How to claim a repayment of Additional Dwelling Supplement (ADS)

The way in which claims for repayment of Additional Dwelling Supplement (ADS) are made depends on who is making the claim.

- Existing agents claiming on behalf of a taxpayer should amend the original LBTT return in SETS

- New agents claiming on behalf of a taxpayer should complete the repayment claim form and email back to Revenue Scotland

- Taxpayers making repayment claims themselves should use the online process

We will aim to process the repayment within 10 working days and we will repay the ADS to you with interest (see the separate guidance on interest on repayments provided at RSTP4004.)

Please note, in some scenarios your request for repayment may take longer. This will depend on the nature of the repayment request and the supporting evidence. If we require further information or evidence to support your claim, we will ask for you this.

Revenue Scotland routinely conducts checks and may open enquiries to ensure the correct amount of tax has been paid and that any claim requests meet the relevant conditions for repayment.

All references in this guidance to:

- The RSTPA 2014 means The Revenue Scotland and Tax Powers Act 2014;

- ‘we’, ‘us’ or ‘our’ means Revenue Scotland; and

- ‘you’ means the person amending the LBTT return (either as the buyer or the buyer’s agent).

Existing agent claiming a repayment of ADS

If you are the existing agent (ie. the same agent that submitted the original LBTT return), you should claim repayment of ADS by amending the original return in the SETS system.

Information on amending the original LBTT return in SETS:

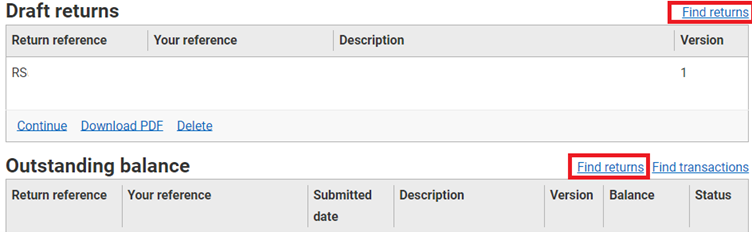

Once in SETS, from the Dashboard, select the ‘Find returns’ button:

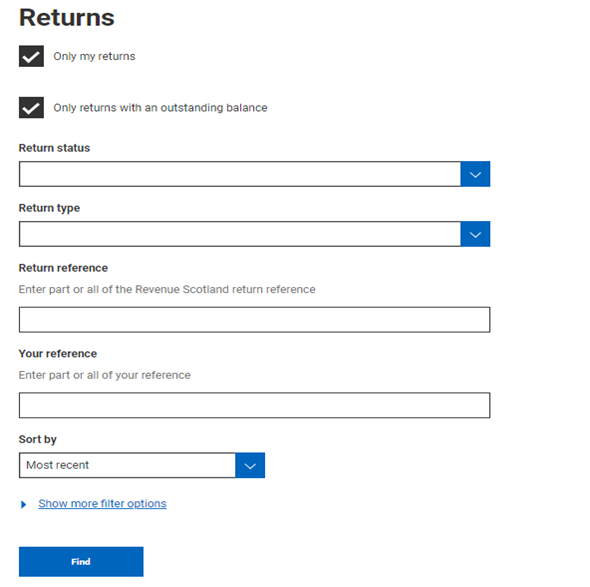

Selecting this will take you to the returns page. You can then search for the return you want to amend, using the various criteria outlined below.

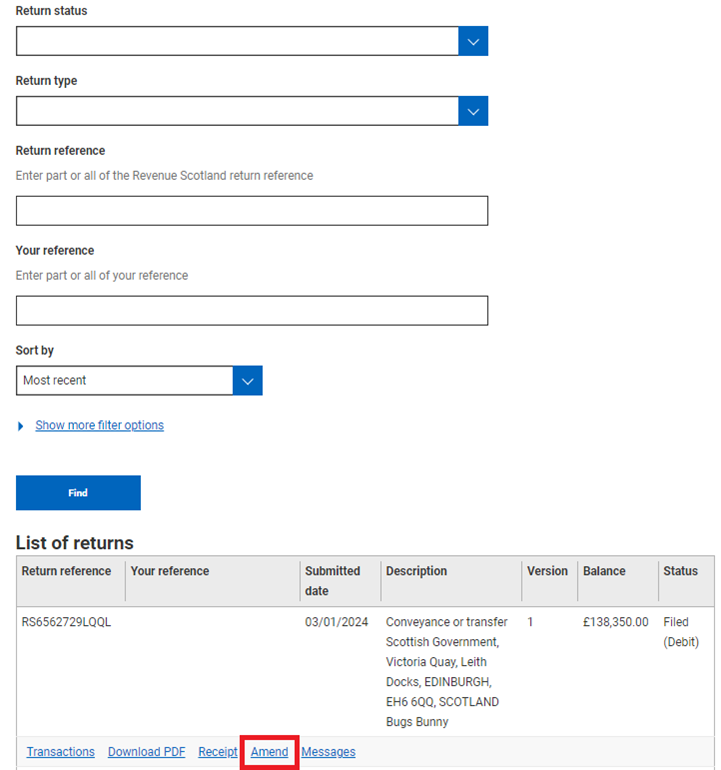

Once you have found the return, click the "Amend" button

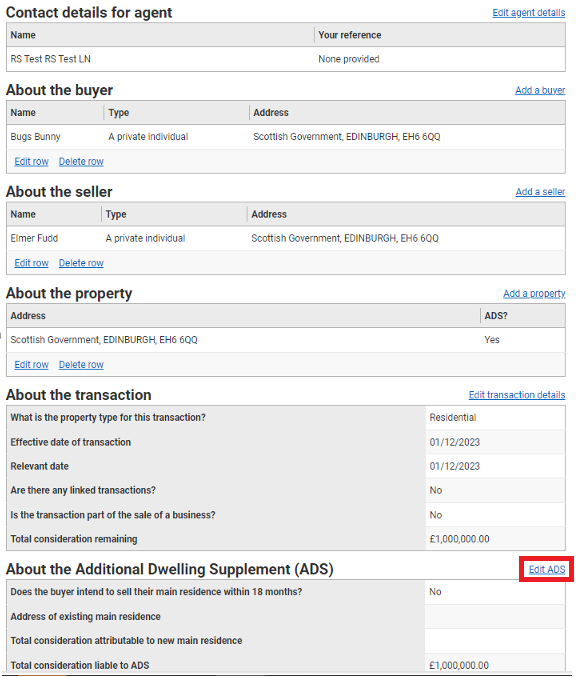

Selecting ‘Amend’ will take you to the return summary screen. In the middle of the page you will see the ‘About the Additional Dwelling Supplement (ADS)’ section. Select the ‘Edit’ button on the right of the section.

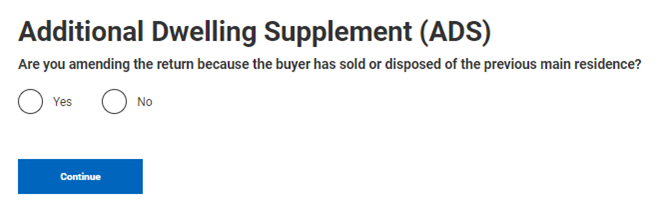

You will be asked ‘Are amending the return because the buyer has sold or disposed of the previous main residence?’. Use the radio buttons to select either Yes or No.

Depending on if you choose ‘Yes’ or ‘No’, different questions will then be asked.

If ‘Yes’:

You will be asked to complete the following information:

If ‘No’:

You will be asked ‘Is the buyer replacing their main residence?’ Use the radio buttons to select either ‘Yes’ or ‘No’.

You will then be asked the following questions:

You will then be taken back to the return summary page. You will no longer see an immediate update of the calculation. We will validate the bank details before the return updates to show the updated calculation. This is to allow us to ensure your payment is going to a valid bank account.

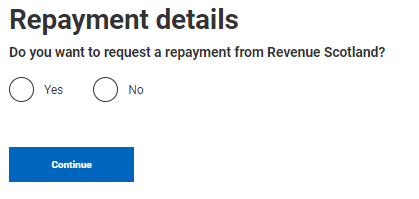

You will then be asked if you wish to claim a repayment from Revenue Scotland. Use the radio buttons to select ‘Yes’ or ‘No’.

If you select ‘Yes’ you will be asked to confirm the amount you are claiming is correct. You will also be asked to provide the bank details you wish the repayment to go to.

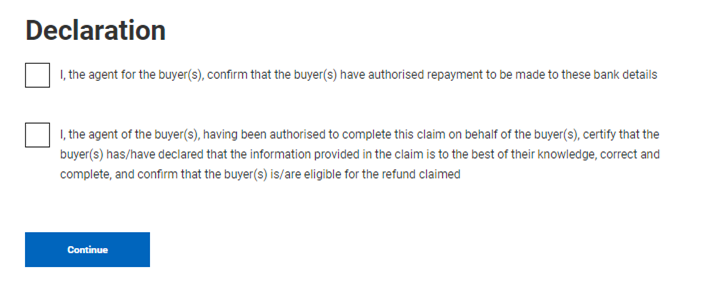

You will then be asked to confirm the following declarations:

I, the agent for the buyer(s), confirm that the buyer(s) have authorised repayment to be made to these bank details. And;

I, the agent of the buyer(s), having been authorised to complete this claim on behalf of the buyer(s), certify that the buyer(s) has/have declared that the information provided in the claim is to the best of their knowledge, correct and complete, and confirm that the buyer(s) is/are eligible for the refund claimed.

Note: You must confirm you agree with these declarations in order to submit the claim.

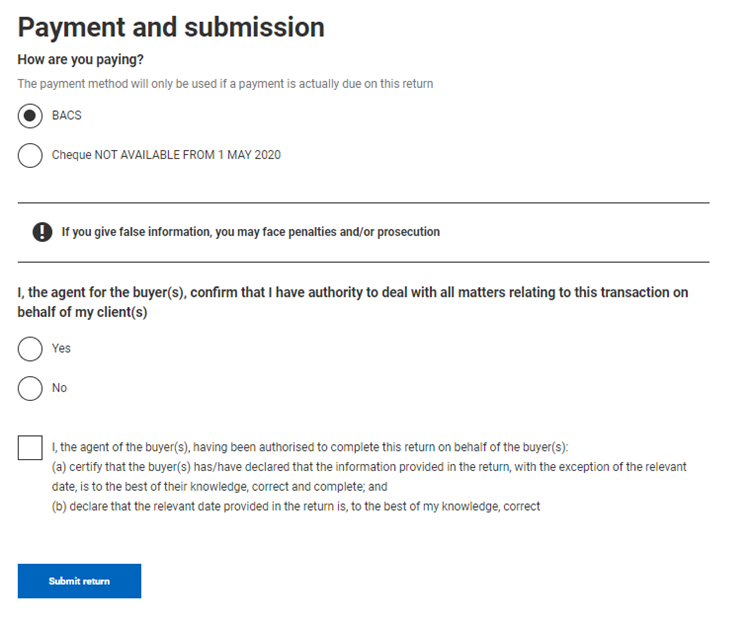

You will then be asked ‘How are you paying’. This is an error within the system and will be fixed in due course.

You will be asked to select either ‘Yes’ or ‘No’ for the following statement:

‘I, the agent for the buyer(s), confirm that I have authority to deal with all matters relating to this transaction on behalf of my clients(s).’ Use the radio buttons to select either yes or no.

You will then be asked to check the box to confirm that;

I, the agent of the buyer(s), have been authorised to complete this return on behalf of the buyer(s):

(a) certify that the buyer(s) has/have declared that the information provided in the return, with the exception of the relevant date, it to the best of their knowledge, correct and complete; and (b) declare that the relevant date provided in the return, is to the best of my knowledge, correct.

Once you have agreed to the declaration, select ‘Submit return’.

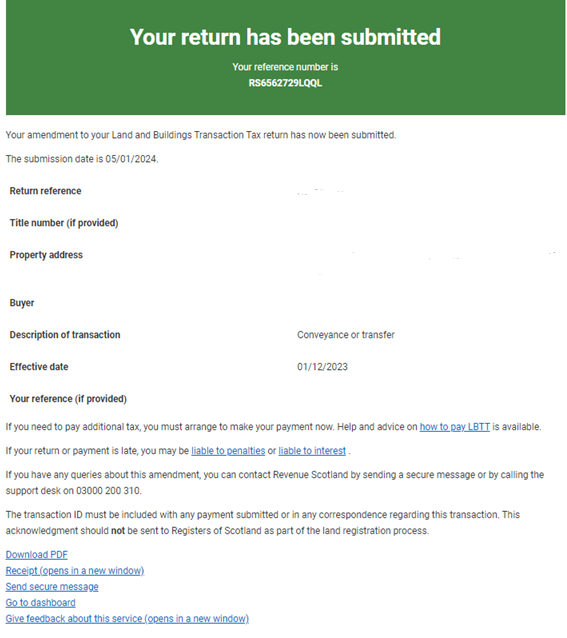

You will then see a return submitted screen, confirming the date of submission, as below:

This submission notice can be printed by selecting the ‘Print this confirmation’ link at the bottom of the page. You can also send a secure message from the submission page. Clicking the ‘send secure message’ button will create a secure message and automatically populate the return reference.

You can then select ‘Go back to dashboard’ to go back to your dashboard.

We aim to process repayment claims within 10 days of receiving all relevant information.

Please note, in some scenarios your request for repayment may take longer. This will depend on the nature of the repayment request and the supporting evidence. If we require further information or evidence to support your claim, we will ask for you this.

Revenue Scotland routinely conducts checks and may open enquiries open enquiries to ensure the correct amount of tax has been paid and that any claim requests meet the relevant conditions for repayment

Help and Support

If you have any questions or are having difficulty amending the original LBTT return, please contact us via the secure message facility in the SETS system or by email: lbtt@revenue.scot

New agent claiming a repayment of ADS

If you are a new Agent (ie. not the agent that submitted the original LBTT return) and unable to amend the original LBTT return in SETS, you should complete the repayment claim form and submit by email to: lbtt@revenue.scot

![]() RS-0005 ADS Repayment Claim Form.pdf

RS-0005 ADS Repayment Claim Form.pdf

Information on how to complete and submit the new ADS Repayment Claim Form:

All sections of the form must be completed where appropriate. All fields marked with an asterisk are mandatory and incomplete forms may be rejected without repayment being made.

If your claim is being made more than 12 months from the filing date of your original return (i.e. more than 12 months after the date on which you bought your new property on which ADS was paid), you will need to provide proof of sale of your previous property and this should be sent along with your completed claim form.

Evidence that can be accepted includes:

- Copy of disposition of sale

- Copy of Land Registration documents

- A letter from your solicitor that clearly states the date of sale

Proof that this property was occupied by all buyers as their main residence at any time in the relevant period prior to the effective date of the purchase of your new property (i.e. the 18 or 36 month period (depending on your effective date) ends on the date you bought your new main residence) is also required to be sent with your completed claim.

Evidence that can be accepted includes:

- Copy of a council tax bill

- Copy of a utilities bill

- Copy of bank statement

Once you have completed the form online, check that all information is complete and correct before electronically signing the declaration.

Please note your electronic signature can be provided as a typewritten signature.

Please submit your completed form, together with any supporting documents, by email to lbtt@revenue.scot.

We may ask additional security questions to verify that the correct person is making the repayment claim. Any omission, error or inaccuracy in the claim may render you liable to financial penalties and/or prosecution.

We aim to process repayment claims within 10 days of receiving all relevant information.

Please note, in some scenarios your request for repayment may take longer. This will depend on the nature of the repayment request and the supporting evidence. If we require further information or evidence to support your claim, we will ask for you this.

Revenue Scotland routinely conducts checks and may open enquiries open enquiries to ensure the correct amount of tax has been paid and that any claim requests meet the relevant conditions for repayment.

Help and Support

If you have any questions or are having difficulty completing the repayment claim form, please contact Revenue Scotland by email: lbtt@revenue.scot

Taxpayer claiming a repayment of ADS

Claims for repayment of ADS can be made directly by taxpayers using the online repayment claims process.

Claim ADS repayment for taxpayers

Please note: Paper claims, submitted by post, can no longer be accepted. Claims for repayment of ADS by Agents are handled differently; see above for more information.

Information on completing the online repayment claims process:

How to claim ADS repayment for taxpayers | Original transactions on or before 31 March 2024

How to claim ADS repayment for taxpayers | Original transactions on or after 1 April 2024

Useful links to the above videos - LBTT1004 - Effective Date and LBTT10070 Amendments to Returns

and repayment claims for the ADS

![]() ADS Repayment Claims - Taxpayer guidance - April 2024.pdf

ADS Repayment Claims - Taxpayer guidance - April 2024.pdf

We aim to process repayment claims within 10 days of receiving all relevant information.

Please note, in some scenarios your request for repayment may take longer. This will depend on the nature of the repayment request and the supporting evidence. If we require further information or evidence to support your claim, we will ask for you this.

Revenue Scotland routinely conducts checks and may open enquiries open enquiries to ensure the correct amount of tax has been paid and that any claim requests meet the relevant conditions for repayme

Help and Support

If you have any questions or are having difficulty completing the new online repayment claims process, please contact Revenue Scotland by email: lbtt@revenue.scot