Performance Overview

This overview gives a summary of Revenue Scotland’s purpose and objectives, key risks to the delivery of those objectives, together with its budget and performance for the year. Further detail is

Introduction

The performance report includes a short performance summary and an analysis section which considers performance against the strategic outcomes of our Corporate Plan 2021-24.

Who we are and what we do

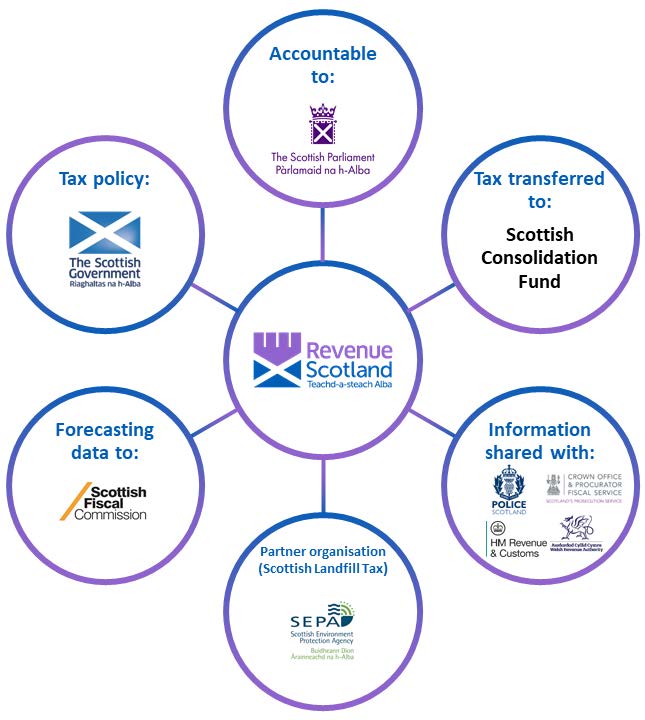

Revenue Scotland was established by the Revenue Scotland and Tax Powers Act 2014 (RSTPA) and is responsible for the collection and management of the taxes fully devolved to Scotland – currently Land and Buildings Transaction Tax (LBTT) and Scottish Landfill Tax (SLfT).

As a non-ministerial office, Revenue Scotland is part of the Scottish Administration and is directly accountable to the Scottish Parliament to ensure the administration of tax is independent, fair and impartial. included within the Performance Analysis section.

The Scottish Government is responsible for tax policy and the setting of tax rates. Revenue Scotland supports policy development through the provision of information, advice and data based on our operational experience. The Scottish

Fiscal Commission (SFC) is responsible for providing independent forecasts of tax revenue in line with the Fiscal Framework. To support forecasting work, Revenue Scotland provides the SFC with SLfT and LBTT data in an anonymous, aggregated form.

Revenue Scotland delegates the delivery of specific functions for the collection of SLfT to the Scottish Environment Protection Agency (SEPA).

We also work with His Majesty’s Revenue and Customs (HMRC) for the purposes of compliance activity, and with the Welsh Revenue Authority and other tax authorities on the British Isles Tax Authorities Forum sharing knowledge and best practice in tax collection and management.

How we are governed

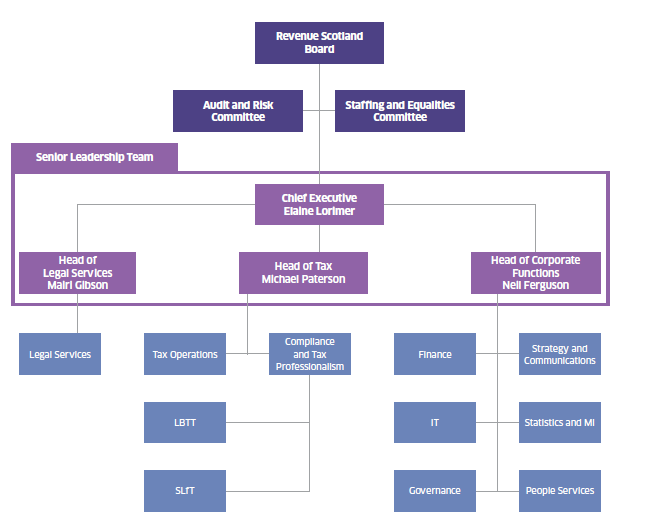

The Revenue Scotland Board at 31 March 2022 comprised six members appointed by Scottish Ministers through the Scottish Public Appointments process. A further three members were appointed with effect from 1 June 2022 and the appointments of two members were concluded at the end of June 2022. The Board has responsibility for the strategic direction, oversight and governance of Revenue Scotland. Board members provide specialist knowledge in key areas and act as ambassadors for the organisation.

The Board has two committees; the Audit and Risk Committee (ARC) and the Staffing and Equalities Committee (SEC), which undertake detailed scrutiny of key areas of work and report on these to the Board.

The Chief Executive is accountable to the Board and acts in a personal capacity as the Accountable Officer for Revenue Scotland.

The Chief Executive is responsible for the day-to-day leadership and operation of the organisation.

Further details about the activities of the Board, committees and staff are contained in the Accountability Report section.

How we are structured

The Senior Leadership Team comprises the Chief Executive along with the Head of Tax, Head of Corporate Functions and Head of Legal Services all of whom report directly to the Chief Executive. The diagram below illustrates Revenue Scotland’s organisational and team structure.

How are we funded

Revenue Scotland is part of the Scottish Administration and has its budget set out in the annual Budget Bill. The Scottish Government liaises with Revenue Scotland to identify its budgetary requirements which are then reflected in the Budget Bill that Ministers present to the Scottish Parliament. Where additional funding for major programmes is required, proposals for funding are developed in line with the guidance on business cases in HM Treasury’s ‘The Green Book: appraisal and evaluation in central government’.

Revenue Scotland is responsible for managing its budget for each financial year to deliver its statutory functions. Revenue Scotland has authority to incur expenditure on individual items but this is subject to the limits imposed by the budget allocated by the Scottish Parliament and guidance from Scottish Ministers.

Revenue Scotland’s purpose and vision

On 30 November 2021, we published our third Corporate Plan, for the period of 2021-24,after laying it in Parliament. The Corporate Plan 2021-24 outlines the purpose, vision, strategic objectives and performance measures for Revenue Scotland. Together, these will help us continue our work in raising revenue to support public services across Scotland.

Purpose

To efficiently and effectively collect and manage the devolved taxes which fund public services for the benefit of the people of Scotland.

Vision

We are a trusted and valued partner in the delivery of revenue services, informed by our data, digital by design, with a high-performing and engaged workforce.

Corporate Plan 2021-24 strategic outcomes

After seven years of operation, Revenue Scotland is firmly established in the tax and public sector landscapes in Scotland. Our Corporate Plan 2021-24 is built on the four pillars of excelling in delivery, investing in our people, reaching out and looking ahead, and on the objectives we have identified, that will take the organisation forward in a sure-footed and value-added way. It builds on our strong achievements to date – not least the collection of approaching £5 billion ofrevenue since 2015, all of which stays in Scotland and helps fund Scotland’s public services.

Excelling in delivery

We are committed to delivering excellent public services with users at the heart of them. Our focus is on investing in new systems and the latest technology, as well as ensuring we

are able to continue to get quality data analytics to make smarter decisions and connections – all in order to meet taxpayer needs and expectations while making our work as efficient and effective as possible.

Investing in our people

We have a great team, who, along with our partners, are our most important asset. Staff health, safety and wellbeing are our priority, and our staff have demonstrated resilience to

the challenges that the COVID-19 pandemic brought about. Our People Strategy sets out our ambition to be an employer of choice which is diverse and inclusive. We are committed to investing in our people, building capability and nurturing our talent. We maintain an acute awareness that we exist as a public service, and we will continue to adapt our ways of working to meet the needs of our staff and taxpayers.

Reaching out

We are an accessible, collaborative and transparent organisation that is keen to learn from others and to share our experiences and expertise. In particular, we strive to engage users in the design of our services, maximise the opportunities of technology and expand the reach of our engagement to diversify our stakeholder base. We will collaborate effectively with others to deliver public service improvements and efficiencies.

Looking ahead

We continue to strive to deliver excellence in all we do and are committed to responding constructively to current economic and societal challenges and requirements as part of

public sector reform. We plan and deliver change and new responsibilities flexibly, on time and within budget. We have a digital mindset, maximising the use of our data and harnessing new technology to improve our working practices and services.

How we deliver our purpose and measure our success

Revenue Scotland delivers its purpose through the strategic outcomes in the Corporate Plan. Performance is measured through the use of key performance indicators (KPIs) as set out in the Corporate Plan, and against the delivery of milestones relating to the objectives of the key projects.

We have a Business Plan that sets out projects and other cross-cutting pieces of work which help us deliver the strategic outcomes in the Corporate Plan, and it also informs team plans and personal work objectives. This structure provides a clear ‘line of sight’ between the work objectives of each staff member and the strategic outcomes set out in the Corporate Plan.

A structured approach to performance management supports how we monitor and record progress across the organisation. Monthly reports are produced for the Senior Leadership Team that capture the collective contributions made to our performance, and a quarterly report is produced for the Board. The performance reports are also considered alongside regular assessment of our operational performance, key performance indicators, financial position, analysis of risk and consideration of our capacity. These all contribute to the performance record and form the basis of our analysis of performance that follows.

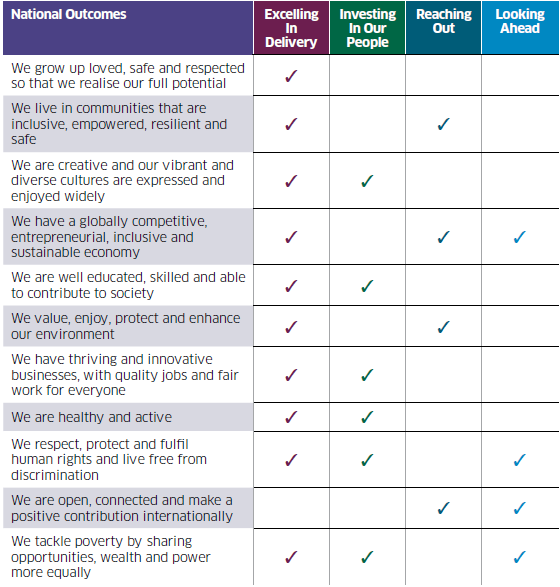

National Performance Framework

Scotland’s National Performance Framework (NPF) sets an overall purpose and vision for Scotland. It establishes broad ‘National Outcomes’ and provides measures on how well Scotland is progressing towards those outcomes.

Our Corporate Plan 2021-24 clearly aligns with and prominently features the National Outcomes. It is this plan, and in it the National Outcomes, that strategically direct and prioritise all our work as an organisation. To ensure the successful delivery of the Corporate Plan, our objectives and deliverables are further defined and translated into action through a strategic framework of corporate strategies, business plan and team plans, and we have comprehensive performance reporting processes in place to monitor our progress against objectives on a monthly and quarterly basis.

Through the collection of devolved tax revenues that fund Scottish public services, Revenue Scotland indirectly contributes to all of the National Outcomes. Six of the National Outcomes are particularly relevant to the work we do: economy, environment, fair work and business, communities, human rights and health. In these areas we contribute through investment in staff, commitment to equality and diversity, through working in collaboration with stakeholders and taxpayers and acting in an open, transparent and accountable manner. Scottish Landfill Tax, in particular, is essentially an environmental fiscal measure and acts to promote the circular economy. In this way, we make an important contribution to the environmental NFP outcome.

The following table shows which Revenue Scotland strategic themes are relevant to the various National Outcomes.

Key issues and risks

Revenue Scotland managed a number of risks and issues during 2021-22. The Board of Revenue Scotland was kept informed throughout and scrutinised and monitored progress in the management of these risks and issues.

Staff wellbeing (and mitigating the impacts of the COVID-19 pandemic) remained a key focus for the organisation. This included the need to proactively manage the impact of positive COVID-19 testing amongst staff and to facilitate the return to office working as part of the wider approach to hybrid working. A project team was established to lead this activity over the last year, tasked with ensuring that health and wellbeing were central to the approach. This facilitated the maintenance of our service to taxpayers and their agents in the face of staff absences, and a safe return to office working, and ensured any potential for transmission has been limited as far as possible. As part of Revenue Scotland’s commitment to wellbeing, our Health and Wellbeing Group has delivered a number of wellbeing-related sessions to staff over the past financial year. These included: musculoskeletal awareness, work/life balance, hybrid working, healthy eating, the importance of taking breaks, and, mindfulness and mindful walking. Employee one-to-one consultations were conducted throughout the year to ensure staff were able to work from home safely. Display screen equipment (DSE) assessments were also carried out as part

Revenue Scotland works closely with its trade unions (TU) at all levels with the aim of making the organisation a healthier and safer place to work. This commitment is demonstrated through the inclusion of TU representation on the Health, Safety and Wellbeing Committee.

In addition, a wider review of health, safety and wellbeing has been undertaken. This has resulted in significant progress against Revenue Scotland’s health and safety action plan. It has also ensured the right training has been put in place to support the return of staff to offices; for example, first aid and fire safety training. As part of this, Revenue Scotland has worked closely with Scottish Government colleagues to make the best use of the support available within the Scottish Government estate.

In response to heightened alertness on cyber security threats and as a result of the wider geo-political context and an attack in December 2020 on our partner organisation SEPA, cyber security has been a key issue for the organisation over the last year. A desktop exercise was conducted to test the resilience of the organisation in the face of common attacks detailed by the National Cyber Security Centre. Action has been taken to further strengthen controls in this area based on the outcomes of this exercise and lessons learnt from the attack on SEPA.

Other initiatives to address issues and mitigate risks included

Tax solutions: A number of project teams were established throughout the year to provide various solutions to improve the service provided to taxpayers. These have included: a secure messaging service to enable prompt responses, proportionate measures to alleviate the burden on taxpayers potentially facing penalties for late returns or payments, and tailored support to taxpayers to submit lease review returns on time.

Tax Assurance Group (TAG): TAG continues to meet regularly to discuss complex cases and operational changes. A key feature of 2021-22 was the approval of updated compliance plans, that detail how Revenue Scotland operates under an established risk management framework. The framework aligns with the best practice guidance presented through the Scottish Public Finance Manual and the Scottish Government’s Risk Management Guidance document. The framework sets out the process for identifying and documenting risk, assigning ownership of risk, scoring risk, determining responses to risk and monitoring and reporting on progress in managing risk.

Learning and development: The Scottish Tax Education Programme (STEP) continued to thrive during 2021-22 with the delivery of the virtual foundation modules to many of the new staff who joined the organisation throughout the year. Development began on a number of specialist learning areas such as: corporate strategy, investigatory powers, styles, behavioural penalties and reviews and piloted modules relating to debt, Additional Dwelling Supplement (ADS) and leases. All this progress was supported by our training champions, who have embraced new technology such as the use of Mentimeter, Canva and MS Teams to further improve learner engagement and experience. 98% of attendees confirm that attending STEP has improved their skills and knowledge.

Wellbeing: We have continued to promote wellbeing and engagement across Revenue Scotland. Throughout the year we have continued to deliver a comprehensive induction programme for new staff. Approximately 35% of our workforce changed during 2021-22, this presented both opportunity and challenge. Connecting staff as one organisation continues to be a priority and we hosted two virtual all-staff gatherings during the year.

Delivering legislative change

2021-22 saw Revenue Scotland implement changes announced in the Scottish Budget to both LBTT and SLfT, taking effect from 1 April 2021. After a temporary change during the COVID-19 pandemic, the ceiling of the nil rate band for residential LBTT returned, as planned, to £145,000 for transactions as of 1 April 2021. Rates for the Additional Dwelling Supplement (ADS) and non-residential LBTT remain unchanged. The Scottish Budget 2021-22 also confirmed, and Revenue Scotland implemented, an increase in SLfT rates from 1 April 2021, as follows:

|

Rate/Year |

2021-22 |

2020-21 |

|---|---|---|

|

Standard rate per tonne |

£96.70 |

£94.15 |

|

Lower rate per tonne |

£3.10 |

£3.00 |

Revenue Scotland also actively collaborates with Scottish Government officials in the design and structure of possible future legislative change. This involvement, including consultations, during 2021-22 is likely to lead to further legislative change in 2022-23 and beyond.

Litigation

In our Annual Report and Accounts for 2020-21, we reported on the impact of COVID-19 on our litigation. While in 2020-21 only four virtual tribunal hearings took place for devolved taxes, over the course of 2021-22, COVID-19 restrictions affecting litigation gradually eased.

During 2021-22, Revenue Scotland participated in seven tribunal hearings, of which four were LBTT appeals and three were SLfT appeals. Three LBTT hearings and one SLfT hearing were conducted virtually. The remaining three hearings were held in person.

For both virtual and in person proceedings, the tribunal directed electronic submission of documents. This resulted in a cost saving in relation to printing and posting for both parties. The technology and arrangements for virtual hearings has worked well and Revenue Scotland welcomes the availability of an alternative virtual format. There is a complex mix of factors which will impact which format is appropriate and Revenue Scotland is supportive of legal developments in this area.

Since Revenue Scotland was established in 2015, we have been collecting data in relation to litigation. Trends are consistently showing higher volumes of LBTT appeals compared to SLfT appeals. There has also been an increase in the tribunal rejecting appeals seeking ADS repayment.

Future Operating Model

Early in 2021 the Chief Executive commissioned the Scottish Government Directorate for Internal Audit and Assurance (DIAA) to undertake a review of action taken during the pandemic. The positive report outcome led us to consider how the changes introduced as a result of working remotely could be considered as part of more permanent working arrangements.

The Chief Executive commissioned consultancy firm EY to undertake a short piece of work to develop an options appraisal1 of three possible future operating models – fully remote, fully office-based and hybrid – against the following criteria: our service, our organisation, our people, scalability, value for money and green recovery. This aimed to enable us to

determine what our optimal future operating model could be. It considered the case for change, the risks and the development of a principles-based hybrid operating model that could be evaluated.

The key outcome sought was the operating model which produced the best business performance. Employee personas were developed to reflect our staff’s different preferences and needs with regards to office, home and hybrid working. They also accounted for the health, safety and

wellbeing of individuals, and the implication on their preferred work setting. Additionally, role personas were identified; these were aimed at helping to define the distinct purpose of the workplace and when the employees would interact with the office.

In June 2021 the Revenue Scotland Board committed to piloting a hybrid model for a year, which would be subject to quantitative and qualitative analysis. This will enable the organisation to determine its optimum hybrid operating model for 2023-24 and beyond.

A futures project team was established to develop the options appraisal, participate in the scoring exercise and then take forward the planning required to implement the Board’s decision. The team developed three phases to introduce hybrid working. Phase one commenced in September 2021. This phase permitted staff with health and safety or wellbeing issues, or staff undertaking business- critical work, to return to our Victoria Quay office. A duty manager role was established to provide support to those staff returning.

In March 2022 COVID-19 restrictions were further relaxed, and phase two of the trial invited staff who identified with a blend of home- and office-based persona to attend the office. As an organisation we collectively reviewed activities that could be optimised in the office and defined the office-based activities for which all staff would attend the office. The final phase of our hybrid pilot includes inviting all staff to attend the office for defined activities and sees the use of a hub site in Glasgow. In preparation for staff returning to the office, a health and safety inspection was carried out in conjunction with the trade unions, a hybrid staff handbook was developed, IT was refreshed, and office space repurposed to optimise the hybrid experience. The evaluation of the hybrid model of working will be evidence-based. Staff pulse surveys have been taken at regular intervals and a full evaluation will be undertaken at the end of the pilot in March 2023.

Performance summary

Key projects

Revenue Scotland’s Business Plan includes 10 key strategic projects for 2021-22, which represent a large investment and/or which are of strategic importance to the organisation

and contribute to the delivery of the Corporate Plan. At the end of 2021-22, most projects were either complete or continuing to progress.

| Project and scope | Progress | Status |

|---|---|---|

| 1. Scottish Budget changes To deliver changes to the devolved taxes through changes introduced to the Scottish Budget, ADS and SLfT provisions |

No changes were made to LBTT bands; however, both the standard and lower rates of SLfT increased. The website was updated to reflect the new rates and operators have been contacted to inform them of the rate changes. Testing of our Scottish Electronic Tax System (SETS) was also completed to ensure that the system correctly reflected the changes. |

Complete |

| 2. LBTT legislative guidance To revise and refresh the external guidance, including legislative guidance for both devolved taxes, ensuring accessibility and stakeholder standards are met |

Changes to guidance are ongoing. |

Ongoing |

| 3. Finance system renewal To renew the tax finance system contract and to explore a new system in 2022-23 |

The contract was successfully renewed with updated contract terms. |

Complete |

| 4. Remote printing project To develop, roll out and integrate a third-party printing solution as an element of our Target Operating Model |

Project has been completed; all applicable business areas are now using the printing solution. |

Complete |

| 5. Development of learning experience platform Development of a Revenue Scotland learning experience platform which will sit within the SG Thrive platform. It will contain learning & development (L&D),Scottish Tax Education Programme (STEP) and provide a platform for staff to lead on their own L&D and build capability for the future. |

Work on this project is ongoing; user testing has begun. |

Ongoing |

| 6. Enhanced support policy To develop a suitable policy and solutions for customers and staff who require varying levels of enhanced support or services |

The policy has been split into an internal and external policy. Significant progress has been made but is still ongoing. |

Ongoing |

| 7. Capital Investment Programme To maintain Revenue Scotland’s programme of continuous improvement suggestions |

Development and implementation of improvements are in progress |

Ongoing |

| 8. Analytical workbench Accessing Edinburgh University’s Analytical Workbench to provide data analytics ability, load testing, and functionality testing of SETS, to support the continuous improvement programme (related to Data Science Accelerator Programme) |

Programme has concluded: findings were taken and further research by IT teams is being undertaken to develop similar solutions. |

Complete |

| 9. Implementation of Jira service desk To deliver a service and incident management tool to enable the management and provide visibility of and reporting of workflows and requirements |

After a review of Jira, Scottish Government’s iFix service was implemented as a shared service pending a broader review of IT service management practices. |

Complete |

| 10. Annual Report and Accounts To produce the Annual Report and annual Accounts for the current financial year |

The production of Annual Report and Accounts were completed for the applicable financial year. This process is annual. |

Complete |

KPIs overview

The Corporate Plan 2021-24 includes 10 key performance indicators (KPIs) which

demonstrate Revenue Scotland’s performance against the plan and towards our targets.

Full details relating to each KPI and target can be found in the Performance Analysis section

of this Annual Report and page numbers are provided in the table.

The KPIs demonstrate our operational performance in the midst of the challenges associated

with the COVID-19 pandemic in 2021-22.

New KPIs were introduced in 2021-22 to monitor our performance against new priority

objectives, including work relating to equalities mainstreaming, service user feedback, and

progress towards becoming a greener organisation. Previous KPIs were also updated to

more accurately reflect our performance against key areas. For these reasons comparison

to previous years is not always available.

| No. | Indicator | Target/Indicator | 2021-22 | 2020-21 | Status |

|---|---|---|---|---|---|

| 1 | Tax collection rate: Percentage of tax declared which has been collected |

Comparison to 2017-18 baseline (99%) |

99% | 100% | Achieved |

| 2 | Response to user requests |

Composite of calls, written correspondence and time to process claims for repayment of tax. Green – 95% Amber – <95% >90% Red – <90% |

95% | N/A – New for this year |

Achieved |

| 3 | Tax secured through Revenue Scotland’s compliance activity |

Compared to previous year’s compliance activity, no formal target set |

£721k | £963k | Not applicable |

| 4 | Administrative cost of tax collection |

<1% | 0.68% | 1% | Achieved |

| 5 | Skills and knowledge development |

>90% of staff having completed 30 hours (pro rata) learning and development |

94% | N/A – New for this year |

Achieved |

| 6 | People Survey Engagement and Stress Proxy Index |

Combined score to be within top 25% of CS organisations |

Combined score of 33 |

N/A – New for this year |

Not achieved |

| 7 | Service users feedback |

Developing KPI definition and measure |

N/A | N/A – New for this year |

In development* |

| 8 | Equalities | RAG status applied based on progress against Equalities Mainstreaming action plan |

Amber | N/A – New for this year |

Partially achieved |

| 9 | Environment | Developing KPI definition and measure |

N/A | N/A – New for this year |

Removed** |

| 10 | Delivery of key strategic projects |

Combined RAG status of 10 key strategic projects |

Green | N/A – New for this year |

Achieved |

*In 2021-22 Revenue Scotland started gathering service user feedback via the online tax collection system SETS; this will continue during 2022-23 to set a benchmark.

**In May 2022, the Board agreed that KPI 9 was to be set aside, while a revised Green Strategy and environmental targets are to be considered in 2022-23.

Financial performance

Resource accounts

The figures given below are the final budget (revenue and capital) after adjustment in the

Spring Budget review.

|

Net Expenditure against Resource Budget |

Actual Total

£'000 |

Budget Total

£'000 |

|---|---|---|

|

Financial year 2021-22 expenditure |

6,338 |

6,596 |

|

Financial year 2020-21 expenditure

|

6,233 |

6,600 |

|

Expenditure against Capital Budget (Note 5 of Financial Statements) |

Actual Total

£'000 |

Budget Total

£'000 |

|---|---|---|

|

Financial year 2021-22 expenditure |

299 |

500 |

|

Financial year 2020-21 expenditure |

349 |

400 |

In 2021-22, revenue expenditure was £258,000 (4%) less than budget and capital expenditure

was £201,000 (40%) less than budget. Savings occurred in many areas as a result of pandemic

restrictions on office working. In particular:

- Scottish Government HR pressures and increased volumes of recruitment as a result of the pandemic contributed to delays in the recruitment process and the onboarding of new staff.

- Tax tribunal hearings and outcomes were postponed resulting in delays in incurring legal costs.

- Planned capital spend was delayed due to supply chain issues on the IT hardware refresh and a longer development process for upgrades to our tax collection platform SETS.

Development of SETS remains a priority for Revenue Scotland with significant expenditure

planned for the next few years.

In 2021-22 Revenue Scotland spent £67,000 (2020-21: £230,000) on costs associated with

our response to the COVID-19 pandemic. These were:

|

|

2021-22 |

2020-21 |

|---|---|---|

|

Staff seconded to Scottish Government |

0 |

136 |

|

Agency staff |

0 |

45 |

|

Training |

0 |

3 |

|

IT |

7 |

13 |

|

Shared services |

0 |

23 |

|

Consultancy |

60 |

0 |

|

Other |

0 |

10 |

|

Total |

67 |

230 |

COVID-19 expenditure in 2021-22 was greatly reduced from 2020-21 when some staff were

seconded to Scottish Government’s response to the pandemic and costs borne by Revenue

Scotland. In 2021-22 expenditure related to minor IT hardware and expenditure incurred with

management consultants to assess a range of operating models for Revenue Scotland as noted

above under Future Operating Model.

Devolved Taxes

|

Revenue net of repayment, excluding interest payable and revenue losses |

2021-22 |

2021-22 |

2020-21 |

|---|---|---|---|

|

LBTT |

807,183 |

586,000 |

517,354 |

|

SLfT |

125,248 |

88,000 |

106,528 |

|

Penalties and interest |

1,245 |

0 |

138 |

|

Total |

933,676 |

674,000 |

624,020 |

The values in the above table are for tax returns and amendments submitted during 2021-22 and adjusted for the value of LBTT and SLfT returns received during April and May 2022 which relate to the period up to March 2022.

The tax returns submitted during 2021-22 may include adjustments to returns originally submitted in previous financial years. However, unless these adjustments were received in April or May of the relevant financial period and therefore accrued into the financial statements of that year, these are accounted for in the year of receipt.

The LBTT revenue raised in 2021-22 is dependent on performance of both the residential and non-residential property markets within Scotland.

The SLfT revenue raised in 2021-22 is dependent upon categories and tonnage of waste deposited in landfill sites within Scotland.

Independent forecasts of LBTT and SLfT revenue are published by the Scottish Fiscal Commission, which publishes forecast evaluation reports comparing outturn figures to Budget Act estimates, detailing the reasons for any differences observed.

The housing market continued to recover in 2021-22 from the pandemic. A summary of the tax revenue and our resource spend over the period 2017-2022 is shown on pages 100-102 and this forms part of our Performance Report.

Further information on the collection of the devolved taxes is given in the Annual Report and Accounts for the Devolved Taxes for 2021-22, which is published separately.

Performance against the Revenue Scotland Corporate Plan

The Corporate Plan 2021-24 sets out how Revenue Scotland will carry out its functions under

the Revenue Scotland and Tax Powers Act 2014 (RSTPA). The Corporate Plan identifies four

strategic outcomes we are seeking to achieve by delivering a series of underlying strategic

outcomes in key areas. In addition, the plan sets out 10 KPIs which measure the success of

the organisation in delivering against these objectives. Our performance against each of the

strategic objectives is considered in the analysis below, including discussion of our

performance against the KPIs.

Excelling in delivery

We seek to offer user-focused services that are digital by design and provide value for

money, convenience and ease of use for internal and external users.

To achieve this we have twelve underlying objectives:

- use technology, data and innovation to develop and enhance our tax collection systems and guidance

- adopt continuous improvement processes to make our services more effective and easier to use

- use our statutory powers appropriately to help taxpayers get to the right tax position

- seek to resolve disputes and pursue non-compliance by using our powers proportionately

- develop options for measuring and addressing tax receipt shortfall

- design and deliver systems that are compliant, reliable, efficient and cost effective

- undertake effective management of assets through their lifecycle

- exemplify best practice in the ways we hold and manage data

- use our expertise in collecting devolved taxes to help shape the development of tax policy and legislation

- design and deliver public services that meet the diverse needs of our users

- include environmental impact as a key principle in our service delivery model

- meet our obligations as a public body and embed the management and mitigationof risk in our planning activities and operations.

Tax revenue

|

|

2021-22

£’000 |

2020-21 |

|---|---|---|

|

LBTT |

807,183 |

517,354 |

|

SLfT |

125,248 |

106,528 |

|

Penalties and interest |

1,245 |

138 |

|

Total tax |

933,676 |

624,020 |

Tax revenues were at a record high in 2021-22, and nearly 50% higher than 2020-21 which

was affected by the pandemic. Both residential and non-residential LBTT revenues declared

were the highest seen in a financial year, with residential revenues being driven by increasing

house prices. Increases in SLfT over the past year were, in part, due to increased taxation

rates, although volumes of waste going to landfill were lower in 2020-21 than 2021-22

due to the pandemic.

For SLfT, in 2021-22 we changed our procedures to identify the higher-risk areas, presented

by quarterly returns. Following further consideration of health and safety procedural

arrangements and on account of pandemic restrictions, landfill site visits were curtailed.

However these will be taken forward as we move further out of the pandemic.

In addition, several of our KPIs are used to measure performance contributing to the area

of excelling in delivery.

As per KPI 1, our tax collection rate in 2021-22 was 99%, equal to the 2017-18 baseline

of 99%.

The efficiency of our service is reflected in the low administrative of tax collection (KPI 4).

The cost of collection in 2021-22 was less than 1%, which has improved compared

to 2020-21.

Guidance, advice and support

The service we provide to taxpayers is of utmost importance to us and to this effect we introduced a new key performance indicator (KPI 2). This is a composite measure of response times to different service user requests, including calls, written correspondence and time to process claims for repayment of tax, and we achieved our target with 95%.

We seek to provide effective and easy-to-use guidance and support to help taxpayers pay the right tax and to explain the outcomes of non-compliance, such as penalties, up front. We aim to respond promptly to enquiries and requests for tax opinions. To this effect we launched our new website in April 2021, which makes it easier for service users to find the information they are looking for. We continue to analyse taxpayer feedback and behaviour to identify areas where guidance could be improved in order to provide better support. This work informs compliance activity, identifying common situations where returns have been filed incorrectly, and improving guidance to enable returns to be correct first time, avoiding additional administration costs and penalties.

Specifically, in 2021-22 we developed a targeted plan for enhancing LBTT guidance. The focus of the LBTT projects was informed by legislative changes, litigation updates, website traffic data and user feedback.

We also established a new key performance indicator (KPI 7) to gather and use service user feedback to inform improvements to our service.

Capital Investment Programme

In 2021-22, Revenue Scotland’s capital budget has been employed primarily to invest in the improvement of Revenue Scotland’s digital technology.

Revenue Scotland ensures that all capital expenditure is delivered through key corporate projects directly linked to the priorities set out in our Corporate Plan. The capital budget is usually allocated to projects that can span more than one financial year. Working closely with our IT partner, NEC,

we have delivered a series of enhancements to our digital tax collection platform SETS. This work has led to improvements for the customer-facing portal and has kept pace with the ever-changing business needs of the tax and finance teams. In the second half of the year, an IT refresh project commenced, to upgrade our IT hardware (to provide staff with the tools they need to work effectively) and will eliminate costs which would be incurred supporting ageing technology.

Building on the recommendations of a Gateway Review 54 assurance review exercise conducted in December 2021, Revenue Scotland established a Capital Investment Programme to provide oversight to the Senior Leadership Team and Revenue Scotland Board of the collaborative work needed to ensure best use of public funds.

Programme governance and assurance is provided by the Capital Investment

Programme Board to the Senior Responsible Owner. The role and responsibilities of the programme board are documented in an agreed Terms of Reference and it meets on a six-weekly basis. The programme plan is updated regularly to reflect changes agreed by the programme board. It is also updated during the financial year as part of any financial forecast updates.

Compliance

Revenue Scotland has a duty to protect the revenue and ensure that the correct amount of tax is collected. As highlighted above under ‘guidance, advice and support’ we do this through encouraging a culture of responsible taxpaying where individuals and businesses pay their taxes as the Scottish Parliament intended. We work to make it as easy as possible for taxpayers to understand and comply with their obligations and pay the right amount of tax, while at the same time working to detect and deter non-compliance.

Our approach to tax compliance, set out in our Compliance Strategy has three key elements:

-

enabling – helping taxpayers comply with their tax obligations, including guidance, a user-friendly online system, support desk, tax opinions and stakeholder engagement.

-

assurance – helping taxpayers get to the right position, including checks applied to returns to ensure they are complete and accurate and highlighting any errors, landfill inspections, sharing of intelligence with other tax authorities, use of investigatory powers, statutory enquiries and assessments.

-

resolution – solving disputes, pursuing non-compliance and applying penalties where required.

Revenue Scotland works in collaboration, sharing information, intelligence and knowledge regularly with His Majesty’s Revenue and Customs (HMRC) and the Welsh Revenue Authority (WRA) within the legal gateways in the RSTPA and through Information Sharing Agreements for the purpose of civil or criminal proceedings.

We attend regular meetings with HMRC and the WRA to discuss matters of mutual interest regarding our taxes. We also regularly meet with bodies such as the Chartered Institute of Taxation (CIOT), the Institute of Chartered Accountants of Scotland (ICAS), the Law Society Scotland (LSS), the Convention of Scottish Local Authorities (COSLA) and the Resource Management Association Scotland (RMAS).

As measured under KPI 3, tax secured through Revenue Scotland’s compliance activity was £721k in 2021-22, reduced from £963k in 2020-21. Importantly, this figure does not reflect upstream compliance activity, such as guidance to assist taxpayers to comply with their obligations.

Disputes

There are three main routes for taxpayers, agents and other members of the public who wish to dispute an action or decision by Revenue Scotland or on our behalf by our partner organisations.

Complaints

Complaints are expressions of dissatisfaction about the organisation’s action or lack of action, or about the standard of service provided by Revenue Scotland or on our behalf. They are distinct from tax disputes. Where complaints are received we seek to learn from these to improve our operational procedures and processes. Revenue Scotland’s complaints handling procedure seeks to resolve taxpayer dissatisfaction as close as possible to the point of service delivery and to conduct thorough and impartial investigations of complaints so that evidence-based decisions can be made on the facts of the case.

The complaints handling process complies with the Scottish Public Services Ombudsman’s (SPSO) guidance. This allows for two opportunities to resolve complaints internally:

-

Stage 1 – frontline resolution

-

Stage 2 – investigation.

|

Complaint Stage |

No. of complaints 2021-22 |

% Resolved in 20 days or less |

No of complaints 2020-21 |

% Resolved in 20 days or less |

|---|---|---|---|---|

|

Stage 1 |

4 |

100% |

0 |

- |

|

Stage 2 |

0 |

- |

1 |

100% |

Tax disputes – reviews and appeals

Revenue Scotland aims to minimise tax disputes by providing clear information and guidance to taxpayers and having robust decision making processes in place. In the event of a dispute a taxpayer may request an internal review of a decision, request or agree to mediation, or appeal a decision to the Scottish Tribunals.

Taxpayers and their agents have the right to request that Revenue Scotland reviews any decision which affects whether a person is liable to pay tax, the amount of tax due, the date the tax is due and payable and the imposition of a penalty or interest. Revenue Scotland must notify the taxpayers or their agents of its view of the matter within 30 days from the day on which it received the review request (or such longer period as reasonable). For the next stage Revenue Scotland must inform the taxpayers or their agents of its conclusion of the review and its reasoning within 45 days of sending the Stage 1 response.

The RSTPA sets out the decisions which are reviewable and appealable. An appeal may be made regardless of whether or not a review has been sought or mediation entered into. The Tax Chamber of the First-Tier Tribunal for Scotland (FTTS) decides appeals against Revenue Scotland decisions, and the Upper Tribunal (UT) decides appeals on a point of law from decisions of the FTTS.

Appeals

| 2021-22 | 2020-21 | |

|---|---|---|

| Number of cases at 1 April |

6 | 11 |

| New cases initiated |

11 | 2 |

| Cases decided | 7 | 5* |

| Cases settled** | 0 | 2 |

| Number of cases at 31 March |

10 | 6 |

*In our Annual Report 2020-21 we stated the number of decided cases for 2020-21 as 6; this was incorrect; it should have been 5.

** ‘ Settled’ covers a range of outcomes including: agreement between the parties, withdrawal of the appeal by either Revenue Scotland or the taxpayer, or for instance, duplicate appeals raised in error.

During 2021-22, 10 appeals were initiated in the Tax Chamber of the First-Tier Tribunal for Scotland. One case was initiated in the Upper Tribunal for Scotland in 2021-22.

No decisions were issued by the Upper Tribunal in 2021-22. Revenue Scotland received no requests for mediation in 2021-22.

Investing in our people

The second strategic outcome in our Corporate Plan 2021-24, investing in our people, reflects our ambition to be a high-performing, outward-looking and

diverse organisation, providing a great place to work. The organisation places high value on staff motivation and engagement, and we invest in our employees’ learning and development, health, safety and wellbeing to develop and support a highly skilled workforce, upholding the required standards of professionalism and integrity.

The seven underlying objectives are:

-

ensure our staff have the capability, skills and knowledge to deliver an excellent service

-

ensure our staff have the skills and tools required to efficiently access and analyse our data to better inform decision making

-

take action to expand the diversity of our workforce and promote access to employment for those with protected characteristics

-

be a trusted, valued and respected tax authority which prioritises staff capability, skills and knowledge development

-

be a high-performing organisation where staff feel trusted, valued, motivated and empowered, creating a culture with work/life balance, health, safety, wellbeing and resilience at heart

-

enhance our use of data to inform our capability and capacity requirements for the delivery of our organisational objectives

-

support individuals to have flexible choices on where and when they work.

The Staffing and Equalities Committee (SEC) supported the development of the 2021-24 People Strategy, which has direct links to the Corporate Plan and clear deliverable actions set out in the action plan. Our People Strategy is underpinned by four strategic themes. These are wide-ranging and ambitious, reflecting our commitment to being an inclusive and agile workforce:

-

engaged

-

capable

-

diverse

-

workforce.

The People Strategy was endorsed by the committee and Revenue Scotland Board. Throughout the year the SEC noted demonstrable progress in delivery of the People Strategy, health, safety and wellbeing, equality and diversity, and, learning and development. A priority for 2021-22 was to review our shared service agreement with the Scottish Government People Directorate. This resulted in the decision to bring the HR function in house which is now managed by a small team of HR professionals supporting our staff and managers through the lens of early intervention and prevention.

In addition we aim to enhance the use of data to inform our capability and capacity for the delivery of our objectives whilst providing support and flexibility to staff about how, when and where they work.

The delivery of this strategic outcome is primarily evaluated through the organisation’s performance against KPI 5 which measures skills and knowledge development and KPI 6 which measures the People Survey Engagement Index. KPI 5 achieved 94% staff completing at least 30 hours, learning and development against a target of 90%. KPI 6 achieved a combined performance score of 33, which places Revenue Scotland in the second quartile against a target to be in the upper quartile of 25 or less.

Our commitments include taking action to improve the diversity of our workforce and removing barriers to employment in line with our equalities action plan. Staff and managers have undertaken a range of learning, this includes neurodiversity awareness, inclusive leadership, inclusive practice and inclusive recruitment. Our gender pay gap as at 31 March 2022 was nil.

During 2021-22, in line with Scottish Government COVID-19 guidance, the organisation transitioned from fully remote working to hybrid working. The immediate priority was to support staff who, for health and wellbeing reasons, were unable to continue to work remotely. A full health and safety review was undertaken to ensure we provided a safe return to the workplace for our staff. A range of measures have been put in place to support this including:

-

COVID-19 safety measures

-

health and safety training

-

several individual risk and wellbeing assessments

-

staff guidance on hybrid working

-

health and wellbeing activities to promote hybrid working best practice.

Learning and development is a key part of the People Strategy. We recognise that a highly skilled workforce underpins and enables everything we do. The delivery and development of the STEP continues and the foundation programme is embedded into the induction schedule for new staff with 98% reporting the sessions improved their performance. Our induction programme has been adapted to support hybrid working and our Professional Qualifications Policy has supported staff to develop expertise and achieve professional qualifications across a range of our professions.

Maintaining a culture as one organisation while working hybrid has been a priority during 2021-22. Weekly all-staff sessions have been held to engage staff in the organisation’s progress and priority areas. We continue to host coffee-and-chat sessions with Senior Leadership Team and fortnightly social chats that are themed to support our health, wellbeing and diversity initiatives. Two virtual staff conferences were hosted throughout the year. These focused on engaging staff with the Corporate Plan, People Strategy and reviewing our approach to hybrid working. Giving employees a voice is essential for staff engagement and creating the conditions for staff to connect with our organisational objectives and purpose has been our focus.

The 2021 People Survey* results for Revenue Scotland saw an increase in the 2021 Engagement Index for Revenue Scotland to 65% from 57%. The index is comprised of five questions measuring pride, advocacy, attachment, inspiration and motivation. The Proxy Stress Index reduced from 27% to 22% in 2021. This index measures the conditions that contribute to stressful environments. It is based on the Health and Safety Executive stress management standards: demands, control over work, support, relationships, role in organisation and change; a score of 100% would reflect a negative response to the questions.

Staff also reported increased satisfaction in the survey’s wellbeing questions, with a 19% increase in satisfaction with life and 21% increase in happiness. Our People Strategy action plan will further address the areas for continued development identified from the people survey.

*The People Survey is an annual cross-Civil Service staff survey.

Reaching out

We aim to build on our reputation as an accessible, collaborative and transparent public body, keen to learn from others and share our experience and expertise.

To achieve this, we have seven underlying objectives:

-

engage users in the design of our services, maximising the opportunities of technology and drawing on best practice from other service delivery organisations

-

help taxpayers to understanding and comply with their tax obligations through the services we provide

-

engage regularly and effectively with users to keep them informed, content and productive, enabling them to work collaboratively

-

effectively communicate data and analysis to our stakeholders and audiences, including the provision or high-quality data and advice to support the Scottish Fiscal Commission in its tax forecasting role and the Scottish Government in the development of tax policy

-

as a transparent and open organisation, listen to and engage collaboratively with our staff and stakeholders

-

in our communications, provide the audience with the right information in the right tone and style at the right time

-

expand the reach of our engagement to diversify our stakeholder base and sharpen our understanding of equality issues, digital developments and our operating environment.

Stakeholder engagement

We have continued to engage with a wide range of stakeholders during

2021-22. This includes regularly meeting with the Scottish Government and Scottish Ministers and providing advice based on our operational experience to support the development of policy and legislation; giving written and oral evidence where required to the Finance and Public Administration Committee of the Scottish Parliament; providing data and information about the performance of the devolved taxes to the Scottish Fiscal Commission (SFC) to support the independent forecast of Scottish tax revenue; producing statistics on both devolved taxes which are published on the Revenue Scotland website; and engaging with other tax authorities on tax administration issues as well as with other public bodies on a range of corporate issues, such as risk management, business planning and equalities and diversity.

Service user feedback

KPI 7 is a new indicator, introduced and still being under development in 2021-22, to gather and use service user feedback.

This reflects our aim to be user-centric and therefore involve stakeholders in the development of service improvements.

While this measure is still under development, we have started receiving feedback by asking users to rate the content on each page of our website, and by asking for feedback on the ease of use of tax collection platform SETS.

After an upgrade to SETS during 2021-22 we were able to run a first survey among users in March 2022. During this period, 66% of respondent rated the service as ‘very easy’ or ‘easy’ to use. Feedback also helped us identify a number of areas improvement; for instance, 47% of responses mentioned duplication of data entry, specifically referencing there being no ability to use an address previously entered within the return. The high number of user comments on this issue has subsequently informed our prioritisation of issues in the development of SETS. Embedding increased engagement with service users and other external stakeholders into our work is going to be a key theme of a new Communications and Engagement Strategy that is to be finalised in 2022-23.

Equalities

As part of its commitment to contributing to a fair and equal society in Scotland, Revenue Scotland is an organisation which has fairness and inclusion at the heart of its operation as a public service provider and as an employer. In 2021-22, we introduced a new key performance indicator (KPI 8),

making this an even higher strategic priority. The KPI monitors performance in this area and reports quarterly on progress against the delivery of our Equalities Mainstreaming Action Plan.

This plan also provided us with another means of mainstreaming the Public Sector Equalities Duty (PSED) into our organisation and demonstrate our readiness to be held to account in relation to it.

The outcomes identified in the Equalities Mainstreaming Action Plan 2020-22 are:

-

Equality Outcome 1 – Revenue Scotland will design and deliver public services that meet the diverse needs of its users.

-

Equality Outcome 2 – Revenue Scotland has an increasingly diverse workforce that fully embraces equality, diversity and respect for all.

Revenue Scotland has continued to strive for excellence whilst delivering upon and embedding equalities, diversity and inclusion throughout our organisation. In addition we have delivered new processes and projects to further embed equality, diversity and inclusion at our core.

Highlights of the achieved outcomes include:

-

The Revenue Scotland website was relaunched in April 2021 and was designed to adhere to W3C WCAG 2.1 Level principles and to operate in line with Digital First Standards. The redesign has improved accessibility for our users and provides further compatibility with assistive technologies. We also continue to monitor the website to provide improvements and to identify and address any issues.

-

Stakeholder engagement for our developing Enhanced Support Policy took place throughout 2021 both internally and externally. Positive and constructive feedback was received and a trial of the new policy is planned to commence in 2022 to provide an enhanced level of support for those who need it most. Examples of enhanced support could include minimising the number of staff stakeholders interact with or allowing them more time to respond to Revenue Scotland communications.

-

Work undertaken in relation to Equality Impact Assessments (EqIAs) has resulted in an increased number of assessments being conducted throughout Revenue Scotland. We have worked to improve the infrastructure, guidance and awareness to drive increased output of EqIAs, further embedding them into our processes and culture. We also began working towards our accreditation as a disability-confident employer in 2021-22 (to be achieved 2022-23).

The current cross-organisation equalities group continued to meet on a regular basis to discuss equalities and to devise action plans to continue delivering our mainstreaming outcomes. Progress is reported to the Staffing and Equalities Committee of the Board on a quarterly basis.

Looking ahead

The fourth strategic theme in the Revenue Scotland Corporate Plan 2021-24, looking ahead, aims to plan and deliver change and improvements to our systems and processes flexibly, on time and on budget.

To achieve our ‘looking ahead’ outcomes, we have seven objectives:

-

working with stakeholders, partner organisations and Scottish Government colleagues to use our expertise to design and deliver any new devolved taxes and other revenue raising measures

-

work with others to identify opportunities for sharing IT platforms and management tools to support operational processes

-

exploit the potential of Revenue Scotland’s data by linking to other data sources to deliver better policy outcomes

-

include environmental impact as a consideration in the design and delivery of any now or changing responsibilities

-

encourage staff to be active, engaged, responsible learners who own their learning and development

-

actively plan ahead for our future workforce and capability needs

-

ensure our communications are scalable and capable of being adapted to new responsibilities and audiences.

Sustainability

Protecting the environment and integrating sustainable practices into our processes will be a key feature of our future work. We will focus on reducing the emissions of our buildings, reducing our waste and improving our reuse, and promoting sustainable methods of travel for our business activities. A major part of our sustainability work will be to evolve legislation to allow digital communications with taxpayers – reducing paper waste and postage emissions. In addition to this, ahead of the biodegradable municipal waste ban taking effect from 2025,8 we have been, and will continue to, working closely with stakeholders in the Scottish landfill industry. This reduction in waste will be a positive change as part of Scotland’s climate change and circular economy ambitions, however it will see a reduction in SLfT generated. This change leads to tax risks derived from, for example, waste misclassification, and potential scope for an increase in the unauthorised disposal of waste. We build these risks into our compliance plans and will continue to work closely with our agency partners to address these risks as they emerge.

ADS review

The Scottish Government launched an ADS review in 2021-22, including a three- months consultation. Changes to the ADS as an outcome of the review may involve legislative change and we will work closely with Scottish Government policy colleagues on implmenting these in 2022-23.

We have 10 strategic projects prioritised for 2022-23 and these will be monitored using KPI 10. These include:

- Our agility ensured a successful transition to a remote working model in 2020 during the coronavirus pandemic and this has evolved into our hybrid working model. As we exit the pandemic, we are evaluating our hybrid working model to optimise our performance and achieve our corporate ambitions for 2021-24 and beyond.

- As part of our People Strategy, we will procure and deliver a leadership development programme. This programme will develop, for instance, emotional intelligence and collaborative skills within our organisation.

- We will be working with our Scottish Government policy partners and others to realise the ambition to create legislation to enable devolution of the UK’s Aggregates Levy during the lifetime of this current parliament. We aim to have data and digital at the forefront of the design of the new tax.

- To enable more effective delivery of devolved Scottish taxes, we will be revisiting the Revenue Scotland Tax Powers Act 2014 framework.

- Focus will be placed on enhancing our processes for three-year lease reviews. Work will include improvements to guidance and implementation of the Communications Strategy to meet the evolving needs of our stakeholders.Our Capital Investment Programme aims to make continuous improvement to the tax collection platform SETS.

- Enhanced data validation is one planned improvement and aims to improve compliance and accuracy of information when users are inputting information.

- We will procure two new systems: a new tax finance portal and procure a new contact management system. These new systems will have additional functionality to improve user experience, efficiency and improve data to generate new insights.

- To further enhance our user experience we will expand our use of service user feedback. This will see more frequent feedback and potentially range of feedback mechanisms to gain insights from our users and better target system and service improvements.

- We will also be driving forwards our stakeholder engagement activities. This will begin with a needs analysis survey to inform our future communication plans for bespoke needs of our varied stakeholders.

We will report progress on these objectives in our 2022-23 Annual Report.

Cross-cutting matters

Risk management

Revenue Scotland operates under an established Risk Management Framework which aligns with the best practice guidance presented through the Scottish Public Finance Manual and Scottish Government’s Risk Management Guidance document. The framework sets out the process for identifying and documenting risk, assigning ownership of risk, scoring risk, determining responses to risk and monitoring and reporting on progress in managing risk.

To achieve the ambitions, outcome and priorities set out in our corporate plan, it is essential that we understand, manage and communicate the range of threats and opportunities that could hinder or enhance the organisation.

We ensure risk is sufficiently scored and managed prior to taking action to mitigate it or to take opportunities resulting from it. Explicit reference to ‘risk appetite’, the agreed amount of risk the organisation is willing to tolerate in pursuit of its objectives, allows us to adopt a common understanding across Revenue Scotland and provides a framework for risk owners and managers to confidently make risk based decisions.

The concept of risk appetite continues to be encouraged throughout the organisation through our monthly and individual operational risk management procedures. This allowed issues that carried the highest risk to be prioritised.

Defining a corporate risk

Corporate risks are those of significant, cross-cutting strategic importance that require the attention of the organisation’s most senior managers and Board. While all members of staff have responsibility for managing risks in their areas, each of the corporate risks has one or more named ‘risk owner(s)’ and a risk manager who, together, are accountable for their management. Revenue Scotland’s Board as a whole retains ultimate responsibility.

The corporate risks as they stood at 31 March 2022 are set out below. These risks have been actively managed throughout the year by risk managers and risk owners with oversight from senior management, the ARC and the Board.

| Corporate Risks | |||

|---|---|---|---|

| Protecting the integrity of the tax system recognises our need to ensure we have the necessary infrastructure and operational processes to ensure the integrity of the tax system. |

Legislative and policy change recognises our need to be consulted in good time for any upcoming legislative changes that may impact on devolved taxes. |

Communication and stakeholder engagement recognises our need to have appropriate internal and external engagement to support our activities. |

Budgeting and finance recognises our need to ensure we have the appropriate budget to ensure continued operations, investments in systems and planning of future work. |

| Culture allows us to monitor our culture and take steps to improve any manifestations of poor culture that arise. |

Staff capacity and capability recognises our need to build and/or protect staff capability and capacity in a sustainable way, investing in training and development. |

Health, safety and wellbeing allows us to monitor our legal and moral obligations to health, safety, mental health and wellbeing. |

Systems performance and adaptability recognises our need to invest in our IT capabilities articulated through our IT strategy. |

| Contract management allows us to monitor our business critical relationships with delivery partners in line with contractual obligations and established change control practices. |

Cyber and information security recognises our need to establish effective systems and controls to support the secure management and transaction of our information. |

Governance and compliance allows us to monitor our compliance with our statutory obligations and the effectiveness of our governance procedures and controls. |

Resilience recognises our need to have tested and effective business continuity planning to meet expectations. |

Ethical issues

Revenue Scotland staff are civil servants who adhere to the Civil Service Code of Conduct. Staff are expected to carry out their duties with a commitment to the civil service core values of integrity, honesty, objectivity and impartiality. Staff must not misuse their official position to further their private interest or those of others; accept gifts, hospitality or other benefits from anyone which might reasonably be seen to compromise their personal judgement or integrity. All staff undertake annual mandatory training on counter fraud, bribery and corruption to remind them of their responsibilities in this area.

Environmental

Revenue Scotland is committed to protecting the environment by working sustainably to minimise carbon emissions, meet climate change duties and embed climate change action into the organisational culture.

The COVID-19 pandemic provided Revenue Scotland with an opportunity to review its operational and service delivery model, and evaluate how different models could maximise the environmental sustainability of the organisation. Working in collaboration with EY, Revenue Scotland developed criteria to evaluate how office-based, remote-based, and hybrid operating models could benefit employees whilst also contributing towards Scotland’s climate change ambitions.

Whilst navigating the exit from the COVID-19 pandemic, many of Revenue Scotland’s staff have continued to work from home for some, or all of the working week. 2021-22 also saw all Board meetings held virtually. This has contributed to a decrease in both commuter and business travel emissions. Commuter emissions will continue to be a significant factor in future working models as Revenue Scotland transitions to a post-pandemic way of working. We have also engaged with other Public Delivery Bodies and external experts to establish an effective method to monitor working from home emissions. The information from these discussions will be used to design an employee survey to evaluate the impact of the new operating model. The survey is scheduled for October 2022, and the insights gained will be used to refine Revenue Scotland’s future operating and service delivery model.

Revenue Scotland’s environmental performance has also been strengthened through efforts to reduce waste, especially paper waste. Utilising the ‘digital by design’ approach, all papers for Board meetings were issued electronically, reducing both paper and ink usage. In addition to this, printing of other business documentation, such as legal casework, has substantially fallen, again by using electronic versions of documents in place of paper versions.

Reducing the emissions from buildings we occupy has also been a focus in 2021-22. Two large printers have been removed from the Victoria Quay office, not only reducing energy consumption but reducing plastic waste from ink cartridges.

Finally, Revenue Scotland further supported Scotland’s climate change ambitions by continuing to collect SLfT. This tax supports the development of alternative waste solutions to landfill and helps to minimise hazardous waste that negatively impacts climate change. Since 2015, there has been a decreasing trend in both standard rate and lower rate tonnes of waste put to landfill. There was a small increase in waste tonnage in 2021-22 compared with the previous year, however this is likely a time-lag in waste disposal due to the pandemic and tonnages are expected to reduce in 2022-23. Through collaborative work with colleagues at SEPA, over £125m in tax revenue has been reported in 2021-22.

Since its establishment in 2015, the Scottish Landfill Communities Fund (SLCF) provides funding for community or environmental projects in recognition of the dis-amenity of landfill activity. Revenue Scotland is responsible for the appointment of the regulator and appointed SEPA in 2015. The cumulative sum that has been paid into the SLCF is £53.3m and this year the value of qualifying contributions made to the fund has been £6.1m. Recent years have seen a decline in contributions and this trend is likely to continue, linked to a forecast reduction in landfilling in anticipation of the implementation of the ban on biodegradable municipal waste to landfill in January 2025.

Records management and GDPR

During this reporting period a new Information Governance Manager was appointed and started with Revenue Scotland in February. A main focus has been on the Information Management aspects of a change management programme relating to the Scottish Government’s IT network. This work will ensure improved ways of working through use of better collaborative working tools and encourage increased use of our records management system for our corporate data.

We also worked on refreshing the Records Management Plan in line with the reporting schedule for the next Progress Update Report (PUR) for the National Records of Scotland in October 2022.

Revenue Scotland takes its statutory obligations seriously and has continued to work hard to ensure full compliance with its legal obligations whilst improving on its processes and procedures. In terms of our information management and assurance, we reported the following data incidents and losses.

| 2021-22 | 2020-21 | ||

|---|---|---|---|

| Data incidents | Reported in period | 2 | 2 |

| Reported to ICO | 0 | 0 | |

| Data losses | Reported in period | 5 | 3 |

| Reported gto ICO | 0 | 1 |

Having been thoroughly investigated internally, the incidents and losses identified were

found to be of a minor nature that did not require to be reported to the Information

Commissioner’s Office (ICO).

| 2021-22 | 2020-21 | |

|---|---|---|

| Requests received | 12 | 10 |

| Requests withdrawn | 1 | 0 |

| Requests answered within statutory timescale | 11 | 9 |

Whistleblowing report

Revenue Scotland has a whistleblowing policy and procedures in place to ensure that

issues can be raised. During the reporting periods 1 April 2021 to 31 March 2022 and

1 April 2020 to 31 March 2021, Revenue Scotland received no whistleblowing disclosures.

Revenue Scotland’s Annual Report on Whistleblowing Disclosures 2021-22 is available

on the Revenue Scotland website.

Investigations

No investigations were carried out in this reporting period.

Actions

No actions were required during this period.

Improvement objectives

No improvement objectives were required during this period.

Elaine Lorimer – Chief Executive of Revenue Scotland and Accountable Officer