LBTT6040 – Scottish Budget Transitional Arrangements

The LBTT rates and bands for lease transactions were changed with effect from 07 February 2020. The agreement for lease/missives of let date and the effective date of your transaction will determine whether the changes affect you.

Lease transaction rates and bands for transactions on or after 07 February 2020

| NPV of rent payable | Rate of tax to apply |

| Up to £150,000 | 0% |

| Above £150,000 to £2,000,000 | 1% |

| Above £2,000,000 | 2% |

Lease transaction rates and bands for transactions prior to 07 February 2020

| NPV of rent payable | Rate of tax to apply |

| Up to £150,000 | 0% |

| Above £150,000 | 1% |

Effective date is on or after 07 February 2020 and agreement for lease/missives of let entered into on or before 5 February 2020

Where the effective date of a land transaction is on or after 07 February 2020 but the agreement for lease/missives of let for the land transaction were entered into on or before 05 February 2020, the tax rates and bands for lease transactions that were in force prior to 07 February 2020 will apply.

How to complete a tax return when the transitional provisions apply

When completing the tax return, the tax calculation is based on the effective date of the transaction. For a transaction with an effective date on or after 07 February 2020, SETS will calculate tax using the new rates and bands for leases.

Where the agreement for lease/missives of let for the transaction were entered into before 06 February 2020 but the effective date is on or after 07 February 2020, tax will be calculated using the rates and bands for lease transactions in force prior to 07 February 2020. In order to show this on the LBTT tax return you must overwrite the tax due in the ‘LBTT tax liability on rent’ field. The ‘Total tax payable’ is automatically calculated and cannot be overwritten. Once you have overwritten the ‘LBTT tax liability on rent’ field, the total tax payable will automatically recalculate using the amended amount.

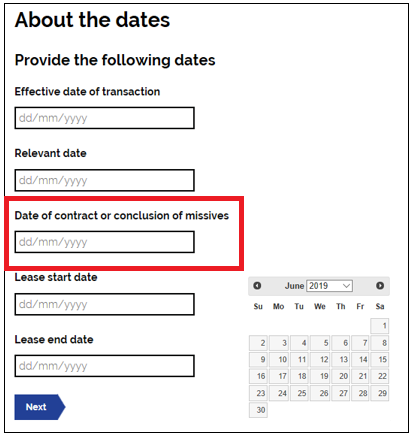

You must also make sure you complete the ‘date of contract or conclusion of missives’ field. This will be used to confirm that you entered into your contract prior to 06 February 2020 and have applied the correct tax rate.

Example

GT Energy Limited entered into missives of let for a 10 year lease of a wind farm on 31 January 2020. The lease is due to commence on 20 February 2020 on a turnover-based rent estimated at £300,000 per annum. The effective date of the transaction is 20 February 2020.

The NPV was calculated to be £2,494,981.60. Although the effective date is on or after 07 February 2020, the rates and bands for lease transactions prior to 07 February 2020 will be applicable as the missives of let were entered into prior to 06 February 2020.

GT Energy Limited is required to calculate the tax liability using the rates and bands for lease transactions in force prior to 07 February 2020 and submit a LBTT return.

When completing the LBTT tax return, they must enter 31 January 2020 in the ‘date of contract or conclusion of missives’ field in the ‘About the Transaction’ section of the return:

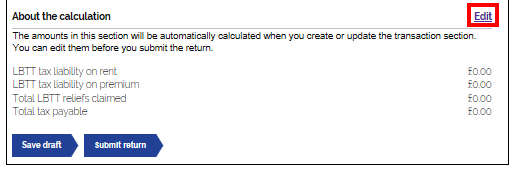

In the ‘About the Calculation’ section of the return, the tax liability will be calculated by the SETS system based on the effective date of transaction. As the effective date in this example is 20 February 2020, the new rates and bands for lease transactions will automatically be applied by the SETS system.

In order to apply the rates and bands for lease transactions that applied prior to 07 February 2020, the taxpayer or person completing the return on their behalf must overwrite the amount of tax due in the ‘LBTT tax liability on rent’ field by selecting ‘edit’.

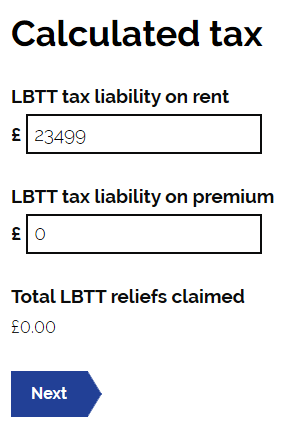

The ‘LBTT tax liability on rent’ figure can then be amended to reflect the rates and bands that were in force prior to 07 February 2020.

Once the ‘LBTT tax liability’ on rent figure has been overwritten to the correct amount due, click ‘Next’. You will then be taken to the return overview and the ‘Total tax payable’ figure will automatically be updated to display the correct amount due.