Scottish Landfill Tax (SLfT)

Scottish Landfill Tax (SLfT) is a tax on the disposal of waste to a landfill in Scotland, whether to an authorised landfill site or not. SLfT applies to all taxable disposals made in Scotland on or after 1 April 2015.

SLfT is chargeable by weight and there are currently two rates for taxable disposals:

- The lower rate, which in 2023/24 was £3.25 per tonne, which applies to those less polluting wastes listed in The Scottish Landfill Tax (Qualifying Material) Order 2016

- The standard rate, which in 2023/24 was £102.10 per tonne, which applies to all other taxable waste.

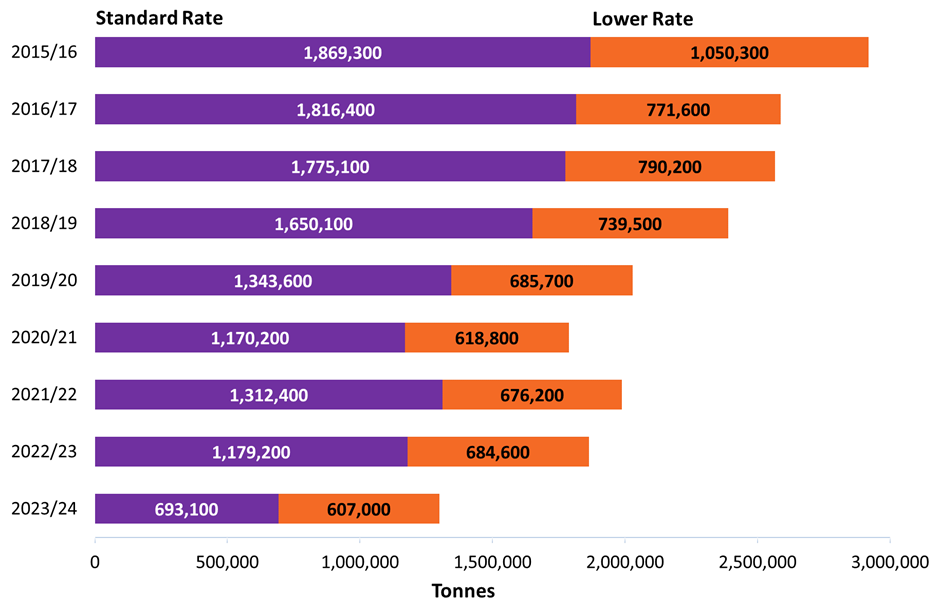

Figure 18: Tonnage of taxable disposals, by rate and year

Standard rate disposals of 0.7 million tonnes were declared in 2023/24, a decrease of 41% on the previous year. Lower rate disposals decreased by 11%. Total tonnage is down 30%, continuing the trend of decreasing tonnage year on year, with the exception of 2021/22, which saw an increase in tonnage, largely due to facilities returning to normal disposal activities after the previous year was affected by the COVID-19 pandemic.

Table 11: SLfT declared due, contributions to the Scottish Landfill Communities Fund (SLCF) and credits claimed by year

|

Year |

£ millions |

|||||||

|

Gross SLfT due |

Contributions to SLCF |

Credit claimed for |

Net SLfT declared due |

|||||

|

Standard rate disposals |

Lower rate disposals |

All |

|

Contributions to SLCF1 |

Other2 |

All |

|

|

|

2020/21 |

110.2 |

1.9 |

112.0 |

5.2 |

4.9 |

0.9 |

5.8 |

106.3 |

|

2021/22 |

126.9 |

2.1 |

129.0 |

6.3 |

5.7 |

1.7 |

7.4 |

121.7 |

|

2022/23 |

116.3 |

2.2 |

118.4 |

6.1 |

5.5 |

2.9 |

8.4 |

110.1 |

|

2023/24 |

70.8 |

2.0 |

72.7 |

3.6 |

3.2 |

0.9 |

4.1 |

68.7 |

Notes:

- Taxpayers can claim a credit equal to 90 percent of their contribution to the SLCF.

- Credit claimed for bad debt and permanent removals.

Net SLfT declared due relates to the lower and standard rate disposal tonnages, lower and standard tax rates, as well as contributions to the Scottish Landfill Communities Fund (SLCF).

In 2023/24 net SLfT declared due was £69 million, a 38% decrease on the previous year. The long-term decrease in net SLfT , with the exception of 2021/22, is mainly due to standard rate disposal tonnages decreasing faster than the standard rate of tax has increased.

Standard rate disposals account for the vast majority of SLfT due, making up 97% in 2023/24. In previous years, typically the tonnages of standard rate disposals are about twice as high as that of lower rate disposals, however, in 2023/24 the tonnage is only 1.1 times higher. Although the standard rate tonnage is only slightly higher than the lower rate tonnage, the tax rate is around 31 times higher.

The Scottish Landfill Communities Fund (SLCF) is a tax credit scheme for SLfT which allows landfill site operators to contribute tax credits to benefit community and environmental projects.

Table 12: Proportion of gross SLfT declared due by EWC code and year

|

EWC code |

Description |

Estimated proportion of total gross SLfT declared due |

||||

|

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

||

|

20 03 01 |

Mixed municipal waste |

46.3% |

52.0% |

49.1% |

57.7% |

46.4% |

|

19 12 12 |

Other wastes (including mixtures of materials) from mechanical treatment of wastes other than those mentioned in 19 12 11 |

35.3% |

34.2% |

35.3% |

29.0% |

33.8% |

|

Other or unknown |

|

18.4% |

13.8% |

15.6% |

13.3% |

19.8% |

European Waste Catalogue (EWC) codes are a coding system used to describe and categorise waste.

Mixed municipal waste is the most prevalent waste type, contributing around 46% of SLfT revenue in 2023/24. A further 34% was attributable to disposals of EWC code 19 12 12 – other wastes. Disposals of these two waste streams have accounted for the majority of gross SLfT declared due each year.

Note that as EWC code 19 12 12 constitutes waste “from the mechanical treatment of waste” it will contain other waste types (other EWC codes) that have then been mechanically treated.

Table 13: Taxable disposals by EWC code and SLfT rate, 2015/16 – 2023/24

|

EWC code |

20 03 01 |

19 12 12 |

Other or Unknown |

|

Description |

Mixed municipal waste |

Other wastes (including mixtures of materials) from mechanical treatment of wastes other than those mentioned in 19 12 11 |

Other or Unknown |

|

Standard Rate |

100.0% |

66.3% |

24.6% |

|

Lower Rate |

0.0% |

33.7% |

75.4% |

|

Taxable disposals (tonnes) |

7,958,700 |

4,984,400 |

6,490,400 |

Mixed municipal waste has accounted for 8 million tonnes of taxable disposals since 2015/16, all of which was subject to the standard rate of SLfT. EWC code 19 12 12 has accounted for 5 million tonnes over the same time span. 66% of EWC code 19 12 12 disposals were subject to standard rate tax and 34% were subject to the lower rate.