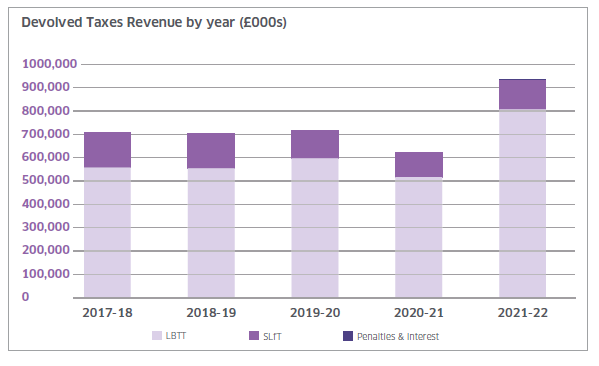

Devolved Taxes 2017-22

|

|

2017-18

£'000 |

2018-19

£000 |

2019-20

£'000 |

2020-21

£'000 |

2021-22

£'000

|

|---|---|---|---|---|---|

|

LBTT |

557,267 |

554,185 |

597,368 |

517,354 |

807,183 |

|

SLfT |

147,984 |

148,517 |

118,959 |

106,528 |

125,248 |

|

Penalties & Interest |

1,754 |

3,135 |

735 |

138 |

1,245 |

|

Total Tax Revenue |

707,005 |

705,837 |

717,062 |

624,020 |

933,676 |

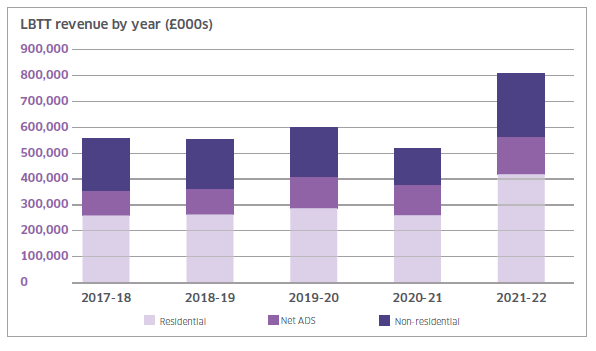

LBTT 2017-22

|

LBTT |

2017-18 |

2018-19 |

2019-20 |

2020-21 |

2021-22 |

|---|---|---|---|---|---|

|

Residential |

258,386 |

262,336 |

286,908 |

259,632 |

418,390 |

|

Net ADS |

94,645 |

99,211

|

120,226 |

115,104

|

140,750 |

|

Non-residential |

204,236 |

192,638 |

190,234 |

142,618 |

248,043 |

|

Total LBTT (£’000) |

557,267 |

554,185 |

597,368 |

517,354 |

807,183 |

|

No. of Tax Returns |

116,380 |

120,280 |

121,050 |

109,170 |

126,350 |

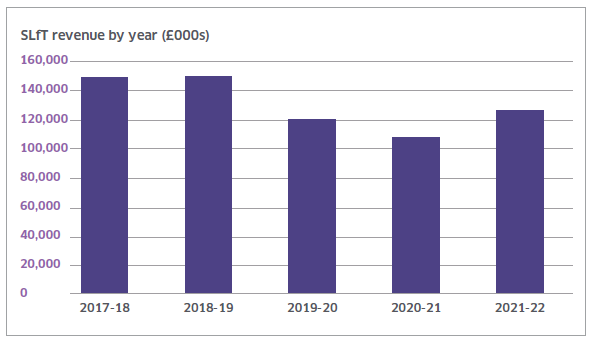

SLfT 2017-22

|

SLfT |

2017-18 |

2018-19 |

2019-20 |

2020-21 |

2021-22 |

|---|---|---|---|---|---|

|

Tax (£’000) |

147,984 |

148,517 |

118,959 |

106,528 |

125,248 |

|

Standard rate tonnage |

1,775,000 |

1,650,100 |

1,343,700 |

1,170,300 |

1,348,600 |

|

Lower rate tonnage |

790,300 |

739,500 |

685,700 |

618,800 |

680,100 |

|

Total tonnage |

2,565,300 |

2,389,600 |

2,029,400 |

1,789,100 |

2,028,700 |

Resource Spend (including programme costs) 2017-22

|

|

2017-18

£'000 |

2018-19

£'000

|

2019-20

£'000 |

2020-21

£'000 |

2021-22

£'000 |

|---|---|---|---|---|---|

|

Income |

0 |

0 |

0 |

59 |

41 |

|

Staff costs11 |

(2,785) |

(3,448) |

(3,998) |

(4,234) |

(4,324) |

|

Goods & services |

(1,613) |

(1,668) |

(1,912) |

(1,651) |

(1,638) |

|

Programme costs12 |

(1,075) |

(1,095) |

(763) |

(30) |

0 |

|

Depreciation & amortisation |

(12) |

(16) |

(182) |

(377) |

(417) |

|

Provision |

0 |

0 |

(212) |

0 |

0 |

|

Net operating costs |

(5,485) |

(6,227) |

(7,067) |

(6,233) |

(6,338) |

11 Includes compensation on early retirement

12 Includes staff and non-staff costs of developing processes and systems to comply with new legislation or the introduction of IT systems