LBTT4021 - LBTT return where contingency ceases or consideration ascertained

Where there is contingent, uncertain or unascertained consideration, the following applies.

There are two events that may occur:

- In the case of contingent consideration, this will be where the contingency occurs or it becomes clear that it will not occur.

- In the case of uncertain or unascertained consideration, the amount becomes ascertained.

If either of the above occur and because of the event the transaction becomes notifiable where it wasn’t previously or additional tax is payable or tax is payable where none was payable before, a return must be made to Revenue Scotland within 30 days of the event occurring. For the purposes of the return, the date of the event is the relevant date.

Any tax chargeable on this further return is calculated by reference to the tax rates and bands in force at the effective date of the original transaction.

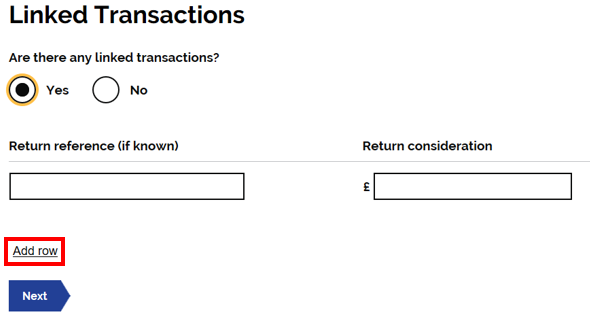

When you file a subsequent return, you should link your return to the previous return submitted.

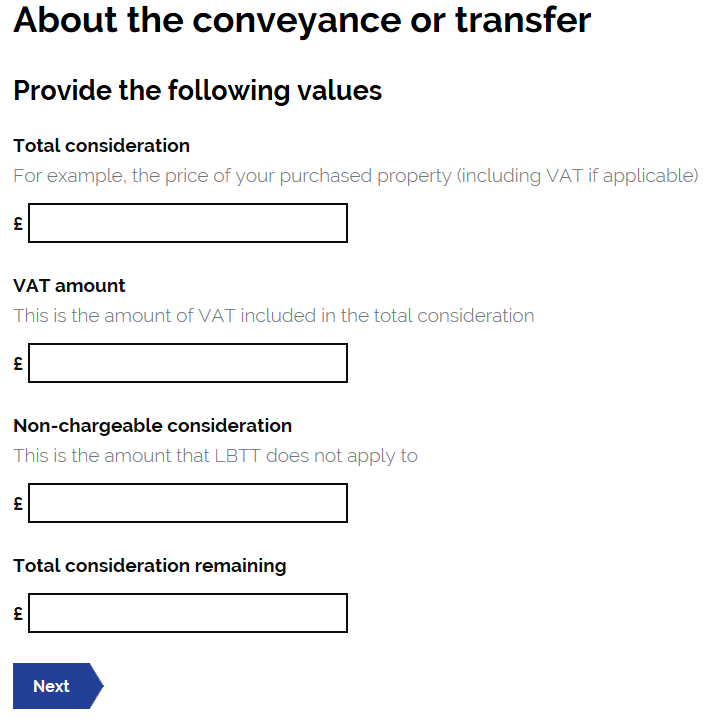

Under ‘total consideration’, you must now include the amount that is actually known. This includes both the non-contingent element from the initial return and the further non-contingent element that has become known.

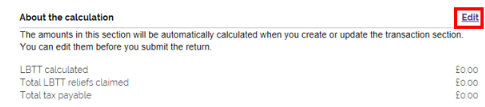

You must then amend the ‘total tax payable’ under the ‘About the calculation’ section of the return to include only the additional amount due now if additional tax has become due that has not been paid.

When asked if there are any linked transactions, you must click ‘yes’ and include the return reference for the original return, alongside the consideration shown in that return. Guidance on linked transactions can be found at LBTT2008.

A buyer required to make an LBTT return to Revenue Scotland is also required to keep and preserve certain records in relation to making a correct and complete return. See the guidance on keeping and preserving records (LBTT9001) for more information.

Less tax payable

A claim can be made for repayment of tax if less tax is payable for the transaction as a result of the contingent consideration ceasing or the uncertain or unascertained consideration becoming known. If the event occurs within the 12 month period allowed for the amendment of a LBTT return, the claim must be made by amending the LBTT return (see LBTT4006).

If the claim is made after the end of the 12 month amendment period, the claim must be made under section 107 of the RSTPA 2014 and no later than five years after the date the original return was required to be made (see section 115 of the RSTPA 2014). Further guidance on how to make such a claim can be found in RSTP7003.

Interest will be paid on repayment of overpaid tax from the date of original payment by the buyer. Interest will be charged however from the day after the payment was due (see RSTP4004).

Example

- A contracts with B to buy a plot of land for £10m with an additional £5m of contingent consideration, payable on A being successful in obtaining planning permission to build an industrial park on the land within three years.

- The total chargeable consideration for LBTT is £15m.

- A chooses not to make an application to defer payment of tax, and pays LBTT on the £15m total consideration.

- Three years pass but A is unsuccessful in the planning application, so the £5m is not payable.

- A does not need to make a further return to Revenue Scotland. A can make a claim for repayment of LBTT on £5m. Interest will be payable to A on this £5m.

- As this will be after the amendment window, an amendment to the return will not be possible. Therefore, a Section 107 claim must be made for repayment of the amount overpaid.

Guidance on How to make an LBTT return and pay tax is available separately on our website.

A buyer who fails to make a return to Revenue Scotland by the filing date is liable to a penalty (see RSTP3005). If the return contains an inaccuracy, the buyer may be liable to a penalty (see RSTP3011).

A buyer who fails to pay tax prior to the expiry of 30 days after the date payment is due (the day the LBTT return is made) is liable to a penalty (see RSTP3008). Interest will be charged however on the amount of any unpaid tax from the filing date until the date it is paid (see RSTP4002).

A buyer required to make an LBTT return to Revenue Scotland is also required to keep and preserve certain records in relation to making a correct and complete return. See the guidance on keeping and preserving records (LBTT9001) for more information.

Less tax payable

A claim can be made for repayment of tax if less tax is payable for the transaction as a result of the contingent consideration ceasing or the uncertain or unascertained consideration becoming known. If the event occurs within the 12 month period allowed for the amendment of a LBTT return, the claim must be made by amending the LBTT return (see LBTT4006).

If the claim is made after the end of the 12 month amendment period, the claim must be made under section 107 of the RSTPA 2014 and no later than five years after the date the original return was required to be made (see section 115 of the RSTPA 2014). Further guidance on how to make such a claim can be found in RSTP7003.

Interest will be paid on repayment of overpaid tax from the date of original payment by the buyer. Interest will be charged however from the day after the payment was due (see RSTP4004).