Performance Report

Performance Overview

Introduction

This overview provides a concise summary of Revenue Scotland’s purpose and objectives, along with a detailed account of its budget and performance for the year. The report outlines the key risks that were identified and managed in the achievement of those objectives. In the Performance Analysis section, included in the report on page 29, there is a comprehensive elaboration on these topics

The performance report begins with a brief summary of our performance, followed by an in-depth analysis section that assesses our progress in relation to the strategic outcomes outlined in our Corporate Plan 2021-24.

Who we are and what we do

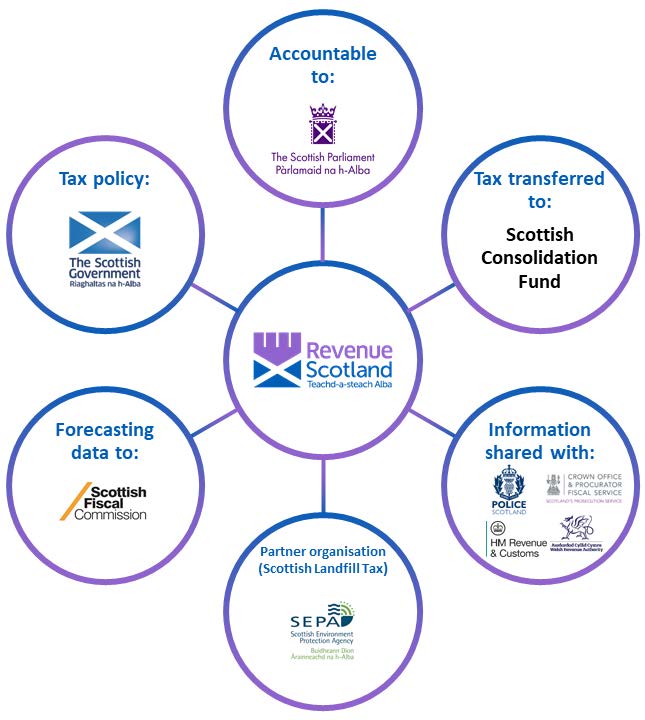

Revenue Scotland was established under the Revenue Scotland and Tax Powers Act 2014 (RSTPA). It is responsible for the collection and management of the fully devolved Scottish taxes: Land and Buildings Transaction Tax (LBTT) and Scottish Landfill Tax (SLfT).

As a non-ministerial office, Revenue Scotland is part of the Scottish Administration and is accountable directly to the Scottish Parliament, ensuring the impartial and fair administration of taxes. The Scottish Government is responsible for tax policy and rates, while Revenue Scotland provides policy development support through the provision of advice, data, and information based on its operational experience.

Revenue Scotland works alongside the Scottish Fiscal Commission (SFC), which is responsible for providing independent forecasts of tax revenue in line with the Fiscal Framework. To aid forecasting work, Revenue Scotland provides anonymous, aggregated SLfT and LBTT data to the SFC.

In addition to delegating specific functions for SLfT collection to the Scottish Environment Protection Agency (SEPA), Revenue Scotland also collaborates with His Majesty’s Revenue and Customs (HMRC) for compliance activity and participates in the British Isles Tax Authorities Forum, working closely with other tax authorities to share knowledge and best practices in tax collection and management.

How we are governed

The Board is responsible for the strategic direction, oversight, and governance of the organisation. It currently comprises seven members appointed by Scottish Ministers through the Scottish Public Appointments process. Board members provide specialist knowledge in key areas and act as ambassadors for the organisation. The Board has two committees: the Audit and Risk Committee (ARC) and the Staffing and Equalities Committee (SEC), which provide direction, support and detailed scrutiny of key areas of work and report on these to the Board. The Chief Executive is accountable to the Board and acts in a personal capacity as the Accountable Officer for Revenue Scotland. The Chief Executive is responsible for the day-to-day leadership and operation of the organisation. Further details about the activities of the Board, committees, and staff can be found in the Accountability Report section of the Annual Report.

How we are structured

The Senior Leadership Team is led by the Chief Executive and includes the Head of Tax, the Head of Corporate Functions, and the Head of Legal Services. These positions report directly to the Chief Executive and are responsible for the operational leadership, directing, and coordinating the delivery of Revenue Scotland’s strategic objectives. The organisational and team structure of Revenue Scotland is depicted in the diagram on the following page, providing a visual representation of the Senior Leadership Team’s role within the organisation.

How we are funded

Revenue Scotland is part of the Scottish Administration and its budget is set by the annual Budget Bill. The Scottish Government liaises with Revenue Scotland to identify its budgetary requirements which are then reflected in the Budget Bill that Ministers present to the Scottish Parliament. Where additional funding for major programmes is required, proposals for funding are developed in line with the guidance on business cases in HM Treasury’s ‘The Green Book: appraisal and evaluation in central government’. Revenue Scotland is responsible for managing its budget for each financial year to deliver its statutory functions. Revenue Scotland has authority to incur expenditure on individual items, but this is subject to the limits imposed by the budget allocated by the Scottish Parliament and guidance from Scottish Ministers.

Revenue Scotland’s purpose and vision

The Corporate Plan 2021-24 outlines our purpose, vision, strategic outcomes and performance measures. These determine our priorities to ensure we continue our work in raising revenue to support public services across Scotland in the most efficient and effective way.

Purpose

To efficiently and effectively collect and manage the devolved taxes which fund public services for the benefit of the people of Scotland.

Vision

We are a trusted and valued partner in the delivery of revenue services, informed by our data, digital by design, with a high-performing and engaged workforce.

Corporate Plan 2021-24 strategic outcomes

After eight successful years in operation, we have solidified our position as a leading and respected figure within Scotland’s tax and public sector landscapes.

Our Corporate Plan for 2021-24 is centred around four key strategic outcomes, as outlined below. These guide our efforts in achieving our strategic objectives, ensuring continued progress and adding value to the services we provide. Building on our impressive track record, which includes collecting nearly £6 billion in revenue since 2015, our plan charts the course for even greater success in the coming years.

Excelling in Delivery

We offer user-focused services that are digital by design, and provide value for money, convenience and ease of use for internal and external users.

Investing in our People

We are high-performing, outward looking and diverse, and provide a great place to work as an employer of choice. Our staff are motivated and engaged, and we invest in their development and health, safety and wellbeing.

Reaching Out

We are accessible, collaborative and transparent, keen to learn from others and to share our experiences and expertise.

Looking Ahead

We plan and deliver change and new responsibilities flexibly, on time and within budget. We have a digital mindset, maximising the use of our data and harnessing new technology to improve our working practices and services.

How we deliver our purpose and measure our success

Our purpose is delivered through the strategic outcomes outlined in the Corporate Plan. Performance is rigorously measured through the use of key performance indicators (KPIs) as set out in the Plan, and against the delivery of milestones related to the objectives of key projects. Our organisation has a Business Plan outlining projects and cross-cutting pieces of work which facilitate the achievement of strategic outcomes in the Corporate Plan, while also informing team plans and personal work objectives. This structure creates a clear line of sight between the work objectives of each staff member and the strategic outcomes set out in the Corporate Plan. Our structured approach to performance management supports how the organisation monitors and records progress across the business.

National Performance Framework

The National Performance Framework (NPF) serves as the cornerstone for the Scottish Government’s overall purpose and vision for Scotland, outlining National Outcomes to gauge progress towards achieving its broad goals. Our Corporate Plan 2021-24 aligns with and prominently features these National Outcomes, strategically directing and prioritising all organisational efforts towards realising those relevant to Revenue Scotland’s remit.

To ensure successful delivery of the Corporate Plan, we define objectives and deliverables. These are translated into action through a comprehensive strategic framework of corporate strategies, business plans, and team plans. We have robust performance reporting processes in place, monitoring progress against objectives on a monthly and quarterly basis. We also indirectly contribute to all National Outcomes by collecting devolved tax revenues which fund Scottish public services. The organisation particularly contributes to six of the National Outcomes: economy, environment, fair work and business, communities, human rights, and health. We support these areas through investment in staff, a commitment to equality, diversity and inclusion, collaboration with partners, stakeholders and taxpayers, and operating in an open, transparent, and accountable manner. Scottish Landfill Tax, in particular, functions as an environmental fiscal measure and promotes the circular economy. In this way, we make an essential contribution to the environmental National Outcome of the NPF. During the 2022-23 fiscal year, we began work on the proposed Scottish Aggregates Tax, further supporting the organisation’s contribution to the environmental ambitions set out in the NPF. The Scottish Aggregates Tax, which will replace the UK Aggregates Levy in Scotland, is an environmental tax levied on sand, gravel, and crushed rock extracted in Scotland, encouraging the sustainable use of Scotland’s natural resources.

The following table shows which Revenue Scotland strategic outcomes are relevant to the various National Outcomes.

| National Outcomes | Excelling in Delivery | Investing in our people | Reaching out | Looking ahead |

| We grow up loved, safe and respected so that we realise our full potential | ✓ | |||

| We live in communities that are inclusive, empowered, resilient and safe | ✓ | ✓ | ||

| We are creative and our vibrant and diverse cultures are expressed and enjoyed widely | ✓ | ✓ | ||

| We have a globally competitive, entrepreneurial, inclusive and sustainable economy | ✓ | ✓ | ✓ | |

| We are well educated, skilled and able to contribute to society | ✓ | ✓ | ||

| We value, enjoy, protect and enhance our environment | ✓ | ✓ | ||

| We have thriving and innovative businesses, with quality jobs and fair work for everyone | ✓ | ✓ | ||

| We are healthy and active | ✓ | ✓ | ||

| We respect, protect and fulfil human rights and live free from discrimination | ✓ | ✓ | ||

| We are open, connected and make a positive contribution internationally | ✓ | ✓ | ||

| We tackle poverty by sharing opportunities, wealth and power more equally | ✓ | ✓ | ✓ |

Key issues and risks

We managed a range of risks and issues during 2022-23. Our Board remained informed throughout the process, closely scrutinising and monitoring the management of these risks and issues. A detailed review of the Corporate Risk register and all of the risks within it was undertaken jointly between staff, members of the Board and the Audit and Risk Assurance Committee in August 2022.

Cyber security is a critical risk which affects all organisations in today’s digital age. We are acutely aware of the threats that exist and have proactively taken measures to mitigate against these risks. These include:

- implementing robust security protocols

- providing training to employees on cyber security best practices

- developing a non-SCOTS device use policy for members of the Board

- conducting regular vulnerability assessments and penetration testing to identify and address any weaknesses in our systems and processes

- ensuring all third party supplier security credentials are up to date, specifically in relation to Cyber Essential Plus and relevant ISO certifications.

We recognise the importance of data in driving informed decision-making and ensuring we deliver effective services to taxpayers. We are developing data and digital strategies and strengthening our data governance framework to ensure we are collecting, storing and using data in a responsible and ethical manner. This includes ensuring we are complying with relevant data protection law, implementing data security measures, and leveraging technology to optimise our data management processes. We have also undertaken a data maturity assessment to understand where we are currently, and how much further we need to go to meet our aspirations.

Our organisation responded to three business continuity events over the past year, testing the resilience of the organisation.

In each instance, we implemented contingency plans allowing us to maintain business processes and minimise disruption to our service users and stakeholders. The ability to respond to business continuity events is critical to our long-term success, and we are committed to continually reviewing our response plans to ensure we can effectively navigate any challenges that may arise.

As part of our commitment to continuous improvement and maintaining a robust risk management framework, we have conducted a thorough review of our assurance map. This assessment has highlighted specific areas where we aim to enhance our controls to further strengthen our risk mitigation measures.

The assurance map review process involved a comprehensive evaluation of our existing controls and their effectiveness in addressing potential risks across various business functions. While we have successfully implemented sound controls in many areas, we recognised the need to fortify our approach in certain key domains to ensure comprehensive risk coverage. Some initiatives to address issues and mitigate risks are included below.

Tax solutions

To enhance the management of risks associated with digital system performance and adaptability, we upgraded our contact management system. This new system streamlines operations for call handlers, ensuring more efficient support for callers. Its advanced reporting capabilities provide valuable insights into frequently asked questions, guiding us in refining our guidance, website, and communications with taxpayers. For a comprehensive overview of our corporate risks, refer to page 48.

In 2022-23 we engaged with a wide range of stakeholders to develop our Enhanced Support Policy. The Policy aims to help service users who may need additional support. Help may include providing documentation in braille or large print, access to translation services, help to register a Power of Attorney and access to a video relay service for Deaf/BSL users.

The Enhanced Support Service launched on 3 April 2023. Improvements to the user journey for lease taxpayers were also made and included updates to our online portal and additional communication methods being trialled. Further enhancements are planned for 2023-24.

We continued with planning, resourcing and governance arrangements to support decision making in complex cases. Performance reports and updates covering these matters are regularly scrutinised by the Board and Senior Leadership Team.

Communications and Stakeholder Engagement

Over the past year, we have made significant strides in improving our communications and stakeholder engagement efforts. Stakeholder engagement is critical to our reputation, building trust, managing risk and achieving our strategic outcomes.

We held a stakeholder roundtable event in January 2023, to inform the development of our Stakeholder Engagement Strategy. This brought together representatives from some of our key external stakeholder groups to discuss their expectations, concerns, and feedback. The discussion provided valuable insights into the needs and priorities of our stakeholders and helped us to identify areas where we could further strengthen and target our engagement efforts.

We have implemented a range of other initiatives to improve our communications with stakeholders. This includes regular updates on our activities and performance through our website and social media channels, as well as targeted communications to specific stakeholder groups.

We have also established feedback mechanisms to ensure we receive and respond to stakeholder feedback in a timely and effective manner. This includes regular surveys, focus groups, and other forms of engagement to solicit feedback on our activities and performance.

Legislative change

We recognise the importance of keeping up to date with relevant legislation and adapting our approach as necessary to ensure compliance. There will be several upcoming legislative changes that will affect our remit and operations, and over the year we took proactive measures to ensure we respond appropriately.

Our staff maintain an overview of legislation developments in areas relevant to them or to Revenue Scotland generally. For instance, Corporate Services teams keep up with developments in relation to data protection, procurement and equalities, diversity and inclusion. Tax and legal colleagues stay informed about developments in tax processes from other tax authorities and comparable tax systems. Over the year we liaised with the Scottish Government in relation to amendments to subordinate legislation relevant to SLfT.

Staff capacity and capability

Our staff are our most valuable asset, and we are committed to ensuring we manage their capacity and capability effectively. This includes ensuring we have the right people in the right roles, with the necessary skills and experience to deliver our strategic objectives.

Our People Services team are responsible for managing our staffing levels and supporting the Senior Leadership Team in our strategic work force planning to ensure we have the necessary resources and capabilities to meet our objectives. This team conducts regular reviews of our staffing levels and works closely with managers to identify any areas where additional capacity or capability is required. Our processes and systems include:

- conducting regular performance reviews and training needs assessments to identify any areas where staff require additional support or development

- identifying high-potential staff using our talent management programme, which helps us to provide employees with opportunities for development and career progression

- conducting regular strategic workforce planning sessions.