This guidance will help you make an online Land and Buildings Transaction Tax (LBTT) lease review return.

Further information about using the online portal, including how to save a draft and amend a return, can be found in the ‘General guidance about the online LBTT return’.

It is the tenant’s responsibility to ensure the LBTT return is complete and accurate.

Where an agent is completing and submitting this on behalf of the taxpayer, you must certify, as part of the declaration page, that the tenant(s) have declared that the return is correct and complete, and that the relevant date entered is correct.

All references in this guidance to:

- LBTT(S)A 2013 means The Land and Buildings Transaction Tax (Scotland) Act 2013 (as amended);

- ‘tenant’ means the buyer as defined in section 7 of the LBTT(S)A 2013;

- ‘landlord’ means the seller as defined in section 7 of the LBTT(S)A 2013;

- ‘we’, ‘us’ or ‘our’ means Revenue Scotland;

- ‘you’ means the person making the LBTT return (either as the tenant or the tenant’s agent);

- ‘original return/transaction’ means the first LBTT return submitted when the lease was granted, or when it became notifiable for the first time.

Protection of information

We will protect and handle any information that you provide us with in your tax return with care. For further information please see our Privacy Policy and guidance on taxpayer information (Chapter 9 of The Revenue Scotland and Tax Powers Act 2014 legislation guidance).

Key information you will need to complete this return

To complete this return, you will need the following information:

- The lease agreement, showing information such as the start and end dates of the lease;

- Transaction reference of the LBTT return original LBTT return submitted for the lease;

- Effective date of the LBTT return original LBTT return submitted for the lease;

- A recalculation of the total LBTT payable on the lease. Please consult our guidance on how to calculate tax on a lease review before using the LBTT on Lease Transactions Calculator;

- How much LBTT has already been paid on the lease.

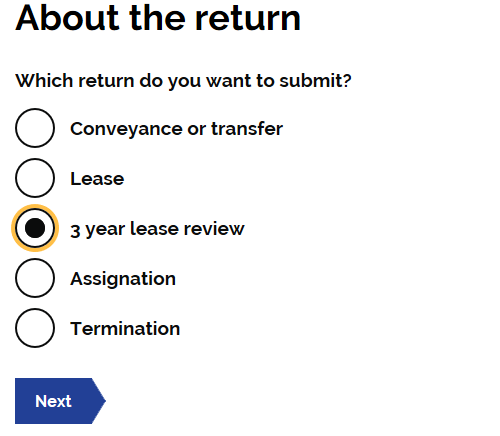

1. About your LBTT return

Select the radio button to indicate that this return is being submitted for a ‘3 year lease review’.

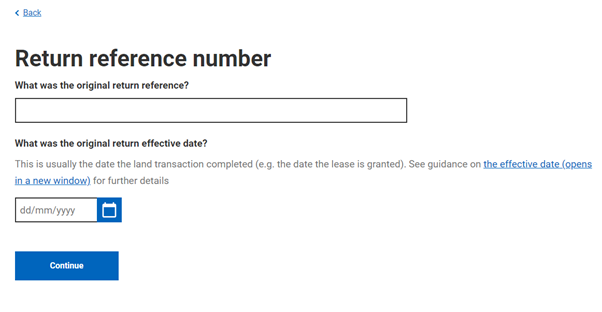

2. Return reference number

Enter the transaction reference of the LBTT return that was originally submitted for this lease. This should be entered in the following format - ‘RSXXXXXXX’.

Enter the original return effective date. This should be entered in the following format DD/MM/YYYY

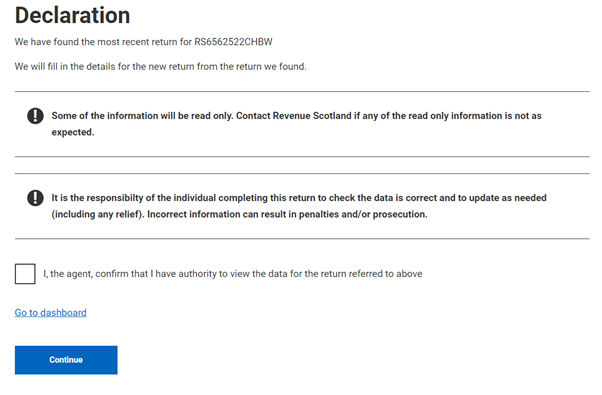

3. Declaration

As information from previous returns will now be prepopulated you will be required to ‘tick’ a declaration before being taken to the return summary page.

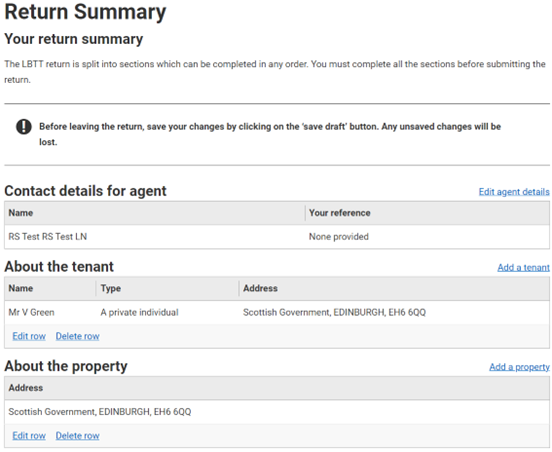

4. Return summary

You will now be presented with an overview of the tax return with all details prepopulated from previous returns. If there are no change you are only required to enter the Relevant date by selecting “edit transaction details”.

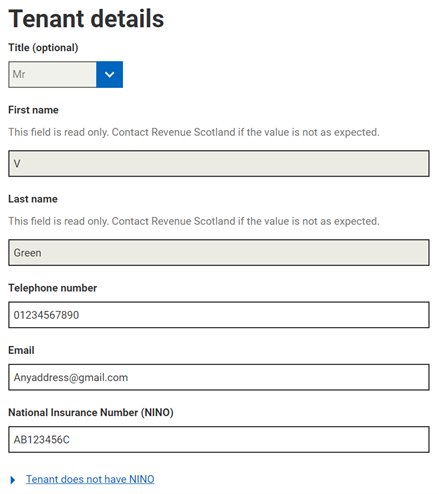

5. About the tenant

All tenant information is now prepopulated. Information that is read only will be “greyed out”. You can however update telephone number, email address and NINO.

Tenant details

Under Tenant details you will be asked the following questions:

- Is the tenant connected to the landlord?

Enter ‘Yes’ if the tenant and landlord are connected persons as defined under section 58 of the LBTT(S)A 2013.

- Is the tenant acting as a trustee or representative partner for tax purposes?

Select either ‘yes’ or ‘no’.

6. About the property

This section is now prepopulated with the property address from the previous return. This section should not be changed, however you can add more details such as:

- Local Authority

- number

- title

- parent title

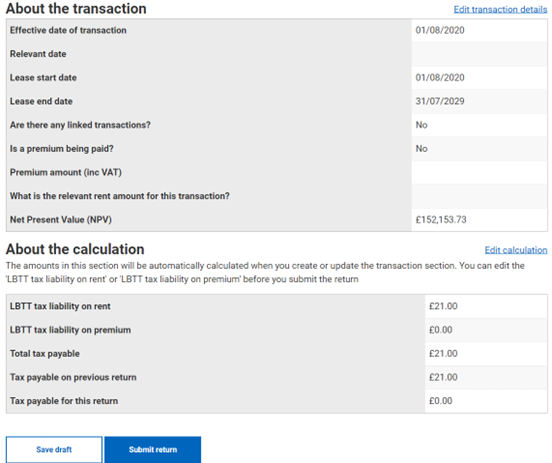

7. About the transaction

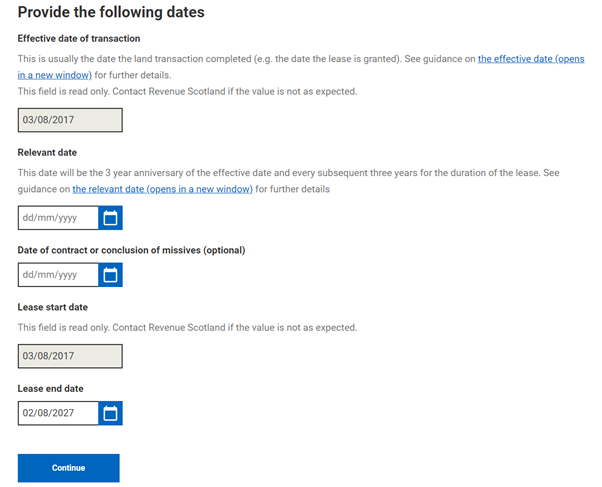

The effective date of transaction and lease start date will be prepopulated and un-editable. If either of these are incorrect you must contact Revenue Scotland and request that this is amended along with evidence of the date/s.

Provide the following dates

You will be asked to provide various dates in reference to the transaction;

Relevant date of transaction

Confirm the following dates

Lease end date

Note: Guidance on these dates can be found at LBTT6001 - Leases.

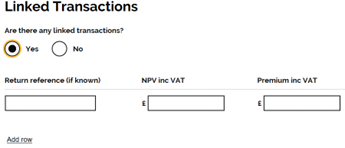

If ‘yes’ is selected a further box will appear and prompt you to complete the following details for the linked transaction

- Return reference (if known)

- NPV including VAT

- Premium including VAT

Note: Guidance on linked leases can be found at LBTT60025 - Linked Leases

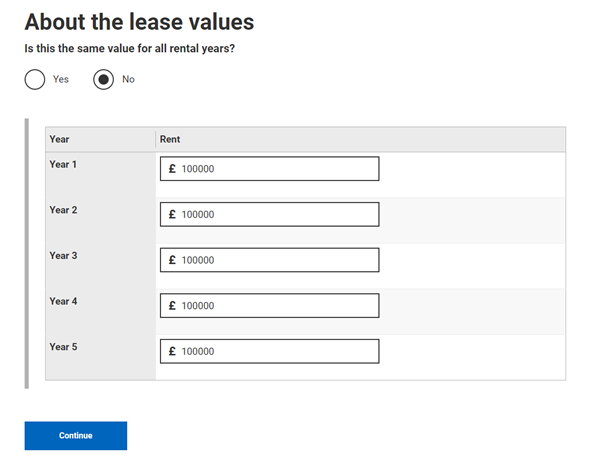

About the lease values

The lease values previously declared will be prepopulated.

You will then be asked ‘is this the same value for all rental years?’. Use the radio buttons to select ‘yes’ or ‘no’

This field asks you to complete the rental figure for each relevant year. The years are populated based on the lease dates provided as the start of the ‘about the transaction section’.

Please complete each box with the rental figure relevant to that year. I.e. Year 1 - £500, Year 2 - £650. Year 3 - £600.

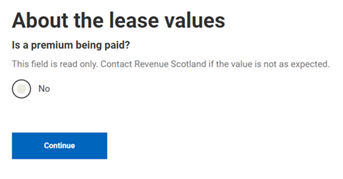

Is a premium being paid

This section will be prepopulated based details from the original return, you will not be able to edit this section.

Net Present Value (NPV)

This will be calculated by the system using the previous figures you have entered. This can be edited if necessary.

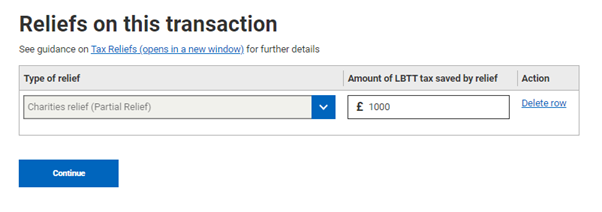

8. Reliefs

If a relief was claimed on the original lease return this section will also appear on the return summary page.

The type of relief will be prepopulated and un-editable, however if partial relief was claimed you will be able to edit the amount of LBTT tax saved by claiming the relief.

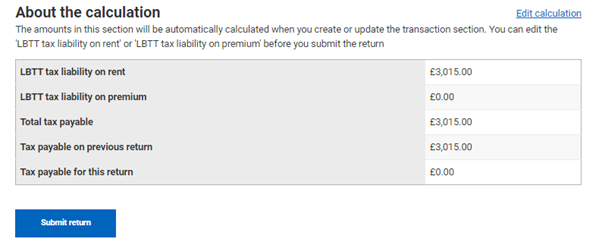

9. About the Calculation

Once the ‘About the transaction’ sections are complete. This will automatically populate the ‘About the calculation fields’.

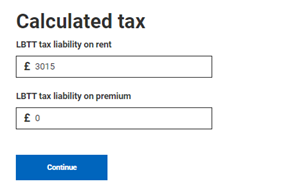

Calculated tax

You can then edit the following fields if necessary.

LBTT tax liability on rent LBTT tax liability on premium.

10. Submitting

Once you have completed all the sections. You need to select the ‘submit’ button.

Payment and submission

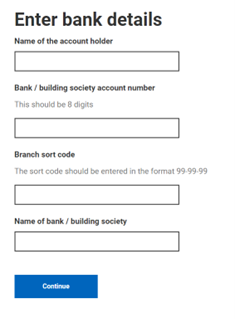

If a repayment is due you will automatically be taken to the claim repayment page. The amount of repayment is calculated for you based on the details you have provided and cannot be changed.

After Clicking ‘Continue’ you will be asked for the bank details you wish the repayment to be paid into.

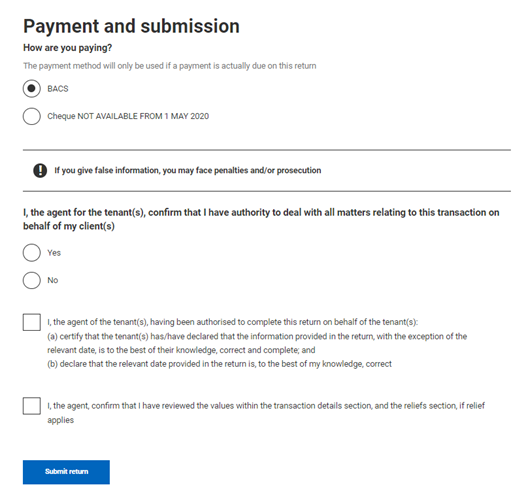

Declaration

You will then be asked ‘how are you paying’. Please select your chosen payment method. Further information on how to pay can be found in our guidance at How to pay LBTT.

If after having read the declaration statement you are content to give your agreement to it, you must declare this by selecting the check-box beside the statement.

You cannot submit and make an LBTT return without completing the declaration statement.

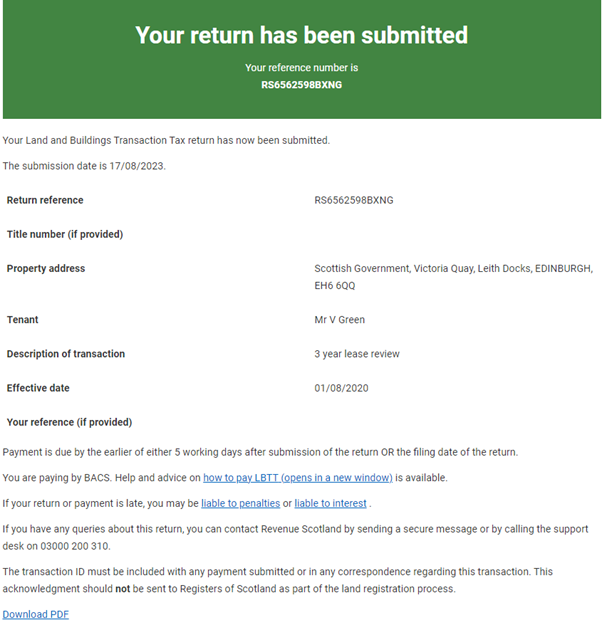

Once submitted you will received on screen confirmation that the return has been submitted. This submission notice will also provide you with a return reference. This will be in the following format : RSXXXXXXXABCD. Please keep a note of this reference.

Note: If you have additional tax to pay, this is the reference number you must use when you are making the payment.

The submission page has various links:

- How to pay guidance – for when a payment is due

- Penalty and interest information

- Print this confirmation – allows you to print for your records

- Send a secure message – opens up a blank message with the return reference to allow you to contact us about the return

- Go to dashboard – will take you back to your system dashboard

Once complete and submitted you can view and amend your submitted return from your dashboard.