Additional Dwelling Supplement

Before completing the Additional Dwelling Supplement

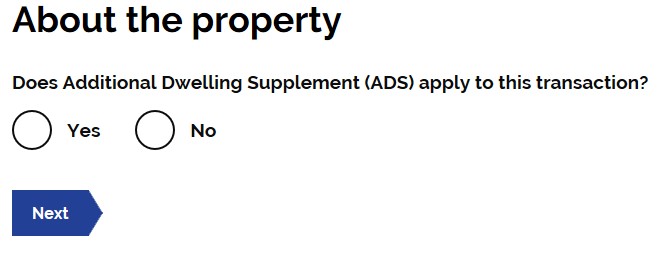

Before the Additional dwelling supplement section will appear on the tax return, you must have selected yes to the question ‘Does ADS apply to this property?’. This question forms part of the ‘About the property’ section of the return. Guidance on how to complete this section can be found in our guidance at About the property.

Note: Full guidance regarding ADS can be found at ADS legislative guidance.

About the Additional Dwelling Supplement

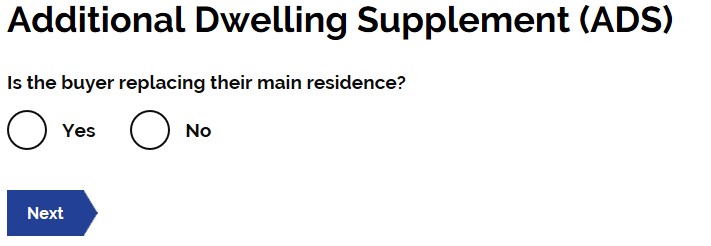

Is the buyer replacing their main residence

Use the radio buttons to select ‘yes’ or ‘no’ to this questions.

If you answered ‘Yes’ you will be asked questions 1 and 2. If you answered ‘no’ you will be asked questions 1.

1. Total consideration liable to ADS

Enter the total relevant consideration chargeable to ADS. If the transaction is for more than one property and not all of the properties are chargeable to ADS, enter the amount of the total consideration attributed, on a just and reasonable basis, to the properties that are chargeable to ADS. LBTT10030 explains how the consideration that is chargeable to ADS can be determined.

If the transaction is a non-residential transaction which involves the purchase of a dwelling(s), this figure will be the total consideration paid attributed on a just and reasonable basis to the dwelling(s) only. This is because ADS is only due in respect of additional dwelling(s).

2. Amount of ADS liability from new main residence

If the transaction is for a single dwelling that is the replacement of the main residence, this will be the same as the total consideration for the transaction.

If the transaction involves both the purchase of a replacement main residence and the purchase of other property that may include other dwellings, this figure will be the consideration attributable to the replacement of the main residence.

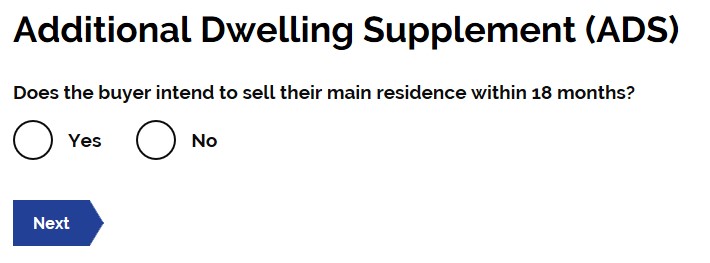

Does the buyer intend to sell their main residence within 18 months?

Use the radio buttons to select ‘yes’ or ‘no’ to this questions.

If you select ‘yes’, you will be asked ‘What is the address of the new main residence’. Please complete the fields provided with the address.

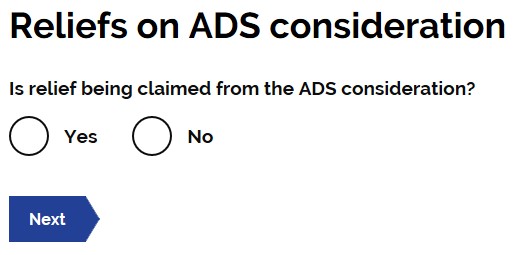

Is relief being claimed from the ADS consideration?

Use the radio buttons to select the appropriate answer.

If you select ‘yes’ a further field will appear. You will then be asked to select which relief you are claiming, as well as the amount of relief you are claiming. There is an option to add a further row if necessary.

The return will then use the information provided to calculate any ADS due. This will appear in the final ‘About the calculation’ section once the full return is complete. For guidance on how to edit this section please see out guidance on ‘About the calculation’.