Where the chargeable consideration for a lease transaction to which this schedule applies includes rent, the tax chargeable is the sum of—

- any tax chargeable on so much of the chargeable consideration as consists of rent, and

- any tax chargeable on so much of the chargeable consideration other than rent.

LBTT60051 – Tax chargeable on rent

The tax chargeable for the rental element of a lease is determined by calculating the tax that is due on the rent using the net present value (NPV) of the rent payable over the term of the lease.

The amount of tax chargeable on the element of chargeable consideration consisting of rent is to be determined as follows.

- Calculate the net present value (NPV) of the rent payable over the term of the lease.

- For each tax band, multiply so much of the NPV as falls within the band by the tax rate for that band.

- Calculate the sum of the amounts reached under Step 2. The result is the amount of tax chargeable in respect of rent.

The NPV is used to estimate the value today of rents that will be paid in the future. It is important to remember that the beginning of the period this calculation runs from is the start of the period of the lease. This may not be the present but a time in the future.

The calculation of the NPV of the rent has three elements.

The first element is the temporal discount rate. The temporal discount rate is set in legislation at 3.5% (see LBTT(S)A 2013 Schedule 19, Paragraph 7).

The second element of the calculation is the term of the lease.

The third element is the amount of rent payable. Any VAT chargeable must be included in the rent calculation.

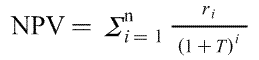

The net present value (NPV) of the rent payable over the term of a lease is calculated by applying the following formula—

where—

r i is the rent payable in respect of year i,

i is the first, second, third etc. year of the term of the lease,

n is the term of the lease, and

T is the temporal discount rate (see paragraph 7).

Once the term of the lease and the rent payable have been ascertained or estimated (if the actual rent is not yet known), the formula above is used to calculate the NPV of the rental payments. The tax rates and bands are then applied to the NPV to work out the tax due on the rent.

The current tax rates and bands that apply are found here: Lease Transactions | Revenue Scotland

The LBTT tax calculator for lease transactions or the formula discussed above can be used to calculate the NPV. LBTT is a self-assessed tax and therefore Revenue Scotland does not accept liability for the use by taxpayers or agents of this calculator.

Tax due on the rent for linked transactions

There is a similar calculation where a lease is one of a number of linked transactions. This is covered at LBTT(S)A 2013 Schedule 19, Paragraph 5.

Where a chargeable transaction is one of a number of linked transactions, the amount of tax chargeable in respect of the rent is to be determined as follows.

- Calculate the total of the net present values (TNPV) of the rent payable over the terms of all the leases, as outlined above.

- For each tax band, multiply so much of the TNPV as falls within the band by the tax rate for that band.

- Total the amounts reached at step 2. This is the total tax chargeable in respect of the rent.

- Divide the NPV of the rent payable over the term of the lease by the TPNV.

- Multiply the total tax chargeable in respect of the rent (step 3) by the fraction reached at step 4. This is the amount of tax chargeable in respect of the rent for the lease in question.

LBTT60052 – Tax chargeable on consideration other than rent

The amount of tax chargeable in respect of consideration other than rent is covered in Schedule 19, Part 3.

Treatment of the premium in a single transaction

Tax is due on any consideration other than rent (‘premium’) paid in addition to rent. The premium is taxed using the tax rates and bands that apply to purchases of non-residential property.

However, where the ‘relevant rent’ is at least £1,000 per annum, the nil rate tax band does not apply in relation to the premium; all such consideration is treated as falling within the next tax band.

The relevant rent is the average annual rent over the term of the lease or, where different rents are payable over different parts of the term, the average rent over the term where the rent is the highest.

Treatment of the premium in linked transactions

Where the transaction is taken into account as a linked transaction for the purposes of section 26, no account is to be taken of rent in determining the relevant consideration.

As is the case for a single lease transaction, where the ‘relevant rent’ is at least £1,000 per annum, the nil rate tax band does not apply in relation to the premium; all such consideration is treated as falling within the next tax band.

Where the transaction is:

- one of a number of linked transactions;

- the relevant land is partly residential and partly non-residential property; and

- the relevant rent attributable (on a just and reasonable apportionment) to the non-residential land is at least £1,000

then the transactions are treated as if they were two sets of transactions, with—

(a) one whose subject-matter consists of all of the interests in land that is residential property, and

(b) one whose subject-matter consists of all of the interests in land that is non-residential property.

The premium is attributed (on a just and reasonable apportionment) to each set of transactions.

The ‘relevant rent’ for linked transactions is the total of the average annual rents in relation to all of those transactions. The annual rent means the average annual rent over the term of the lease, or if different amounts are payable for different parts of the term and they are ascertainable, the average annual rent over the term for which the highest ascertainable rent is payable.

Relevant land means any land which forms the main subject-matter of any of the transactions.

LBTT60053 – Tax Rates and Bands

The following rates and bands apply:

Rent: rates and bands for transactions on or after 07 February 2020

| NPV of rent payable | Rate of tax to apply |

|---|---|

| Up to £150,000 | 0% |

| Above £150,000 to £2,000,000 | 1% |

| Above £2,000,000 | 2% |

Please see LBTT6040 for more information where the effective date of a lease transaction was earlier than this date (or where the agreement for lease/missives of let for the lease transaction were entered into on or before 05 February 2020).

LBTT may also be payable on chargeable consideration other than rent, such as a premium. In such cases, the standard tax rates and bands for non-residential property transactions apply.

Premiums: rates and bands for transactions on or after on or after 25 January 2019

| Purchase price | LBTT rate |

|---|---|

| Up to £150,000 | 0% |

| Above £150,000 to £250,000 | 1% |

| Above £250,000 | 5% |

Where the effective date of a land transaction was on or after 25 January 2019 but the contract for the land transaction was entered in to prior to 12 December 2018, the tax rates and bands for non-residential transactions that were in force to 25 January 2019 will apply.

Transactions prior to 25 January 2019

| Purchase price | LBTT rate |

|---|---|

| Up to £150,000 | 0% |

| Above £150,000 to £350,000 | 3% |

| Above £350,000 | 4.5% |

LBTT60054 – Scottish Budget – Rates and Bands

The LBTT rates and bands for lease transactions may change over time. The agreement for lease/missives of let date and the effective date of your transaction will determine what rates and bands will apply to your lease transaction.

When a rate change is introduced the new rates and bands apply where the effective date is after the commencement date of the new rate. However, the new rates and bands do not apply where the effective date is on or before the commencement date if contracts for the land transaction have been entered into prior to this date.

When a 3-yearly review return is required, the effective date is used to determine the rates and bands applicable to any additional LBTT due.

Rates and Bands

Any consideration other than rent is taxed at the non-residential rates and bands. The rates are available on the Revenue Scotland website.

Lease rates and bands in respect rent for transactions on or after 7 February 2020

| NPV of rent payable | Rate of tax to apply |

|---|---|

| Up to £150,000 | 0% |

| Above £150,000 to £2,000,000 | 1% |

| Above £2,000,000 | 2% |

Lease rates and bands in respect of rent for transactions from 1 April 2015 – 6 February 2020

| NPV of rent payable | Rate of tax to apply |

|---|---|

| Up to £150,000 | 0% |

| Above £150,000 | 1% |

How to complete a tax return when the transitional provisions apply

When completing the tax return, the tax calculation is based on the effective date of the transaction.

For example, for a transaction with an effective date on or after 7 February 2020, SETS will calculate the tax due using the rates and bands for leases as applicable at that date.

Where the agreement for lease/missives of let for the transaction were entered into before 6 February 2020 but the effective date is on or after 7 February 2020, tax should be calculated using the rates and bands for lease transactions in force prior to 7 February 2020.

Where the effective date of a land transaction is on or after 7 February 2020 but the agreement for lease/missives of let for the land transaction were entered into on or before 6 February 2020, the tax rates and bands for lease transactions that were in force from 1 April 2015 to 6 February 2020 will apply.

In order to show this on the LBTT tax return the tax due in the ‘LBTT tax liability on rent’ field must be overwritten. The ‘Total tax payable’ is automatically calculated and cannot be overwritten but once the ‘LBTT tax liability on rent’ field has been overwritten, the total tax payable will automatically recalculate using the amended amount.

The ‘date of contract or conclusion of missives’ field must be completed. This will be used to confirm that the contract was entered into prior to 6 February 2020 and the correct tax rate has been applied. The rates and bands applicable would apply for the purposes of any changes made during the 3-year review cycle.

Example

GT Energy Limited entered into missives of let for a 10-year lease of a wind farm on 31 January 2020. The lease is due to commence on 20 February 2020 on a turnover-based rent estimated at £300,000 per annum. The effective date of the transaction is 20 February 2020.

The NPV was calculated to be £2,494,981.60. Although the effective date is on or after 7 February 2020, the rates and bands for lease transactions prior to 7 February 2020 will be applicable as the missives of let were entered into prior to 6 February 2020.

GT Energy Limited calculates the tax liability using the rates and bands for lease transactions in force prior to 7 February 2020 and submits a LBTT return.

When completing the LBTT tax return, they must enter 31 January 2020 in the ‘date of contract or conclusion of missives’ field in the ‘About the Transaction’ section of the return.

In the ‘About the Calculation’ section of the return, the tax liability will be calculated by the SETS system based on the effective date of transaction. As the effective date in this example is 20 February 2020, the rates and bands for lease transactions for this date will automatically be applied by the SETS system.

In order to apply the rates and bands for lease transactions that applied prior to 7 February 2020, the taxpayer or person completing the return on their behalf must overwrite the amount of tax due in the ‘About the Calculation section’ under ‘LBTT tax liability on rent’ field by selecting ‘Edit’.

The ‘LBTT tax liability on rent’ figure can then be amended to reflect the correct rates and bands.

Once the ‘LBTT tax liability’ on rent figure has been overwritten to the correct amount due, and ‘Next’ is clicked, the ‘Total tax payable’ figure will automatically be updated to display the correct tax due.