Non-residential property

You pay LBTT on increasing portions of the property price when you pay £150,000 or more for non-residential or mixed (also known as ‘mixed use’) land or property.

Non-residential property includes:

- commercial property, for example shops or offices

- property that isn’t suitable to be lived in

- forests

- agricultural land that’s part of a working farm or used for agricultural reasons

- 6 or more residential properties bought in a single transaction

In addition, buildings used for the following are treated as non-residential property:

- a home or other institution providing residential accommodation for children

- a hall of residence for students in further or higher education

- a home or other institution for persons in need of personal care due to age, disability, drug or alcohol dependency or mental health conditions

- a hospital or hospice

- a prison or similar establishment

- a hotel or inn or similar establishment

Whether a transaction is non-residential should be considered on its own merits.

Non-residential property rates and bands

The non-residential LBTT rates and bands were changed with effect from 25 January 2019.

Non-residential rates and bands for transactions on or after 25 January 2019

| Purchase price | LBTT rate |

|---|---|

| Up to £150,000 | 0% |

| £150,001 to £250,000 | 1% |

| Above £250,000 | 5% |

For chargeable consideration above the nil rate band, calculate the amount due within each rate band then add these together to reach the LBTT due.

Examples

| Chargeable Consideration (purchase price) | Rate Band | Consideration within band | Rate | LBTT Amount |

|---|---|---|---|---|

| £145,000 | Up to £150,000 | £145,000 | 0% | Nil |

| Total LBTT | Nil |

| Chargeable Consideration (purchase price) | Rate Band | Consideration within band | Rate | LBTT Amount |

|---|---|---|---|---|

| £465,000 | Up to £150,000 | £150,000 | 0% | £0.00 |

| £150,001 to £250,000 | £100,000 | 1% | £1,000 | |

| Over £250,000 | £215,000 | 5% | £10,750 | |

| Total LBTT | £11,750 |

Transitional Provision

Please note that where the effective date of a land transaction is on or after 25 January 2019 and the contract for the land transaction was entered into prior to 12 December 2018, the tax rates and bands for non-residential transactions that were in force prior to 25 January 2019 will apply.

Transitional Provision Example

SK Design Limited is acquiring new commercial premises for £250,000. Missives concluded on 05 December 2018 and the effective date of the transaction is 01 February 2019.

Although the transaction completed after 25 January 2019, the non-residential rates and bands prior to 25 January 2019 will apply as the contract was entered into prior to 12 December 2018.

Chargeable consideration of £250,000

| Chargeable Consideration (purchase price) | Rate Band | Consideration within band | Rate | LBTT Amount |

|---|---|---|---|---|

| £250,000 | Up to £150,000 | £150,000 | 0% | £0.00 |

| £150,001 to £250,000 | £100,000 | 3% | £3,000 | |

| Over £250,000 | £0.00 | 4.5% | £0.00 | |

| Total LBTT | £3,000 |

How to complete a tax return when transitional provisions apply

When completing the tax return, the calculation is based on the effective date of the transaction. Any transaction with an effective date on or after 25 January 2019 will result in non-residential rates and bands for transactions on or after 25 January 2019 being charged.

Where the contract for the transaction has been entered into prior to 12 December 2018, but the effective date is after 25 January 2019, non-residential rates prior to 25 January 2019 will apply. In order to show this on the LBTT tax return, you must overwrite the amount of tax due in the ‘Total amount of tax due for this transaction’ box on the return.

You must also ensure you complete the ‘date of contract or conclusion of missives’ box at the beginning of the return. This will allow Revenue Scotland to see the contract was entered into prior to 12 December 2018.

Example:

SK Design Limited has acquired new commercial premises for £250,000. The contract was entered into on 05 December 2018. However, the effective date was 01 February 2019. As the contract was entered into prior to 12 December 2018, the non-residential rates and bands prior to 25 January 2019 will apply.

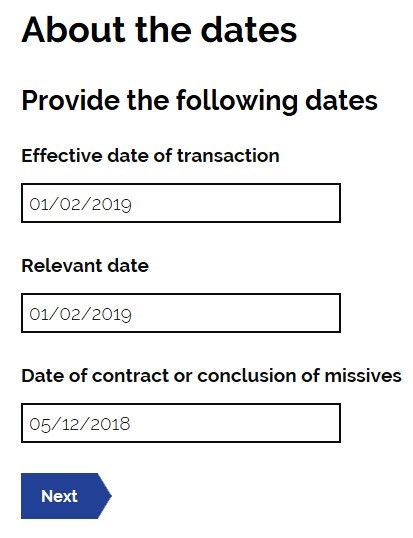

When the agent for SK Design Limited completes the LBTT tax return, 5 December 2018 should be entered into the ‘Date of contract or conclusion of missives’ box on the ‘About the transaction’ section of the return:

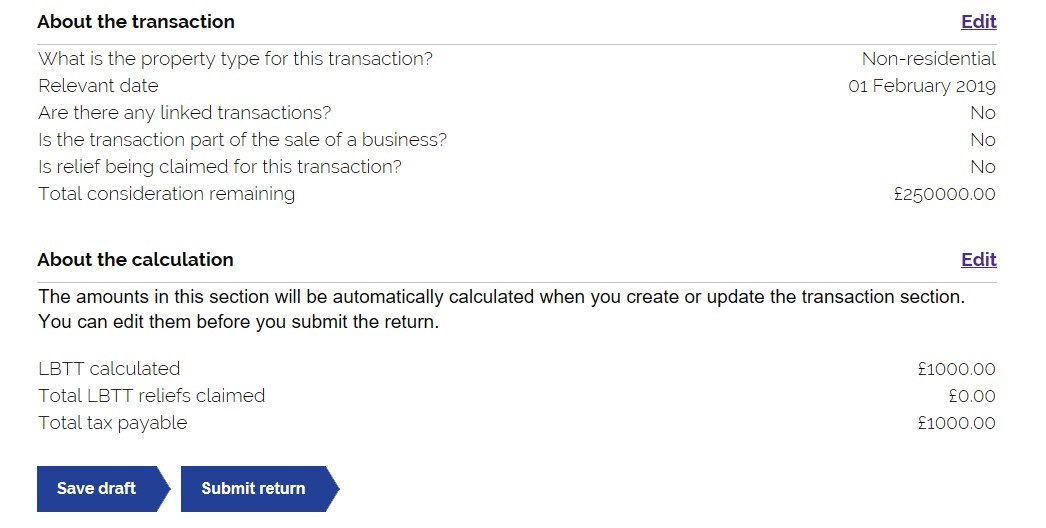

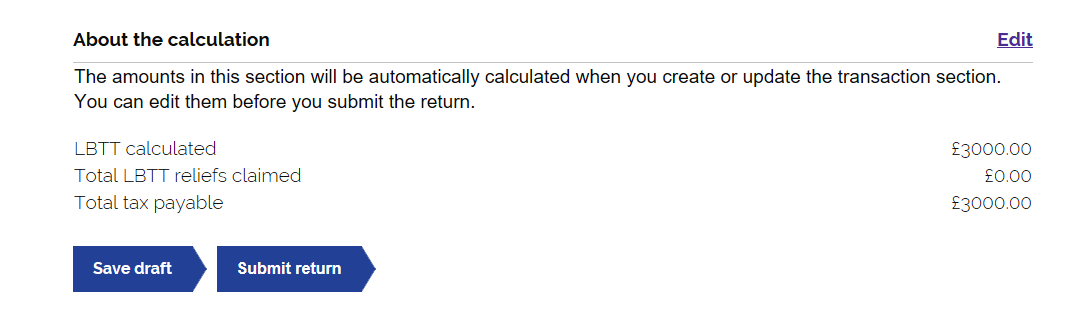

When the agent for SK Design Limited has completed the ‘About the transaction’ section, the ‘About the Calculation’ of the return will automatically populate the LBTT due.

As the effective date is after 25 January 2019, the SETS system calculates tax due using the new rates and bands for non-residential transactions on or after 25 January 2019.

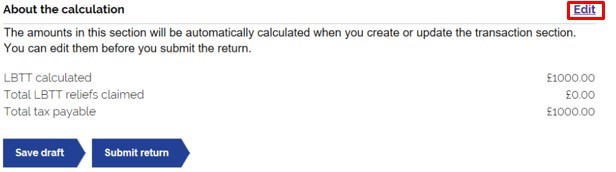

In order to ensure LBTT is calculated and paid at non-residential rates prior to 25 January 2019, the agent for SK Design Limited will have to manually overwrite the amount of tax. This can be done by selecting ‘Edit’ at the right side of the ‘About the Calculation’ section.

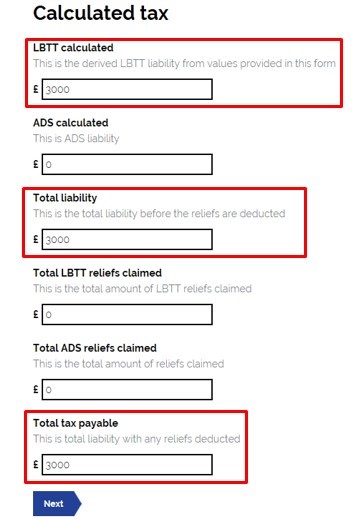

Once in this section, the agent can then overwrite the ‘LBTT Calculated’, ‘Total Liability’ and the ‘Total tax payable’ sections.

Once these have been manually overridden, the agent selects next. This will update the ‘About the calculation’ section and show the correct liability due.

Use the LBTT calculator to work out how much tax you’ll pay.