Monthly LBTT Statistics

Key points

- A total of £79.8m LBTT was declared by taxpayers in September 2024. This is the highest total recorded for the month of September, but 15% lower than the peak of July 2024 (£94.4m).

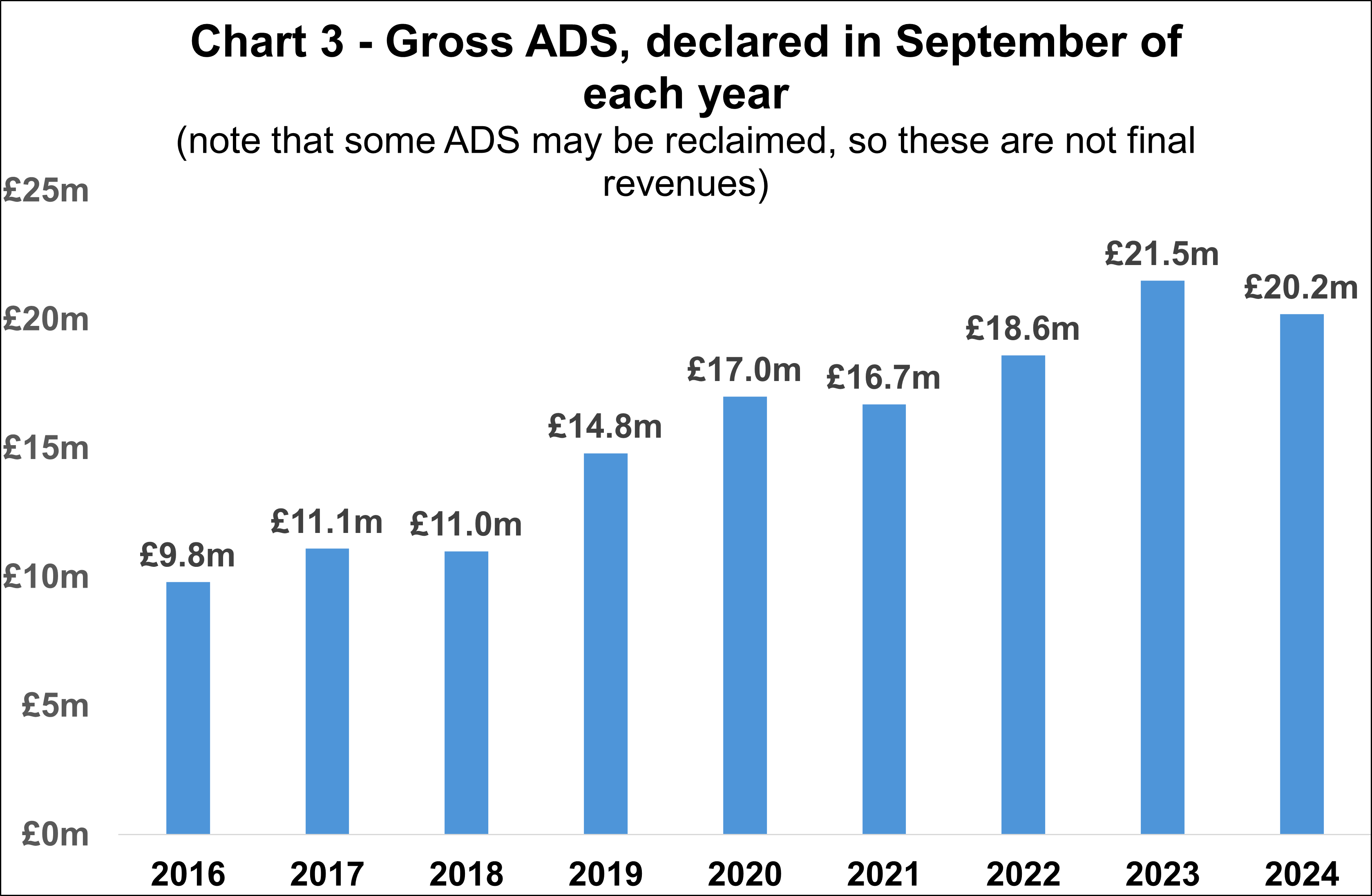

- Residential LBTT excluding ADS (£41.6m) was around average for the month of September compared to the previous three years (£41.3m). However, the number of residential returns (8,870) was below average (9,070). Residential LBTT excluding ADS fell compared to July and August 2024, with the greatest decrease in LBTT coming from the top tax band (over £750,000 total consideration). Residential LBTT excluding ADS typically follows a seasonal pattern peaking in the summer months.

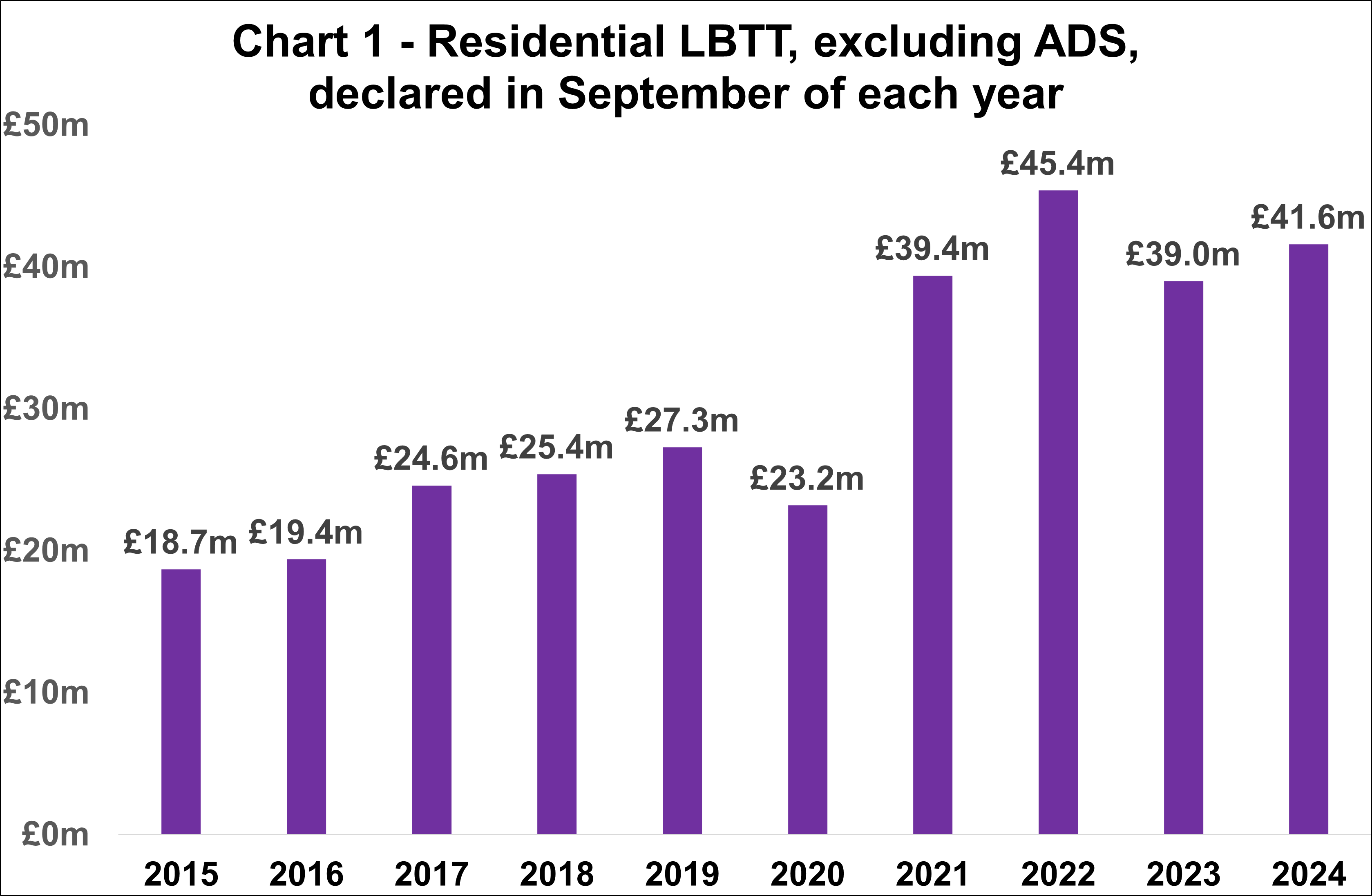

- Non-residential revenues are highly variable between months, due to the impact of small numbers of high value transactions. Non-residential LBTT excluding ADS was £18.2m in September 2024. This was above average compared to the previous 12 months (average £16.6m, ranging from £8.7m to £28.0m).

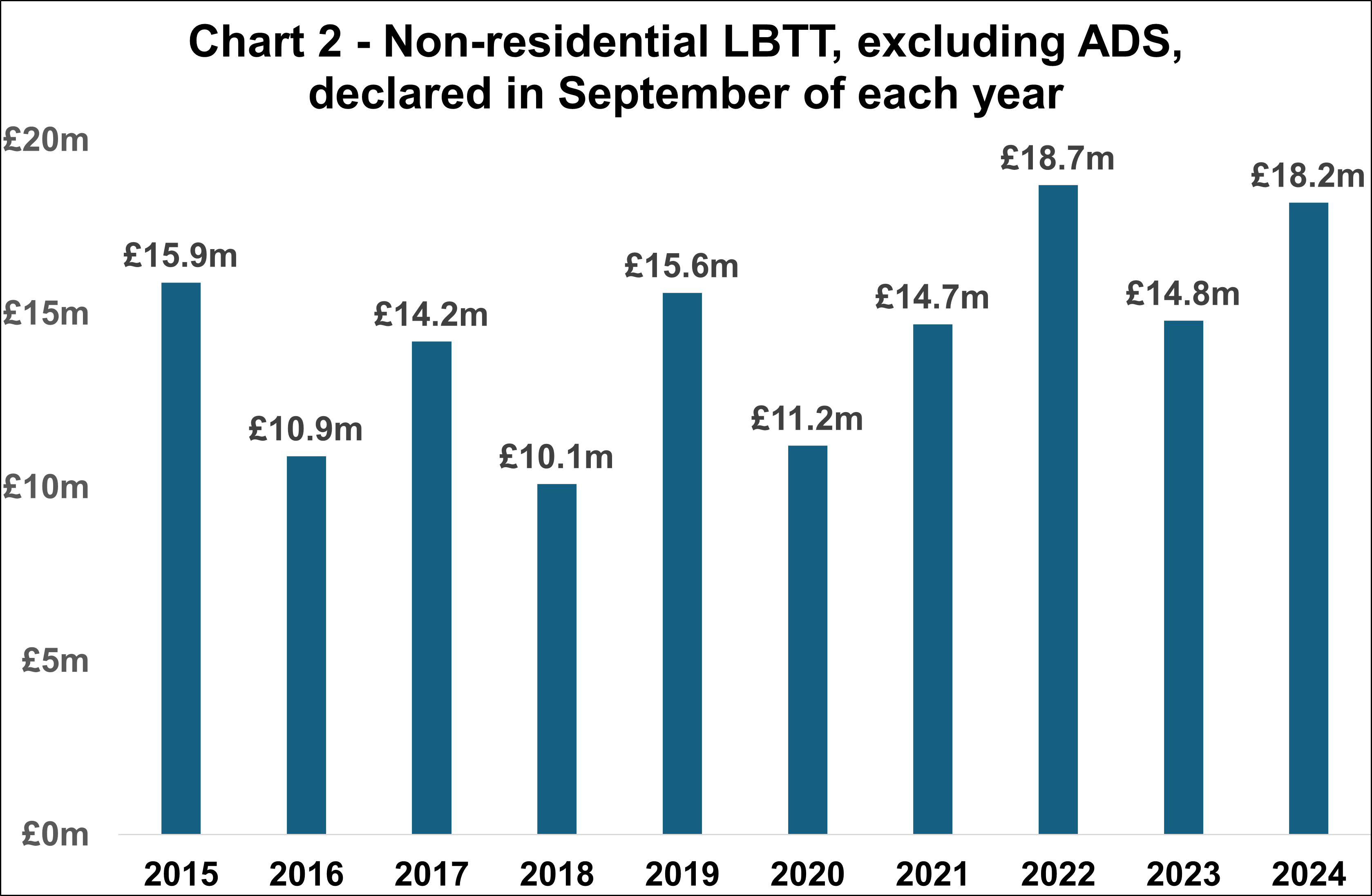

- Gross Additional Dwelling Supplement for September was relatively high (£20.2m) although lower than in September 2023. The number of transactions with ADS declared was the lowest ever for the month of September (1,780).

Image

Image

Image