How to amend an LBTT return

Purpose of this guidance

This guidance will help you amend a Land and Buildings Transaction Tax (LBTT) return after it has been made (whether online or by paper). This complements the separate guidance available on ‘How to make an online LBTT return’ and ‘How to make a paper LBTT return’.

The guidance covers:

- The rules regarding amendments and disregarding a return process

- How to amend an online LBTT return

- How to amend a paper return or online return you can no longer access

If you need to amend an online or paper LBTT return solely to claim repayment of Additional Dwelling Supplement please see our guidance on ‘How to claim a repayment of Additional Dwelling Supplement’

Note: We do not accept amendments to returns over the phone.

Protection of information

We will protect and handle any information that you provide to us in your tax return with care. For further information please see our Privacy Policy and guidance on taxpayer information (Chapter 9 of The Revenue Scotland and Tax Powers Act 2014 legislation guidance).

Rules regarding amendments

Rule 1: No amendment is possible more than 12 months after the filing date

Under section 83 of The Revenue Scotland and Tax Powers Act 2014, no amendment is possible more than 12 months after the filing date and the ‘Amend’ option will be greyed out to prevent you inadvertently doing this after the time limit. If the time limit for amending a LBTT return has passed you can claim a repayment from us, as long as you do so within five years of the filing date – see RSTP7003.

The ‘filing date’, as defined in section 82 of The Revenue Scotland and Tax Powers Act 2014, is ‘the date by which that return requires to be made by under any enactment’ – in other words it is the last day on which the return can be made to us before it is late. In a standard house purchase, for example, the filing date is 30 beginning with the day after the effective date of the transaction, but other filing dates may apply to other types of land transaction.

Rule 2: Amending other details apart from the 'About the return' field

You can amend all details on the LBTT return apart from the ‘About the return’ field. In other words, a return made to us with the ‘Conveyance or transfer’ option selected cannot be changed afterwards to the ‘Lease’ option, and vice versa.

If you do need to change the ‘About the return’ field (for example, you might have mistakenly confused some of the details of one transaction for another) then in addition to making a new LBTT return to us you must disregard the original return by writing to us and requesting a disregard.

Rule 3: When to make a new LBTT return and disregard the original return

In addition to rule 2, although you can amend (subject to the time limit in rule 1) any details in the ‘About the Buyer/Tenant’, ‘About the Seller/Landlord’ and ‘About the Transaction’ sections of the return, you should make a new LBTT return and request a disregard to the original return if any details in these sections alter the transaction to such an extent that it essentially constitutes a different transaction. Examples of this would be:

- the identity of the buyer/tenant changing – for example, the original return contained the wrong buyer/tenant

- the identity of the seller/landlord changing – for example, the original return contained the wrong seller/landlord

- the property (or properties) involved in the transaction changing – for example, the original return contained the wrong property (or properties)

- you have declared additional dwelling supplement as due in error

Disregarding a return

Agents can no longer void a return. They can however, request a return to be disregarded. The situation in which a disregard would be requested are as follows:

1. The transaction was non-notifiable in the first place and a return was made in error

Where this has happened, you must provide us with documents to confirm the transaction was not notifiable.

2. You submitted a duplicate return in error

If you have submitted a duplicate return we will need confirmation of the duplicate reference that needs to be disregarded.

Note: All requests for a return to be disregarded must be made in writing and the relevant documents/information included.

Once we have disregarded your return, we will write to you to confirm this has happened.

Amending an online LBTT return

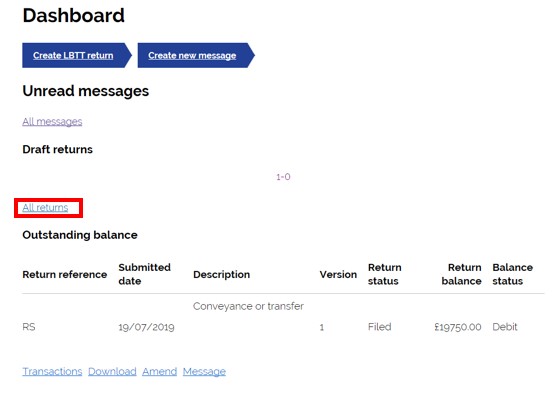

On your dashboard, select the ‘all returns’ button.

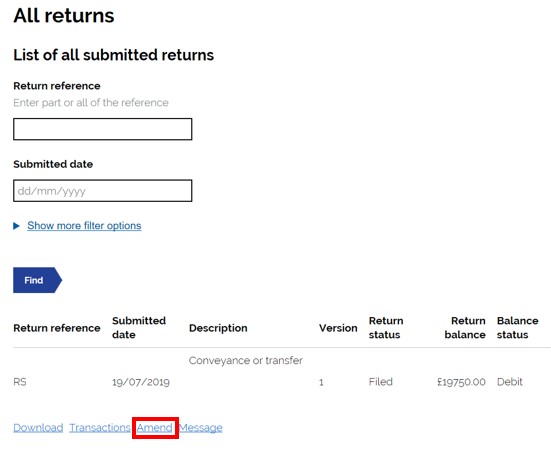

Selecting this will take you to all your returns. You can then search for the return you want to amend. Once you have found the return, there will be four options underneath the return. Here you will find the amend button.

Note: there are rules regarding the amendment of returns. Please see the ‘Rules around amendments’ section further in this guidance.

Clicking this will take you back into the return summary page. You can then amend the information you need to amend.

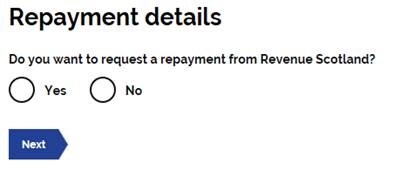

Once you select ‘submit return’ you will be asked ‘Do you want to request a repayment from Revenue Scotland?’. Use the radio buttons to select ‘yes’ or ‘no’.

If you select ‘yes’, you will be asked how much you are claiming for repayment. Use the box to enter the amount you wish to request. You will also be asked to provide bank details for the account you wish the repayment to be made to.

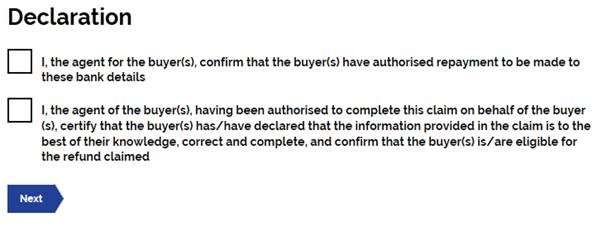

You will then be asked to tick the checkbox against two declarations. You will be asked to confirm:

I, the agent for buyer(s), confirm that the buyer(s) have authorised repayment to be made to these bank details. And;

I, the agent of the buyer(s), having been authorised to complete this claim on behalf of the buyer(s), certify that the buyer(s) has/have declared that the information provided in the claim is to the best of their knowledge, correct and complete, and confirm that the buyer(s) is/are eligible for the refund claimed.

Note: Where ‘buyer(s)’ is mentioned, this will be changed to ‘tenant(s)’ when amending a lease return.

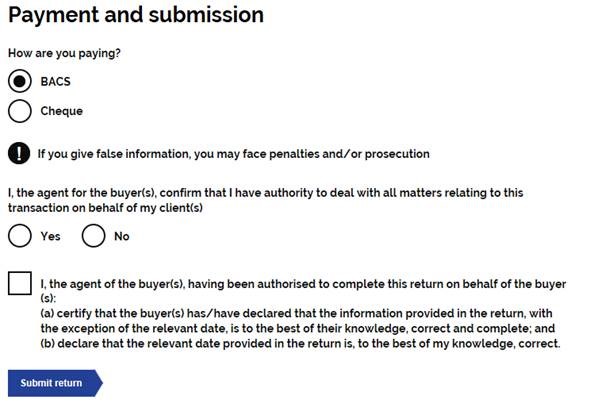

You will then be asked ‘How are you paying’. This is an error within the system and will be fixed in due course.

You will be asked to select either ‘yes’ or ‘no’ for the following statement;

‘I, the agent for the buyer(s), confirm that I have authority to deal with all matters relating to this transaction on behalf of my clients(s).’ Use the radio buttons to select either yes or no.

You will then be asked to check the box to confirm that;

I, the agent of the buyer(s), have been authorised to complete this return on behalf of the buyer(s):

(a) certify that the buyer(s) has/have declared that the information provided in the return, with the exception of the relevant date, it to the best of their knowledge, correct and complete; and (b) declare that the relevant date provided in the return, is to the best of my knowledge, correct.

Once you have agreed to the declaration, select submit return.

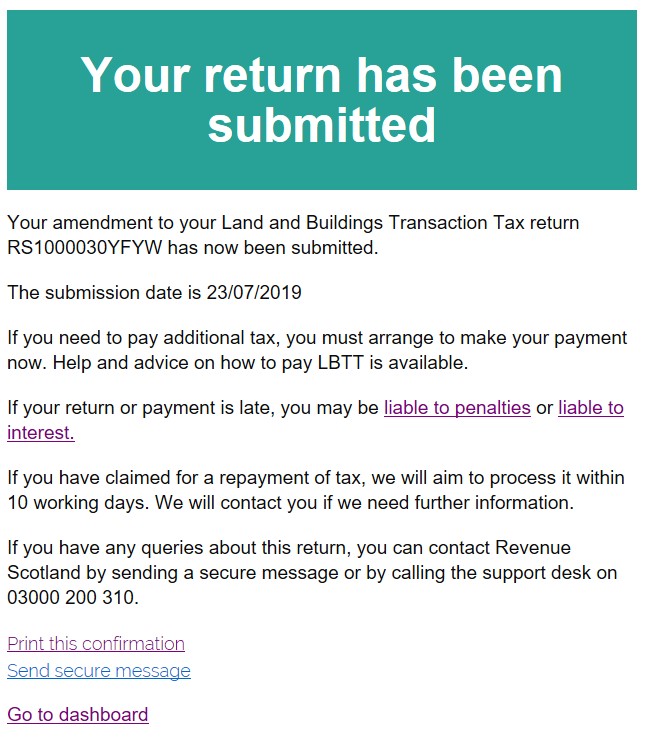

You will then see a return submitted screen, confirming the date of submission.

If there is more tax to pay, see our guidance on how to pay LBTT. There is a link to our penalties and interest guidance for information. If you have claimed a repayment we state that we aim to process any repayment claims within 10 working days.

This submission notice can be printed by selecting the ‘Print this confirmation’ link at the bottom of the page. You can also send a secure message from the submission page. Clicking the ‘send secure message’ button will create a secure message and automatically populate the return reference.

You can then select ‘Go back to dashboard’ to go back to your dashboard.

Amending a paper return or online return you can no longer access

You can amend an LBTT return which has originally been made to us in paper format by writing to us. You need to quote the return reference number and tell us about each field you wish to amend, the current entry and the entry you wish to amend to.

You can also use this method to amend an LBTT return which was originally made to us online, for example: if you no longer have access to the online version of the return because you have changed agent or submitted a tenant online lease review return.

Note: If you are amending a return solely to claim repayment of Additional Dwelling Supplement – Please follow the guidance on ‘How to claim a repayment of Additional Dwelling Supplement’

No amendment is possible more than 12 months after the filing date of the return. We will reject any requests for amendments received after the expiry of this 12 month amendment period.

The ‘filing date’, as defined in section 82 of The Revenue Scotland and Tax Powers Act 2014, is ‘the date by which that return requires to be made by or under any enactment’ – in other words it is the last day on which the return can be made to us before it is late. In a standard house purchase, the filing date is 30 days after the effective date of the transaction, but other filing dates apply to other types of land transaction.

If more tax is payable as a result of the amendments you have made, then the normal payment rules and arrangements apply (that is, you must enclose a cheque for the additional amount payable) – see the separate guidance on ‘How to pay LBTT’. You will also have to separately pay interest on the additional amount of tax payable, charged from the filing date of the return until the date the additional amount is paid.

Note: do not include the interest in any request to amend the ‘Total amount of tax due for this transaction’ question in the ‘About the Calculation’ section of the LBTT return. Interest is administered separately by us and we will send you an Interest Notice if interest is due.

If less tax is payable, we will repay the excess amount to you with interest (see the separate guidance on interest on repayments provided at RSTP4004).

If the amended return contains an inaccuracy then the person on whose behalf the amended return is being made may be liable to a penalty – see RSTP3011.

All amendments to paper returns and any associated payments should be sent to:

Revenue Scotland

PO Box 24068

Victoria Quay

Edinburgh

EH6 9BR