How to make an online LBTT lease review return (tenant)

Purpose of this guidance

This guidance will help you (the tenant) make an online Land and Buildings Transaction Tax (LBTT) lease review return. Separate guidance is available on ‘How to pay LBTT’, including BACS/CHAPS payment arrangements.

This is not guidance about the tax itself. LBTT legislation guidance for taxpayers and agents is available separately on our website. Where we refer to further guidance, for example ‘see LBTT1001’, we mean references to that guidance.

It is the tenant’s responsibility to ensure the LBTT return is complete and accurate. If you are unsure about any matter relating to the LBTT return you should seek professional advice.

Note: If there are two or more tenants, you must complete the online LBTT lease review return form for lease transactions with more than one tenant.

All references in this guidance to:

LBTT(S)A 2013 means The Land and Buildings Transaction Tax (Scotland) Act 2013 (as amended);

- ‘tenant’ means the buyer as defined in section 7 of the LBTT(S)A 2013;

- ‘landlord’ means the seller as defined in section 7 of the LBTT(S)A 2013;

- ‘we’, ‘us’ or ‘our’ means Revenue Scotland;

- ‘you’ means the person making the LBTT return (either as the tenant or the tenant’s agent);

- ‘original return/transaction’ means the first LBTT return submitted when the lease was granted, or when it became notifiable for the first time.

Protection of information

We will protect and handle any information that you provide us with in your tax return with care. For further information please see our Privacy Policy and guidance on taxpayer information (Chapter 9 of The Revenue Scotland and Tax Powers Act 2014 legislation guidance).

Please consult our guidance on how to calculate tax on a lease review before using the LBTT on Lease Transactions Calculator; How much LBTT has already been paid on the lease.

General information

-

This return should only be used by tenants. Agents submitting lease review returns on behalf of tenants should use the SETS online portal.

Key information you will need to complete this return

To complete this return, you will need the following information:

- the lease agreement, showing information such as the start and end dates of

- the lease the transaction reference of the LBTT return originally submitted for

- the lease the effective date of the LBTT return originally submitted

- the lease a recalculation of the total LBTT payable on the lease

- how much LBTT has already been paid on the lease

Please note you need a valid original lease return reference and its corresponding effective date to complete the return. If you don't have these details you'll need to contact us. -

Once you have requested access to the return, you must complete it within 90 minutes.

You cannot save a draft or amend the return so it is important to ensure that you have all the key information, as listed above, to hand before you access the return.Information on how to amend an LBTT lease review return can be found towards the end of this guidance.

Note: We do not accept amendments to returns over the phone.

- 2. Index Page

-

Image

Selecting this button will take you to a screen displaying the following message;

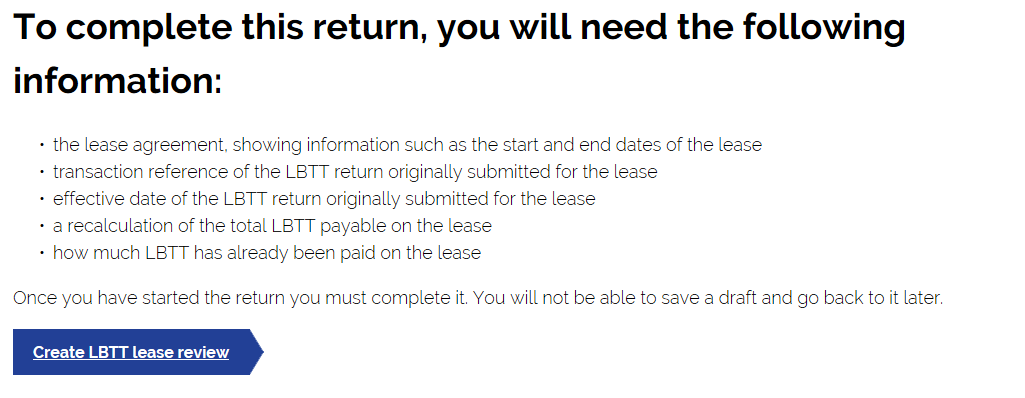

Image

Once you have read this message and have all the details you need, you can select ‘Create the LBTT lease review’.

Image

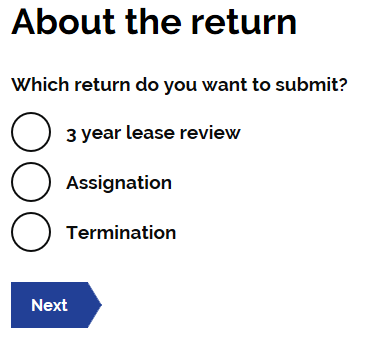

You must then select the option for ‘3 year lease review’.

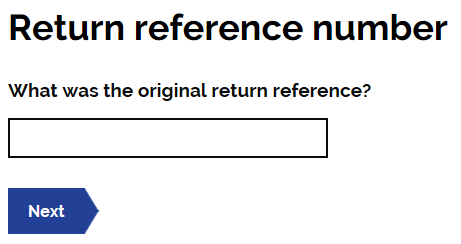

- 3. Return Reference Number

-

Image

Enter the transaction reference of the LBTT return that was originally submitted for this lease. This should be entered in the following format - ‘RSXXXXXXX’

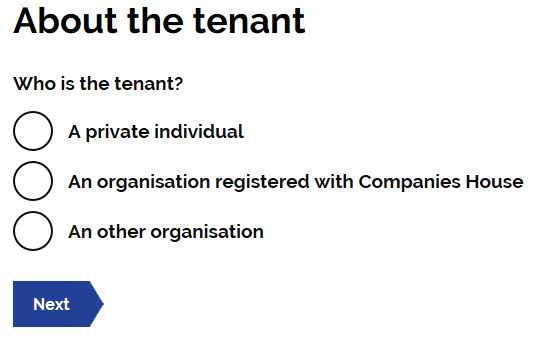

- 4. About the Tenant

-

Image

Who is the Tenant

Select the option which is most relevant to the tenant.

Note: For these purposes, ‘An other organistaion’ includes the option of Partnership, Trust, Charity, Club, Other and Company (Not registered with Companies house).

Depending on the type of tenant you chose, you will be asked for different information.

Tenant type - Private Individual

Tenant details

You will be asked to complete the following details for the tenant;

- Title

- First name

- Last name

- Telephone number

- National Insurance number (NINO) /Other form of ID if no NINO

Note: All these fields, except Title, are mandatory.

Tenant’s contact address

You will be asked ‘should we use a different address for future correspondence in relation to this return?’. Please use the radio buttons to select either ‘Yes’ or ‘No’.

Where ‘Yes’ is selected, please provide the tenants contact address.

Tenant type - Organisation registered with companies house

Registered company details

You will be asked to enter the registered company number. This will populate the Company Name and Address. These can be edited if necessary.

Contact details

You will be asked to complete the following details for the company contact;

- First name

- Last name

- Job title or position

- Address

- Contact phone number

Tenant type – An other organisation

Type of organisation

Here you can select which type of organisation the tenant is.

Note: When ‘other’ is selected, a box will appear to prompt an explanation of the type of organisation the tenant is. If ‘charity’ is selected then you will be asked to provide the charity number.

When you have selected the organisation type you will then be asked to provide the following information;

- Name of the organisation

- Address of the organisation

- The country’s law which governs the organisation i.e. where the organisation is registered

Once this information is completed you will be asked to enter the following details for the organisations point of contact;

- First name

- Last name

- Job title or position

- Address

- Contact phone number

Tenant Details

Under Tenant details you will be asked the following questions;

Is the tenant connected to the landlord?

Enter ‘Yes’ if the tenant and landlord are connected persons as defined under section 58 of the LBTT(S)A 2013.

Is the tenant acting as a trustee or representative partner for tax purposes?

Select either ‘yes’ or ‘no’.

Note: Once complete, you can add additional tenants if necessary. This is done by selecting the ‘Add a tenant’ button.

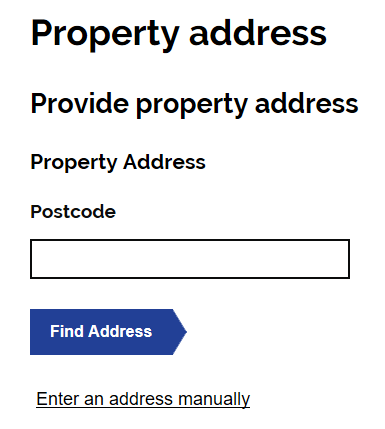

- 5. About the Property

-

Image

Provide property address

Provide the property details for the lease. These must match the property details provided in the original lease.

Local Authority number

From the drop-down list select the local authority in whose area the property in the transaction is situated. If a property straddles a local authority boundary enter the code for the local authority in which most of the property falls.

Title Number

From the drop-down list select the appropriate county code for the property’s title number e.g. for Aberdeen select ‘ABN’. Then in the free-text field to the right of the county code enter the property’s title number.

Parent title

Use the radio buttons to select either ‘yes’ or ‘no’ for this. If ‘yes’ is selected you must then provide the title number.

Note: Once complete, you can add additional properties if necessary. This is done by selecting the ‘Add’ button.

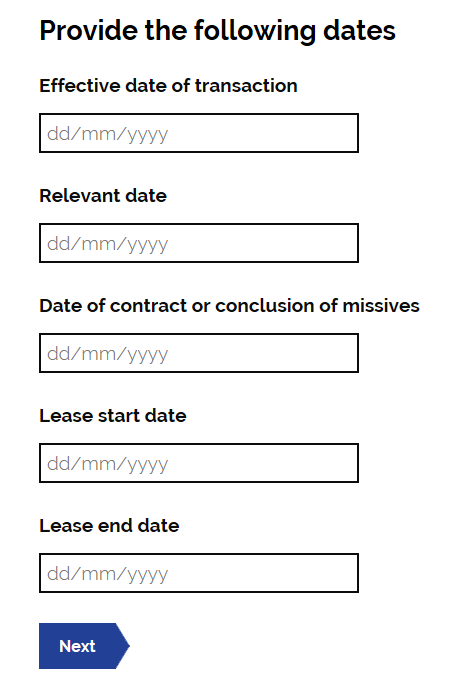

- 6. About the Transaction

-

Image

Provide the following dates

You will be asked to provide various dates in reference to the transaction;

- Effective date of transaction

- Relevant date

- Date of contract or conclusion of missives

- Lease start date

- Lease end date

Note: Guidance on leases can be found at LBTT6001 - Leases.

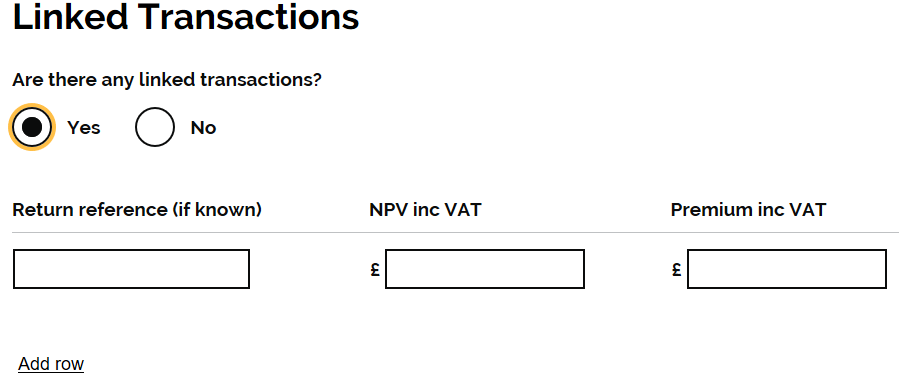

Linked Transactions

Use the radio buttons to select either ‘yes’ or ‘no’ for any linked transactions.

Image

If ‘yes’ is selected a further box will appear and prompt you to complete the following details for the linked transaction;

· Return reference (if known)

· NPV including VAT

· Premium including VAT

Note: Guidance on linked leases can be found at LBTT6022 – Linked leases

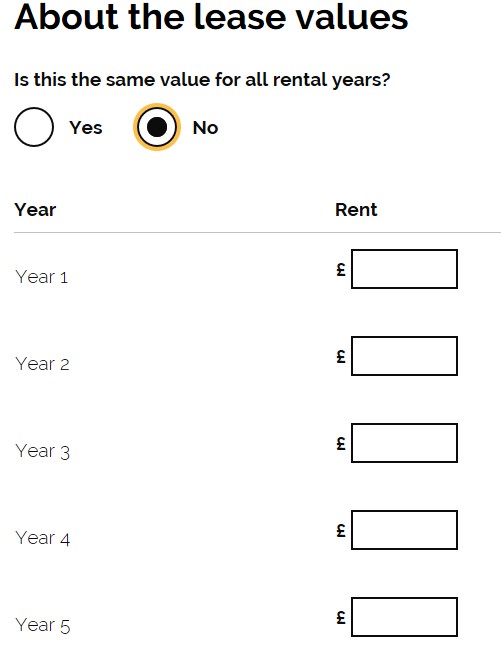

About the lease values

You will be asked to how much the annual rent (including VAT). Please complete this using pounds sterling.

You will then be asked ‘is this the same value for all rental years?’. Use the radio buttons to select ‘yes’ or ‘no’.

Image

If ‘no’ is selected, an additional field will be populated. This will provide a drop down field.

This field asks you to complete the rental figure for each relevant year. The years are populated based on the lease dates provided as the start of the ‘about the transaction section’.

Please complete each box with the rental figure relevant to that year. I.e. Year 1 - £500, Year 2 - £650. Year 3 - £600.

Is a premium being paid

Use the radio buttons to select either ‘yes’ or ‘no’ for a premium being paid. If ‘yes’ is selected this will provide a further field. This field should be completed with the premium amount being paid.

What is the relevant rent amount of this transaction?

You will be asked to how much the relevant rent (including VAT) is.

Net Present Value (NPV)

This will be calculated by the system using the previous figures you have entered. This can be edited if necessary.

- 7. About the Calculation

-

Once the ‘About the transaction’ sections is complete. This will automatically populate the ‘About the calculation fields’.

Image

If you have already paid LBTT on the original lease return, please select edit. You will then be able to enter the amount of LBTT already paid.

Calculated tax

You can then edit the following fields if necessary;

· LBTT tax liability on rent

· LBTT tax liability on premium

· Total tax payable

· Amount already paid

· Amount payable for this return

- 8. Submitting

-

Image

Once you have completed all the sections. You need to select the ‘submit’ button.

Payment and submission

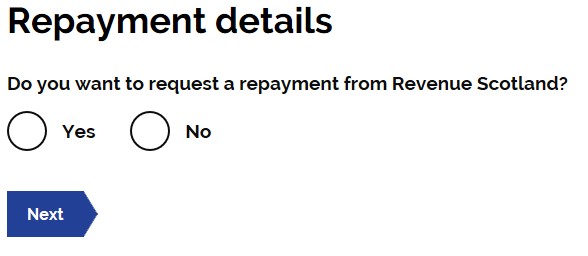

Image

When the return has been submitted, you will be asked if you wish to claim a repayment from Revenue Scotland.

If you select ‘yes’ you will then be asked how much you are claiming for repayment. Once you have entered this you will then be asked to provide the bank details of the account you wish the repayment to be made to.

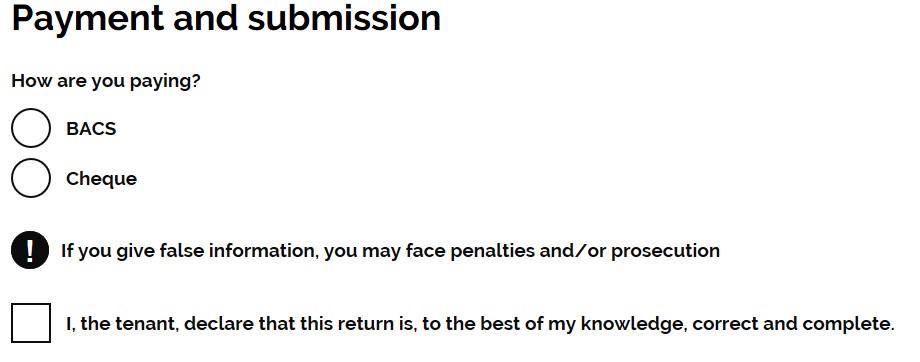

Declaration

Image

You will then be asked ‘how are you paying’. Please select your chosen payment method. Further information on how to pay can be found in our guidance at How to pay LBTT.

If after having read the declaration statement you are content to give your agreement to it, you must declare this by selecting the check-box beside the statement.

You cannot submit and make an LBTT return without completing the declaration statement.

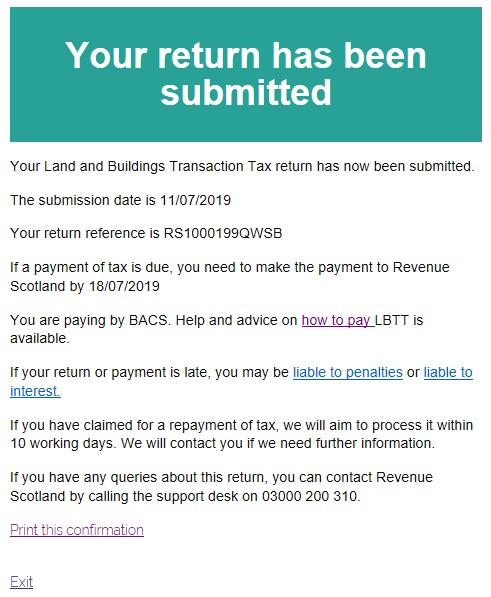

Image

Once submitted you will received on screen confirmation that the return has been submitted. This submission notice will also provide you with a return reference. This will be in the following format : RSXXXXXXXABCD. Please keep a note of this reference.

Note: If you have additional tax to pay, this is the reference number

- 9. Amending a Return

-

You can amend an LBTT lease review return by writing to us at the address shown further below (quoting the return reference number) and telling us, for each field you wish to amend, the current entry and the entry you wish to amend to. We do not accept amendments to returns over the phone

No amendment is possible more than 12 months after the filing date of the return. We will reject any requests for amendments received after the expiry of this 12 month amendment period.

The ‘filing date’, as defined in section 82 of The Revenue Scotland and Tax Powers Act 2014, is ‘the date by which that return requires to be made by or under any enactment’ – in other words it is the last day on which the return can be made to us before it is late. In a three year review return, the filing date is 30 days after the three year anniversary date of the transaction.

If more tax is payable as a result of the amendments you have made, then the normal payment rules and arrangements apply (that is, you must enclose a cheque for the additional amount payable) – see the separate guidance on ‘How to pay LBTT’. You will also have to separately pay interest on the additional amount of tax payable, charged from the filing date of the return until the date the additional amount is paid.

Note: do not include the interest in any request to amend the ‘Amount due for this return’ question in the ‘About the Calculation’ section of the LBTT return. Interest is administered separately by us and we will send you an Interest Notice if interest is due.

If less tax is payable, we will repay the excess amount to you with interest (see the separate guidance on interest on repayments provided at RSTP4004).

If the amended return contains an inaccuracy then the person on whose behalf the amended return is being made may be liable to a penalty – see RSTP3011.

All amendments to paper returns and any associated payments should be sent to:

Revenue Scotland

PO Box 24068

EH6 9BR