How to make an online LBTT lease review return (tenant)

This guidance will help you (the tenant) make an online Land and Buildings Transaction Tax (LBTT) lease review return.

Separate guidance is available on ‘How to pay LBTT’, including BACS/CHAPS payment arrangements.

This is not guidance about the tax itself. LBTT legislation guidance for taxpayers and agents is available separately on our website.

It is the tenant’s responsibility to ensure the LBTT return is complete and accurate. If you are unsure about any matter relating to the LBTT return you should seek professional advice.

All references in this guidance to:

- LBTT(S)A 2013 means The Land and Buildings Transaction Tax (Scotland) Act 2013 (as amended);

- ‘tenant’ means the buyer as defined in section 7 of the LBTT(S)A 2013;

- ‘landlord’ means the seller as defined in section 7 of the LBTT(S)A 2013;

- ‘we’, ‘us’ or ‘our’ means Revenue Scotland;

- ‘you’ means the person making the LBTT return (either as the tenant or the tenant’s agent);

- ‘original return/transaction’ means the first LBTT return submitted when the lease was granted, or when it became notifiable for the first time.

Protection of information

We will protect and handle any information that you provide us with in your tax return with care. For further information please see our Privacy Policy and guidance on taxpayer information (Chapter 9 of The Revenue Scotland and Tax Powers Act 2014 legislation guidance).

Please consult our guidance on how to calculate tax on a lease review before using the LBTT on Lease Transactions Calculator.

Key information you will need to complete this return

This return should only be used by tenants. Agents submitting lease review returns on behalf of tenants should use the SETS online portal.

To complete this return, you will need the following information:

- the lease agreement, showing information such as the start and end dates of

- the lease the transaction reference of the LBTT return originally submitted for

- the lease the effective date of the LBTT return originally submitted

- the lease a recalculation of the total LBTT payable on the lease

- how much LBTT has already been paid on the lease

Once you have requested access to the return, you must complete it within 90 minutes.

You cannot save a draft or amend the return so it is important to ensure that you have all the key information, as listed above, to hand before you access the return.

Information on how to amend an LBTT lease review return can be found towards the end of this guidance.

Note: We do not accept amendments to returns over the phone.

1. About your LBTT return

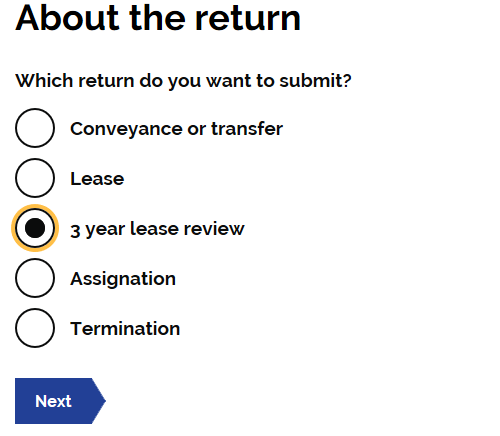

Select the radio button to indicate that this return is being submitted for a ‘3 year lease review’.

2. Return reference number

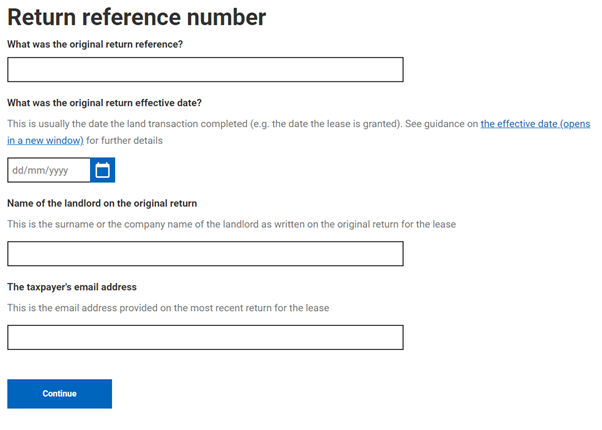

Enter the transaction reference of the LBTT return that was originally submitted for this lease. This should be entered in the following format - ‘RSXXXXXXX’.

Enter the original return effective date. This should be entered in the following format DD/MM/YYYY

3. Latest return for the lease

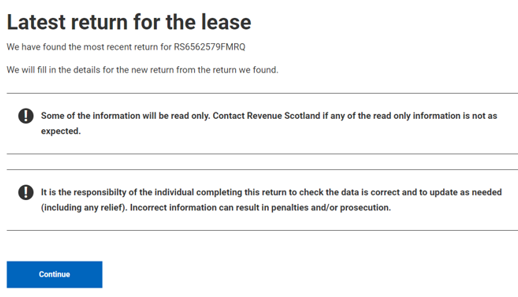

Information will now be prepopulated from the previous lease or lease review return.

4. Return summary

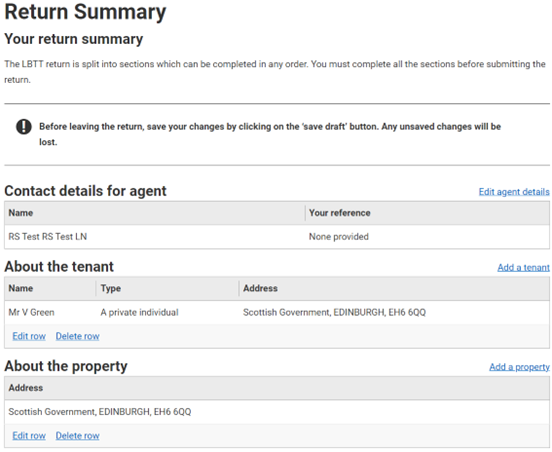

You will now be presented with an overview of the tax return with all details prepopulated from previous returns. If there are no change you are only required to enter the Relevant date by selecting “edit transaction details”.

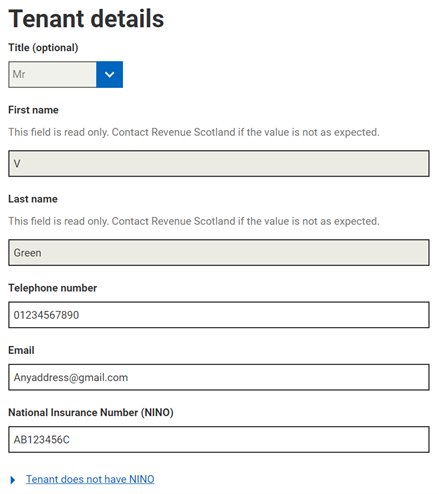

5. About the tenant

All tenant information is now prepopulated. Information that is read only will be “greyed out”. You can however update telephone number, email address and NINO.

Tenant details

Under Tenant details you will be asked the following questions;

Is the tenant connected to the landlord?

Enter ‘Yes’ if the tenant and landlord are connected persons as defined under section 58 of the LBTT(S)A 2013.

Is the tenant acting as a trustee or representative partner for tax purposes?

Select either ‘yes’ or ‘no’.

6. About the property

This section is now prepopulated with the property address from the previous return. This section should not be changed, however you can add more details such as:

- Local Authority

- Title number

- Parent title

Local Authority number

From the drop-down list select the local authority in whose area the property in the transaction is situated. If a property straddles a local authority boundary enter the code for the local authority in which most of the property falls.

Title Number

From the drop-down list select the appropriate county code for the property’s title number e.g. for Aberdeen select ‘ABN’. Then in the free-text field to the right of the county code enter the property’s title number.

Parent title

Use the radio buttons to select either ‘yes’ or ‘no’ for this. If ‘yes’ is selected you must then provide the title number.

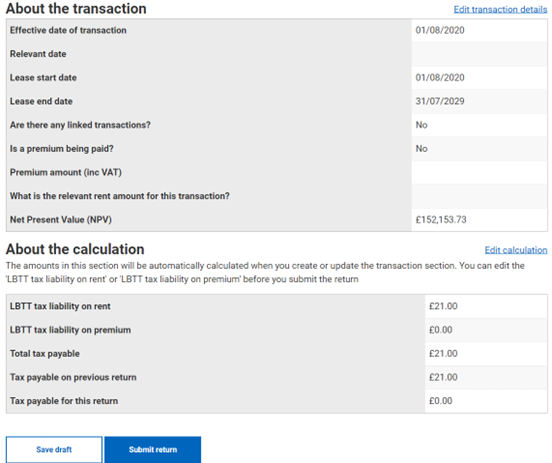

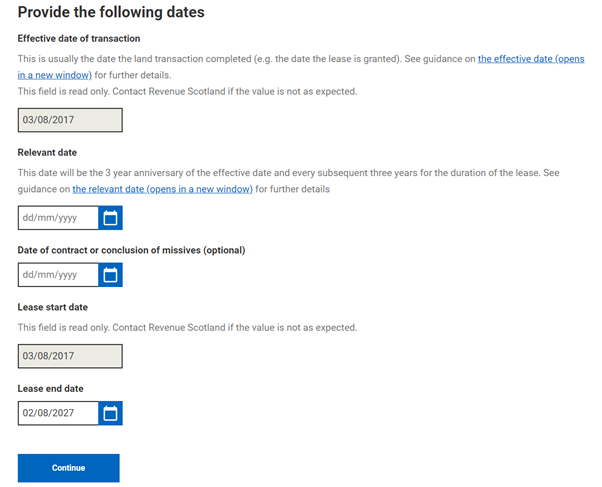

7. About the transaction

The effective date of transaction and lease start date will be prepopulated and un-editable. If either of these are incorrect you must contact Revenue Scotland and request that this is amended along with evidence of the date/s.

Provide the following dates

You will be asked to provide various dates in reference to the transaction:

Relevant date of transaction

Confirm the following dates

Lease end date

Note: Guidance on these dates can be found at LBTT6001 - Leases.

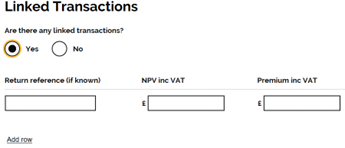

If ‘yes’ is selected a further box will appear and prompt you to complete the following details for the linked transaction

- Return reference (if known)

- NPV including VAT

- Premium including VAT

Note: Guidance on linked leases can be found at LBTT60025 - Linked Leases

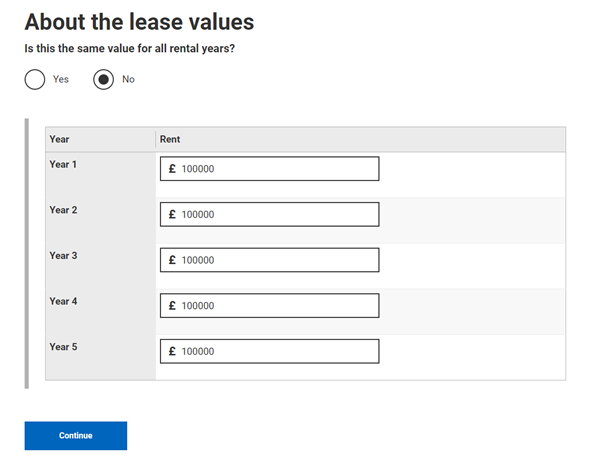

About the lease values

The lease values previously declared will be prepopulated.

You will then be asked ‘is this the same value for all rental years?’. Use the radio buttons to select ‘yes’ or ‘no’

This field asks you to complete the rental figure for each relevant year. The years are populated based on the lease dates provided as the start of the ‘about the transaction section’.

Please complete each box with the rental figure relevant to that year. I.e. Year 1 - £500, Year 2 - £650. Year 3 - £600.

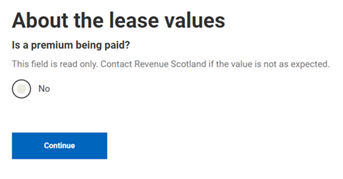

Is a premium being paid

This section will be prepopulated based details from the original return, you will not be able to edit this section.

Net Present Value (NPV)

This will be calculated by the system using the previous figures you have entered. This can be edited if necessary.

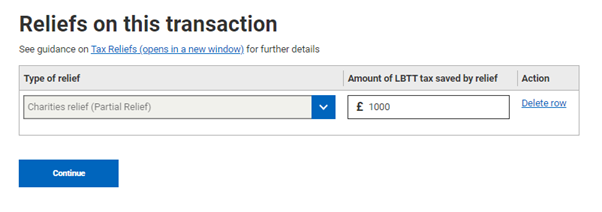

8. Reliefs

If a relief was claimed on the original lease return this section will also appear on the return summary page.

The type of relief will be prepopulated and un-editable, however if partial relief was claimed you will be able to edit the amount of LBTT tax saved by claiming the relief.

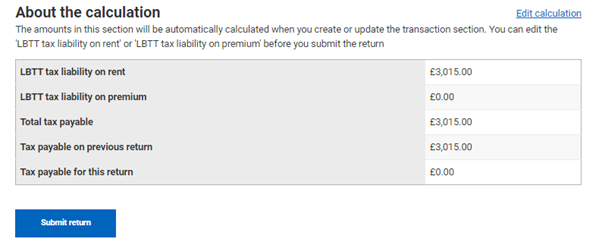

9. About the Calculation

Once the ‘About the transaction’ sections are complete. This will automatically populate the ‘About the calculation fields’.

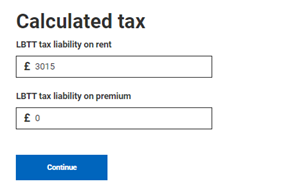

Calculated tax

You can then edit the following fields if necessary.

LBTT tax liability on rent LBTT tax liability on premium.

10. Submitting

Once you have completed all the sections. You need to select the ‘submit’ button.

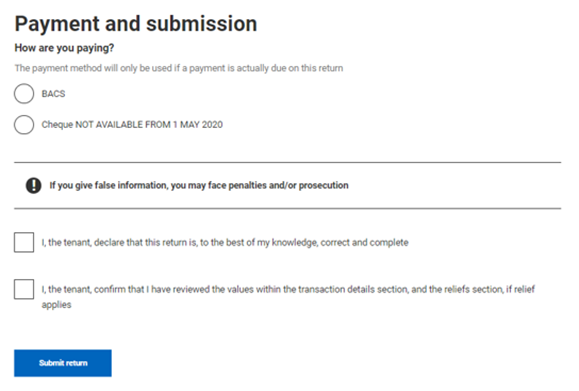

Payment and submission

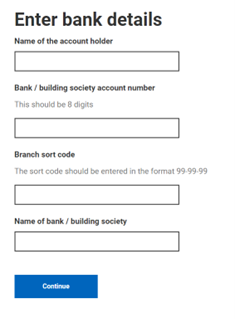

If a repayment is due you will automatically be taken to the claim repayment page. The amount of repayment is calculated for you based on the details you have provided and cannot be changed.

After Clicking ‘Continue’ you will be asked for the bank details you wish the repayment to be paid into.

Declaration

You will then be asked ‘how are you paying’. Please select your chosen payment method. Further information on how to pay can be found in our guidance at How to pay LBTT.

If after having read the declaration statement you are content to give your agreement to it, you must declare this by selecting the check-box beside the statement.

You cannot submit and make an LBTT return without completing the declaration statement.

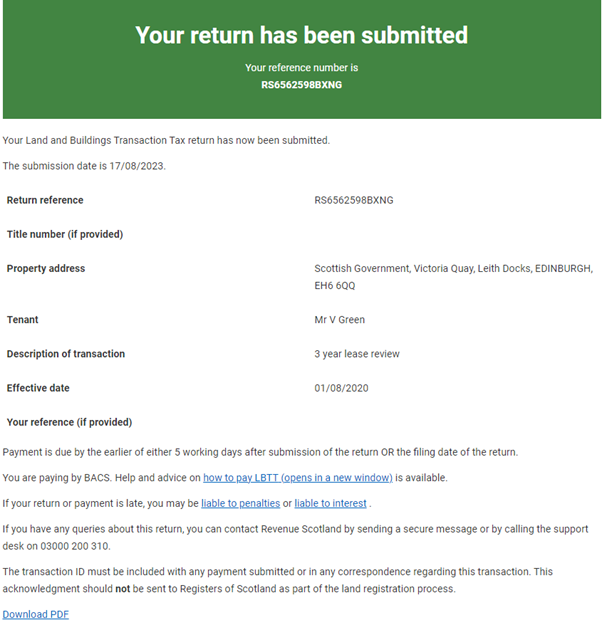

Once submitted you will received on screen confirmation that the return has been submitted. This submission notice will also provide you with a return reference. This will be in the following format : RSXXXXXXXABCD. Please keep a note of this reference.

Note: If you have additional tax to pay, this is the reference number you must use when you are making the payment.

11. Amending a return

You can amend an LBTT lease review return by emailing us at LBTT@revenue.scot (quoting the return reference number) and telling us, each field you wish to amend. Please inform us of the existing entry and the entry you wish to amend to. We do not accept amendments to returns over the telephone.

No amendment is possible more than 12 months after the filing date of the return. We will reject any requests for amendments received after the expiry of this 12 month amendment period.

The ‘filing date’, is as defined in section 82 of The Revenue Scotland and Tax Powers Act 2014, ‘the date by which that return requires to be made by or under any enactment’ – in other words it is the last day on which the return can be made to us before it is late. In a three year review return, the filing date is 30 days after the three year anniversary date of the transaction.

If more tax is payable as a result of the amendments you have made, then the normal payment rules and arrangements apply (that is, you must enclose a cheque for the additional amount payable) – see the separate guidance on ‘How to pay LBTT’. You will also have to separately pay interest on the additional amount of tax payable, charged from the filing date of the return until the date the additional amount is paid.

Note: do not include the interest in any request to amend the ‘Amount due for this return’ question in the ‘About the Calculation’ section of the LBTT return. Interest is administered separately by us and we will send you an Interest Notice if interest is due.

If less tax is payable, we will repay the excess amount to you with interest (see the separate guidance on interest on repayments provided at RSTP4004).

If the amended return contains an inaccuracy then the person on whose behalf the amended return is being made may be liable to a penalty – see RSTP3011.

All amendments to paper returns and any questions regarding the associated payment should be sent to LBTT@revenue.scot.