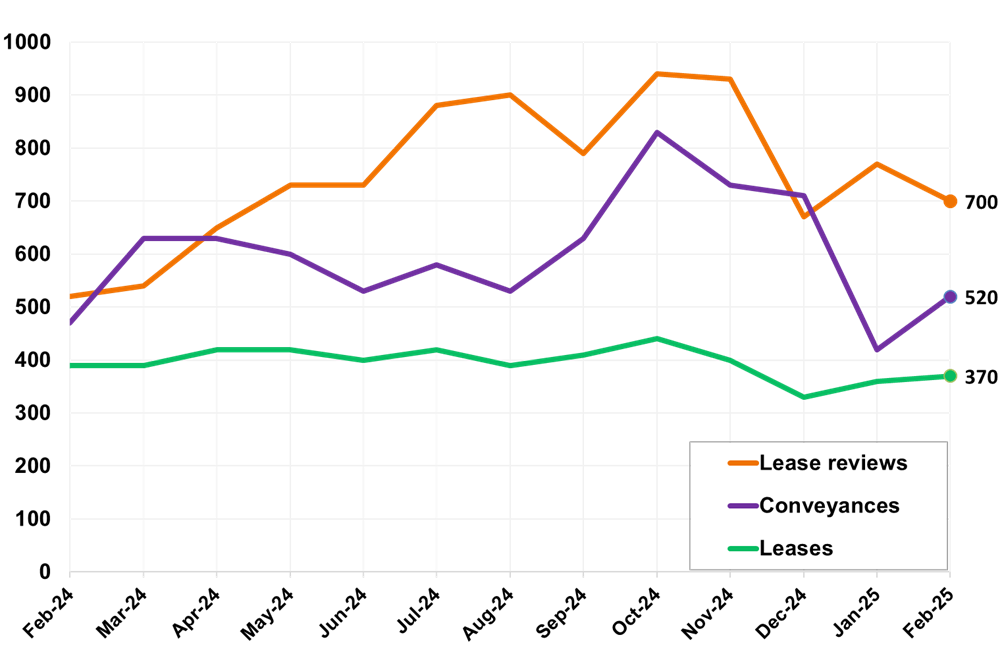

Figure 5: Line chart displaying the number of non-residential LBTT returns submitted, by type of return, by month, February 2024 – February 2025.

Non-residential conveyance returns increased by 24% in February 2025 compared to the previous month. The number of new leases increased slightly on the previous month, while lease review returns dropped by 9% (lease review returns includes 3-year, 6-year and 9-year lease reviews, as well as assignation and termination returns).

Additional Dwelling Supplement (ADS)

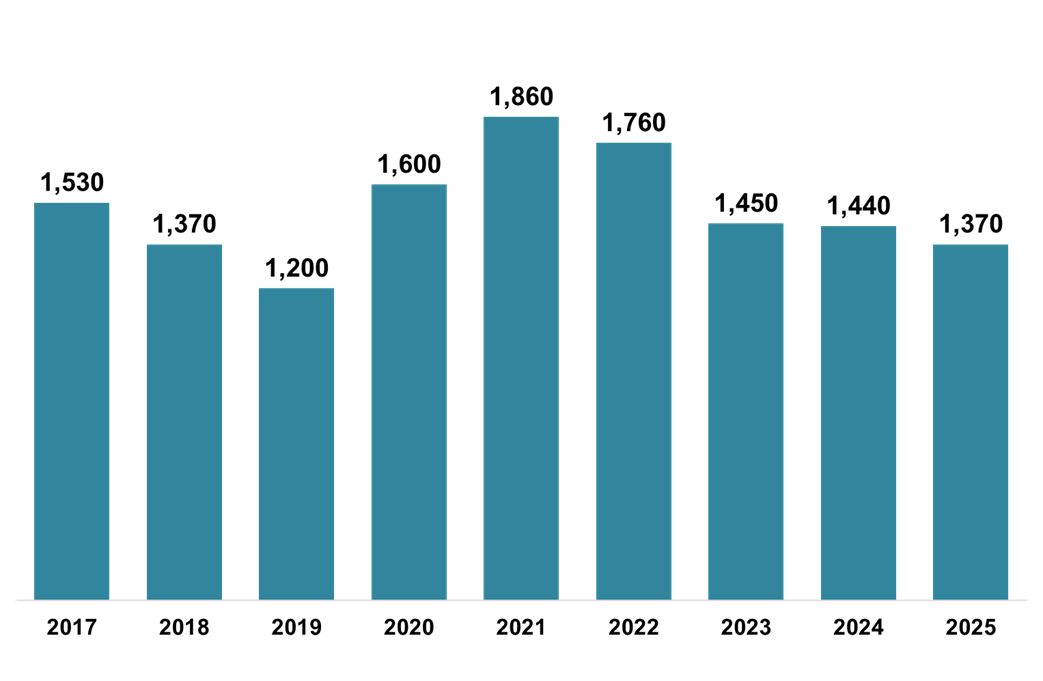

The number of LBTT returns received which declared ADS due was 1,370 in February 2025. This is slightly lower than February 2024 and is the joint second lowest for any month of February on record, though not by a large margin.

Figure 6: Bar chart displaying the number of LBTT returns received which declared ADS due, for each month of February, 2017-2025.

The number of LBTT returns received with ADS declared due was 5% lower in February 2025 (1,370) compared to January 2025 (1,440). This is the joint second lowest so far for the month of February and is 27% lower than the high for the month of February (1,860) received in 2021.

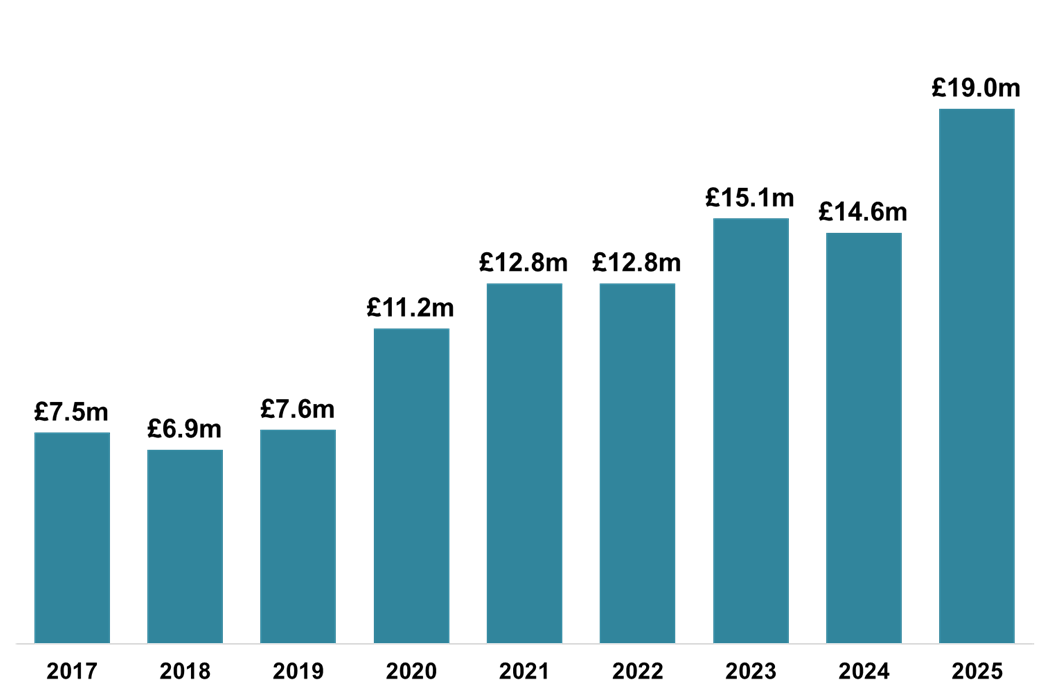

Gross ADS declared in February 2025 was £19.0 million. This is the highest for any month of February.

Figure 7: Bar chart displaying gross ADS declared due in each month of February, 2017-2025.

Gross ADS (ADS before reclaims are deducted) was £19.0m in February 2025. This is the highest figure for any month of February. The increase in gross ADS compared to February 2024, despite fewer returns with ADS due, is largely due to the ADS rate increasing from 6% to 8% in December 2024.

Tell us what you think

We are always interested to hear from our users about how our statistics are used, and how they can be improved.

Enquiries

For enquiries about this publication please contact:

statistics@revenue.scot